- FinTech design trends to follow

- Personalization

- Tailor-made UI/UX design for FinTech

- Total & multi-functionality

- Gamification

- Emotion-led design

- How to design a user-friendly FinTech app?

- Business plan and UX research

- Choose your tech stack and team

- Wireframe design

- Prototype and Release

- Maintenance and support services

- FinTech design outsourcing: how to do it right

- Perform business analysis

- Find a trusted partner

- Proposal contract

- Team assembly and getting started

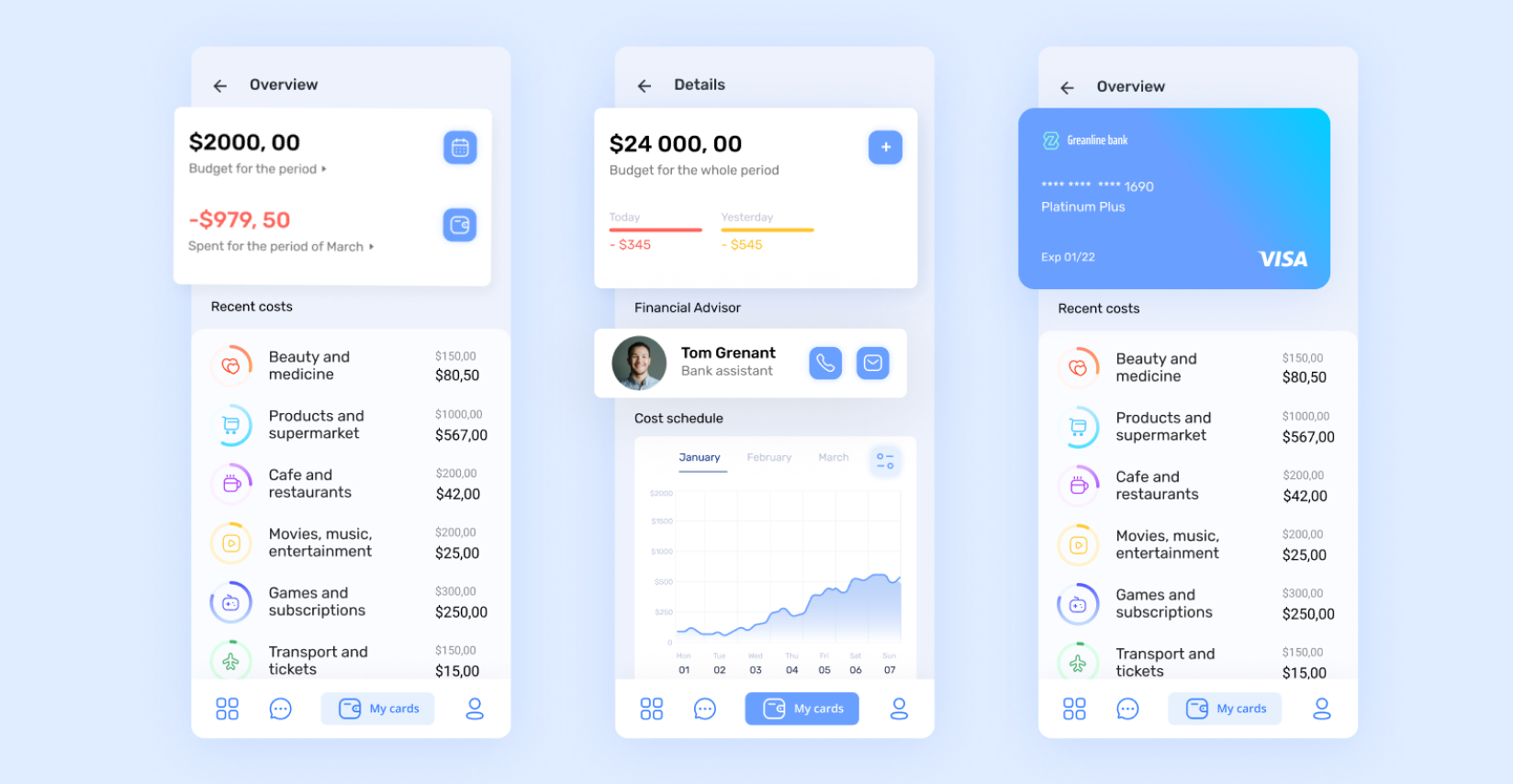

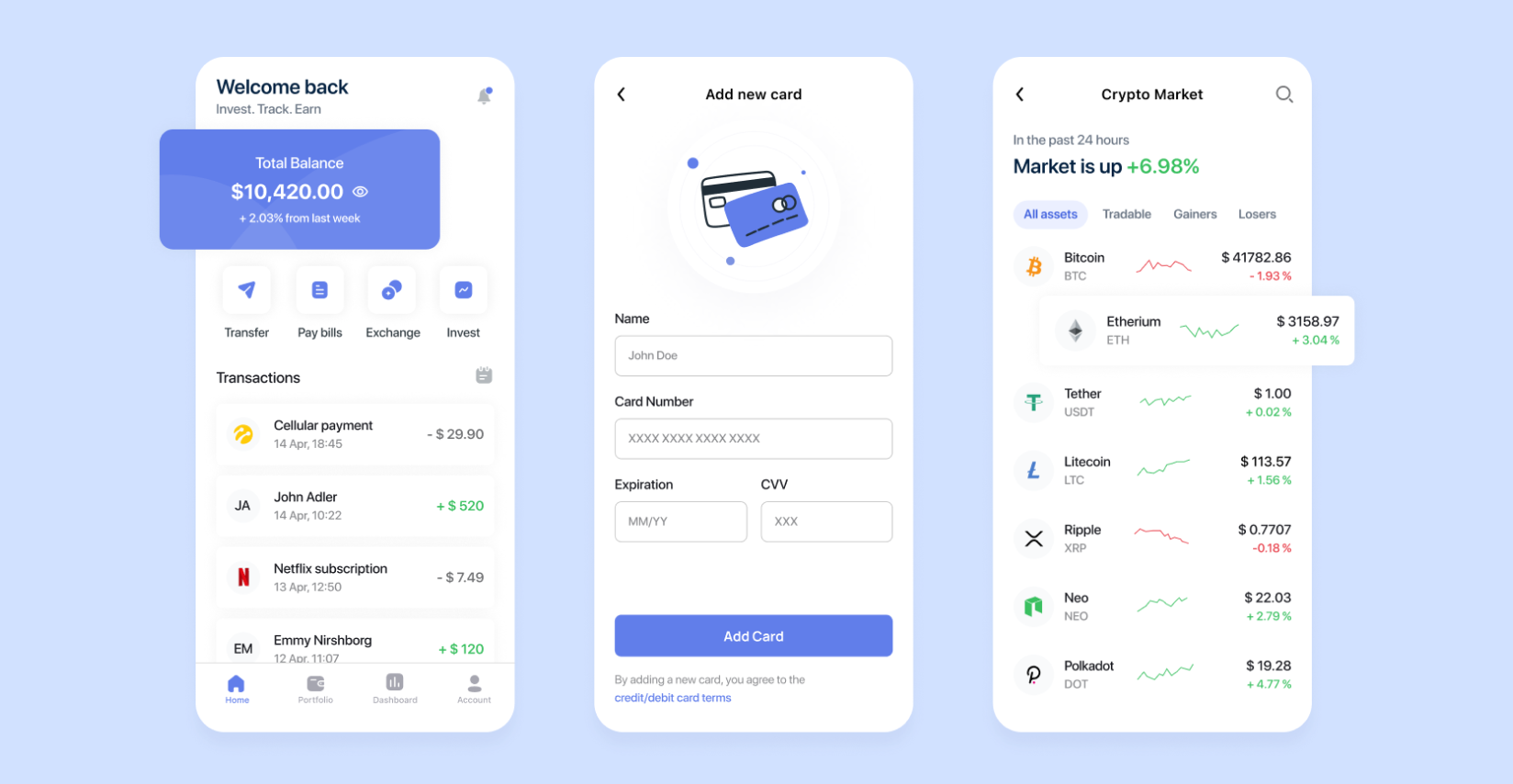

- Andersen’s FinTech design examples

- An eBanking solution with a feature-rich interface

- An app for personal finance management

- An app for financial planning and analytics

- An app for a bank’s corporate clients

- Wrapping up

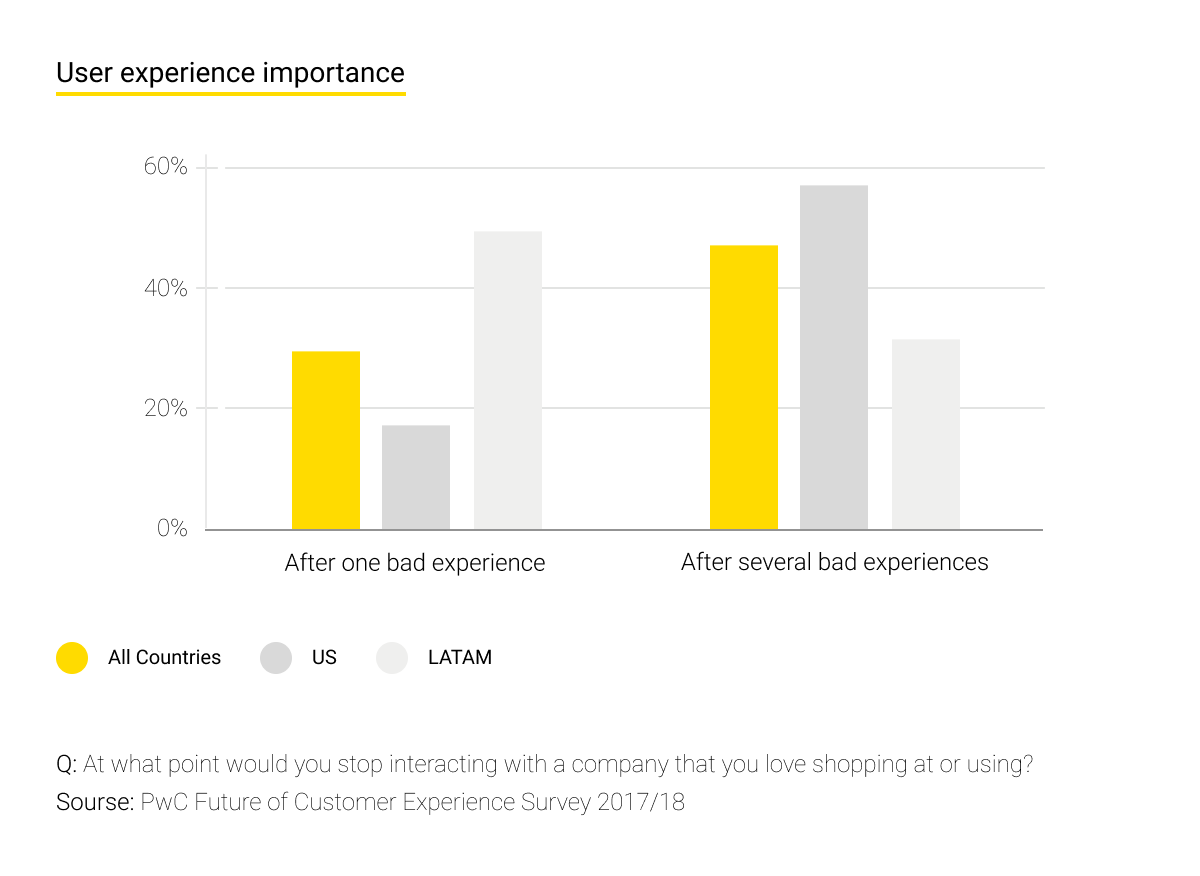

“Wow!” “That’s exciting!” “What an amazing experience!” When was the last time you heard someone say these things about their banking experience? Probably never. But in the current digital climate, user experience is everything. And yes, that includes banking. The demand for smooth, streamlined, and bold FinTech design is increasing, and gone are the days of accepting your usual bank’s slow and glitching mobile banking app. There’s a whole world of new and exciting FinTech startups boasting innovative UI designs, a quick and simple onboarding process, and a mass of multi-functional features with rapid integration with other apps on your smartphone. An app’s FinTech UI design and overall user experience can be the entire company’s making or, if not executed perfectly, its complete downfall. And here’s why: Research shows that one in three people have expressed that they would stop interacting with a brand they love after just one bad experience – that’s just one unsatisfactory experience with a brand they trust and love! – and that percentage goes up to 59% if the bad experiences continue. This shows how easily and quickly people lose confidence in a brand – so your business might not get a second chance once you’ve committed a single UX mistake.

So for any business to swim rather than sink, it’s crucial to keep UX at the forefront of one's strategy and execute great FinTech UI design at all times.

In this article, we will talk about the main trends in FinTech right now and show you how you can create a great user experience for your clients every time and absolutely smash FinTech app design.

FinTech design trends to follow

Personalization

Let’s first talk about the interface in UI and, more specifically, how to make it more unique for each client. Personalizing the interface is a significant trend to implement to win UX brownie points with any audience. Users’ ability to select, move or remove different cards, accounts, currencies, wallets, savings, exchange tools, and loan tools will make the experience personal, streamlined, and therefore more pleasant for everyone. You could also implement personalized elements like targeted offers and discounts, relevant news, suggested services, financial advice and tips, and more.

Tailor-made UI/UX design for FinTech

When designing for FinTech, personalizing apps according to each user is not the only way you can create a unique experience for users. With the B2B market growing in the digital space, the need for tailor-made tools and software is not only trending, but becoming a necessity. There are hundreds, if not thousands, of processes involved in running an online business. Those who notice a new way to simplify these processes are onto a huge opportunity.

Total & multi-functionality

A few years ago, banking apps were just an addition to your bank account. Now people expect (as well as demand) to be able to complete absolutely every action online. As a result, total functionality has become a necessity for all banks, but it’s the neo-banks and other FinTech companies that are leading the race. Multi-functionality is another trend to look out for in 2022. With various FinTech tools popping up and the growing popularity of the Blockchain and crypto, users want to connect all their different apps, wallets, and accounts and be able to go between them to complete simple transactions quickly and on the go.

Gamification

The exciting outcome of neo-banking and innovative FinTech design is the realization that banking can be fun. But be warned, when designing for FinTech, going overboard might hurt your UX and put people off. FinTech design can be fun and bold but should still be serious enough that people trust you with their money.

Emotion-led design

Empathy is critical in the post-pandemic digital world, so designing with the user in mind is vital for any app's success. Creating a user-centric UI can set a business apart from the competition. Therefore, emotive design is a vital trend to implement when creating your app’s UI/UX. Think about how you can engage with the user on an emotional level, and make a real impact, regardless of age, gender, or ethnicity.

How to design a user-friendly FinTech app?

Business plan and UX research

You first want to find out what your customers need and want, their behaviors and patterns, and what features are trending. Creating your ideal user personas will help you easily visualize your target audience and integrate your research into a business plan. Conduct in-depth market analysis and competitor research. Remember to look at design aspects best suited for your market and your FinTech app. Check out the research we’ve compiled on mobile banking apps and get the latest information on the most popular FinTech apps, their advantages, and their disadvantages.

Choose your tech stack and team

Once you have your business plan and main research findings, it’s time to choose your expert engineers and a comprehensive stack of tech tools for your FinTech app design. Here’s where Andersen comes in. We have over 480 experienced software developers trained and experienced in intricate UI/UX design. Having worked on hundreds of large-scale projects, they will deliver on all your unique app development points, including UX and UI, gamification, emotive design, functionality, and more. To ensure you find the best partner for the job:

- Check reviews and testimonials to see the company dynamic and people’s experiences of working with the outsourcing company.

- Ask for references and work samples (ideally of similar projects).

- Compare prices and services of different outsourcing partners.

- Complete a thorough evaluation of how the company communicates and assess if they have your best interests at heart – are they interested in reducing costs? Do they suggest improvements? How’s their problem solving process?

Wireframe design

Once you have your team and the tools secured, it’s time to begin designing the wireframe for your FinTech app. A wireframe will allow your designers and you to plan out what features to add and where, and how the app will work. Your expert team needs to think of the customer and build an app that performs well and has all the essentials. We cannot stress this enough: UI/UX is critical. Therefore, at Andersen, we have a comprehensive Design Studio where you can get excellent solutions with our in-house design team of multidisciplinary experts.

Prototype and Release

Releasing a prototype or MVP of your FinTech mobile app design will allow you to test your product and minimize any risks, bugs, and unwanted complications before you release the final product.

Maintenance and support services

Finally, to ensure the best UX for customers, you will need to keep updating, maintaining, and supporting post-release. User experience is an ongoing process that needs constant care, that’s why at Andersen we have world-class outsourcing technical support services.

FinTech design outsourcing: how to do it right

To successfully outsource to the best UI/UX designers, just follow these steps:

Perform business analysis

Before you start searching for the right team of engineers it’s important that you conduct a thorough analysis of your business, project needs, budget, as well as the opportunities and risks involved. Afterward you can match your project needs and resources with the perfect team. This can save you a lot of time and money as it will eliminate any potential inconsistencies and start you off on the right foot.

Find a trusted partner

Once you have a basic idea of what your project needs you can start looking for the right partner to work with. Finding a trusted company to work with is crucial to your project's success as it will eliminate any risks, misunderstandings, unforeseen charges, and potential failure. To avoid those things, you can check a company’s credibility by looking at reviews and testimonials, past projects, analyzing their online presence (LinkedIn, website, reviews and feedback, etc.), and engaging in pre-selection interviews or meetings.

Proposal contract

Once you’ve found a partner who you connect with and think you’ll work well with it's time to move onto the proposal stage. Here a manager will propose a contract with the main delivery points, rates, and timelines. Be confident and change anything you’re not comfortable with or negotiate on length of time and price. You should also be able to request an NDA. Your project should be safeguarded against any leaks, and be completely private throughout the whole development and pre-release process.

Team assembly and getting started

Here is where you will assemble your team. If you don’t have anyone in your internal team to do this you can leave it up to the experienced team leaders within the outsourcing company. If you’ve selected a good outsourcing partner, they should have no trouble doing this. When you’re satisfied with your new team of world-class engineers, all that’s left is to get started. You should be able to start your new project within just a few days after signing the contract and be on your way to releasing your unique app. For more information on how to hire FinTech developers, check out this ultimate guide.

Andersen’s FinTech design examples

During the 18 years of Andersen’s operation, our top-notch experts have worked on scores of projects, delighting our customers with outstanding results. You can learn about some of them from the case studies below.

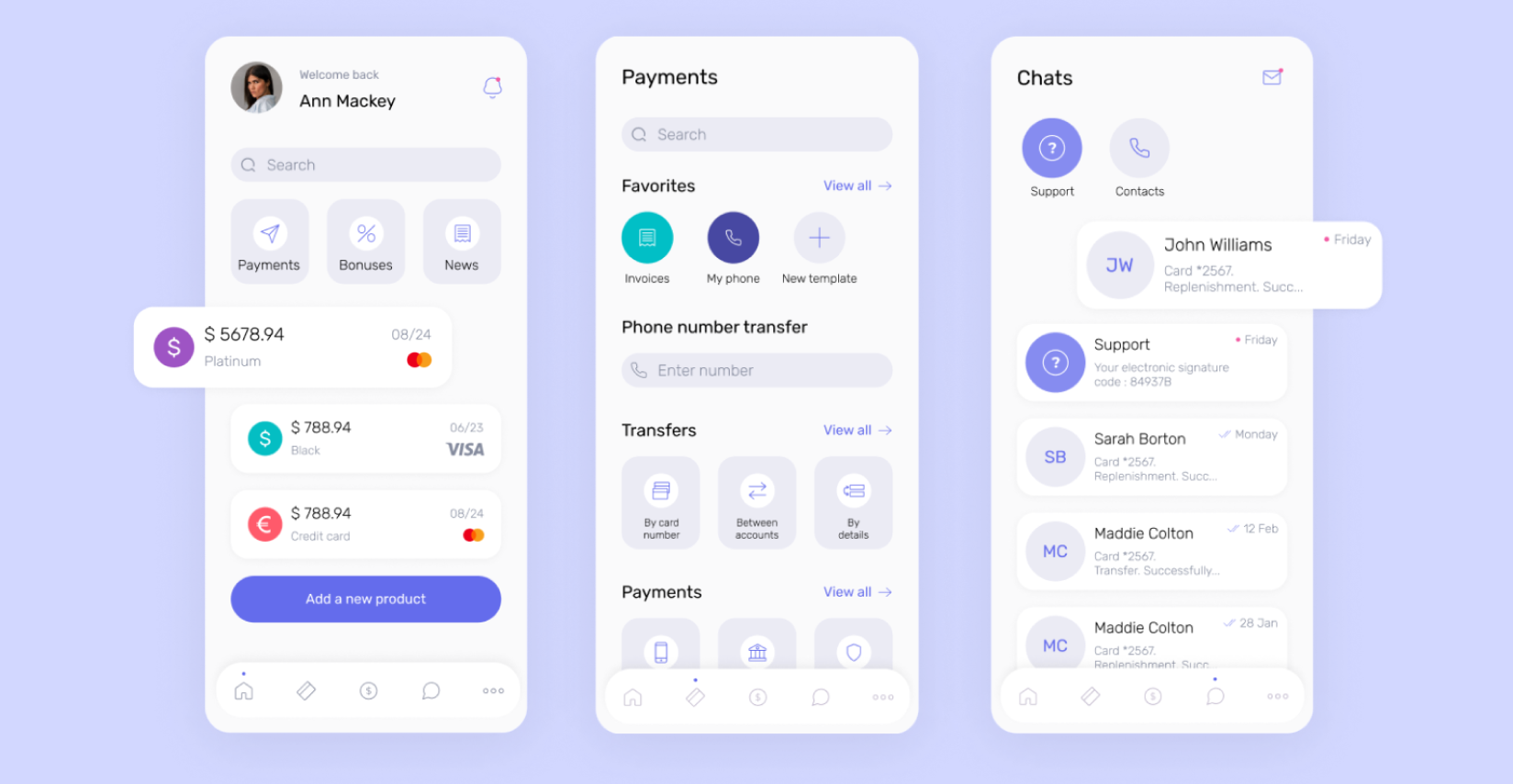

An eBanking solution with a feature-rich interface

The customer was a large online bank that needed to elaborate a complex customized ecosystem for its products. The project lasted for five years, and over a hundred of our specialists were involved.

As a result of our work, the bank has received the following benefits:

- Within a year, they doubled their client base;

- Clients seamlessly interact with the bank to plan their spending, make investments, participate in loyalty programs, get access to various travel and entertainment solutions, and more via intuitive mobile app and website interfaces;

- Users can enjoy a wide range of outstanding services via a single user ID;

- All components of the solution are integrated with each other in a seamless fashion to deliver an exceptional user experience;

AI-powered technology embedded in the solution ensures a high level of service personalization. View the full case study.

An app for personal finance management

The customer was a large European online bank that needed to develop an app for both Android and iOS to allow users to manage their finances in an effective and transparent fashion.

Below are just a few of the project’s impressive results:

- The bank has grown its client base by five times within a year of launching a solution that is capable of generating 25 times greater revenue;

- Users can now quickly and securely manage their savings and make transfers, payments, and investments – all this involving multi-currency options and cryptocurrencies;

- The solution includes advanced features – like cashback and reporting – and is integrated with Google Pay, Apple Pay, and SEPA transfers.

An app for financial planning and analytics

The customer was a company owned by a large financial holding. They needed to create an app that would be used as a financial assistant helping clients effectively manage their funds.

As a result of Andersen’s work, the customer has reaped the following benefits:

- The company has increased its client base by one and a half times;

- Users are enjoying a highly-personalized experience ensured by recommendations, notifications, real-time analytics, and more to substantially improve their financial management and minimize risks;

- The high level of automation and use of AI-powered tools allows the customer to provide better service via this advanced and secure solution.

An app for a bank’s corporate clients

The customer was a Georgian bank that needed to rework its existing digital infrastructure and create apps for Android and iOS.

As a result of our work, the customer’s corporate clients can now enjoy the following functionality:

- Conveniently manage their accounts;

- Efficiently handle loans and installments;

- Benefit from the increased performance of improved app architecture.

Wrapping up

We’ve all used great apps and seen them rise to the top, but we’ve also stumbled upon lousy ones. And there’s nothing worse than a glitchy, confusing, or even ugly app. So what makes the difference? Excellent UI design and UX. If you want to ensure the success of your app and retain your customers, you need to hire world-class engineers for the job. Get in touch with Andersen, and rest assured that we have the best experts, experience, and tech to make your FinTech app ideas a well-polished reality.