Andersen's track record of building APIs, banking and insurance apps, platforms for trading, and other software types speaks for itself.

Financial Software Development Services

Partner with Andersen for your next project

70% of the developers at our financial software development company have more than five years' experience with fintech software.

Andersen's content customers consistently recognize the high quality of our custom financial software development services.

Meet our tech team

Rely on our talent pool to accompany you through each phase of your initiative, from inception to launch.

Meet our tech team

Director of Financial Technologies

Denis successfully leads our financial technologies department. His professionalism has made multiple demanding projects possible.

- Certified Digital Banker;

- MA in Finance with a deep understanding of industry-specific needs;

- 12-year-long successful track record in the financial industry.

Regional Director of Financial Technologies

Regional Director of Financial Technologies

Doing more for the financial sector

Andersen is a reputable and top-ranked provider of software development services for finance, working with customers of all sizes in many regions.

Global companies

Around 200 IT initiatives for financial entities from the Fortune 500 list:

Transformation initiatives and corporate digitization;

Consulting services from knowledgeable experts;

Team augmentation;

Strategic business relationships.

Medium-sized entities

Andersen helps outline priorities and optimize allocations:

Project development services

Team outstaffing;

Team growth and workflow optimization;

Product strategy development.

Startups and SMEs

Accelerating product development by working in a truly adaptable way:

Project development services;

Streamlining the growth of your team and internal processes;

Team outstaffing;

Product strategy mapping;

Managed services.

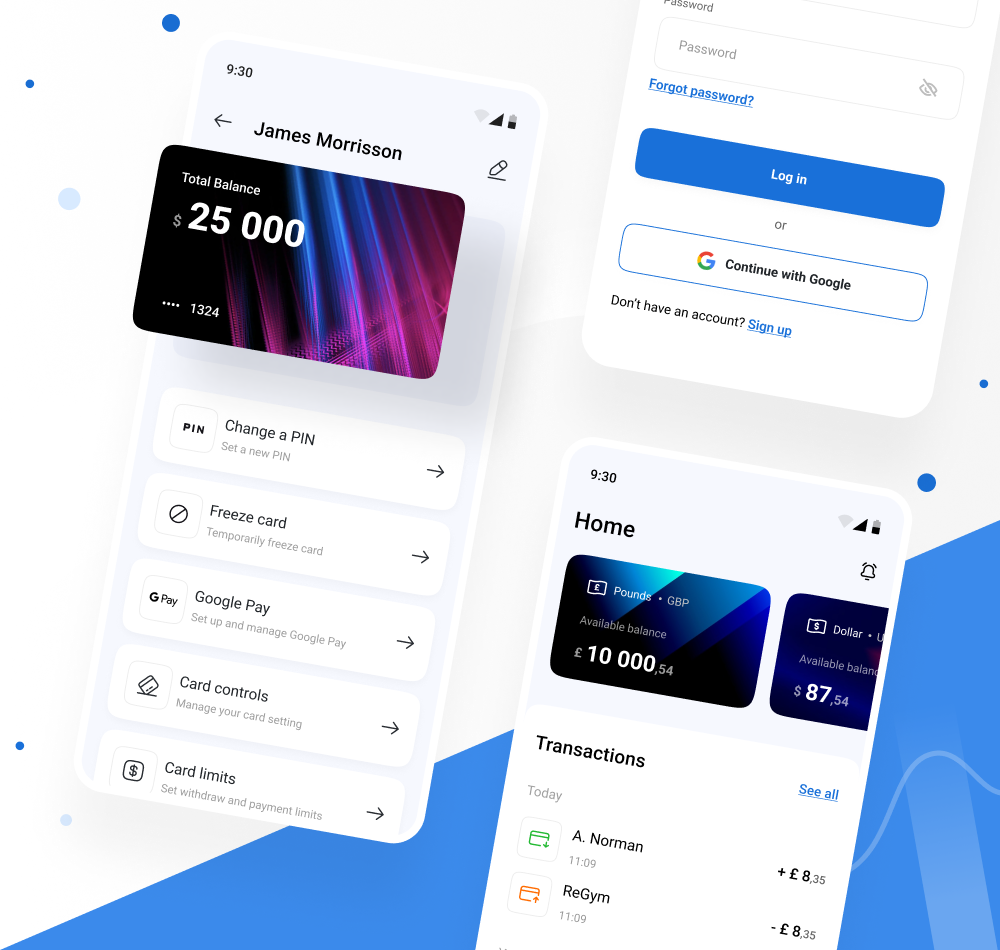

Andersen's digital banking app for financial service companies

Discover the benefits of our white-label digital wallet and mobile banking app, tailored for neobanks, traditional banks, and fintech service providers.

Learn moreFinancial development scope

Banking Software Development

Modernize and digitize your business by applying our expertise in custom products, knowledge of SaaS approaches, and capability to make the most of off-the-shelf products.

FinTech Software Development

Capitalize on our expertise to grow in the highly competitive finance industry environment in conformity with the pertinent regulations.

Insurance Software Development

Ensure accurate projections and calculations while mitigating underwriting risks with software designed by Andersen.

Investment Software Development

Maintain efficient portfolio management, profitability, and client satisfaction with advanced and feature-packed investment tools built by our team.

Financial Technology practice

FinTech features

- Core payment functionalities:

- Payments and billing;

- Money transfers;

- Remittances between banks;

- E-wallets;

- Android Pay and Apple Pay.

- Convenient user accounts:

- Card management;

- Customer support channels;

- Functionality for finding the nearest ATMs and branches;

- Management of card notifications;

- Protected client support channels;

- Ability to save contacts and beneficiaries.

- Extra operations:

- Lending;

- Investments and savings;

- Budgeting and analytics.

Usability and production readiness

- Performance optimization, including lazy loading, code splitting, and server-side rendering;

- Performance monitoring covering responsiveness, load time, potential crashes, etc.;

- User accessibility and device, browser, and OS compatibility;

- Alerts and notifications;

- Security, encompassing user input sanitizing, strong authentication, CSRF, device binding, etc.;

- Harmonious analytics integration to track performance and user behavior;

- User feedback, including rating prompts, feedback forms, bug reports, etc.;

- Offline functionalities ensured via caching, data storage, access, etc.;

- Integration with social media, including features like sharing, unified access points, and platform-specific APIs;

- Search and filtering components;

- Continuous maintenance, support, and updates, including A/B test-based improvements.

Middleware solutions

- Creating custom software based on open-source options;

- Building on top of solutions and integration platforms from other vendors;

- Designing truly omnichannel experiences across digital apps and websites;

- Providing real-time access to money and financial products via a digital interface for customers;

- Crafting one-of-a-kind custom software components built from scratch to deliver tailored-fit functionalities.

Core solutions

- Revamping core platforms and redesigning them based on open and modular architecture principles.

- Market research and solution comparison reports covering applicable platform details;

- Core banking vendor assessment and selection based on specific sets of questionnaires;

- Provision of faster time-to-market with new core banking platforms;

- Integration with core systems.

Solid IT expertise in Finance

This approach is ideal for transformation or migration projects, demanding thorough preparation crafted by highly skilled business analysts and solution architects.

Partner with a trusted provider of financial software development to deliver a comprehensive solution freeing you from the challenges of daily project management.

Enhance your in-house staff with highly skilled tech experts equipped to drive success. Andersen will provide carefully selected CVs to ensure the perfect fit for your requirements.

This approach is ideal for transformation or migration projects, demanding thorough preparation crafted by highly skilled business analysts and solution architects.

Partner with a trusted provider of financial software development to deliver a comprehensive solution freeing you from the challenges of daily project management.

Enhance your in-house staff with highly skilled tech experts equipped to drive success. Andersen will provide carefully selected CVs to ensure the perfect fit for your requirements.

Financial Software Consulting

IT projects for Finance

From seamless mobile payment solutions to advanced retail finance platforms, we empower customers worldwide with custom financial software, speeding up development cycles and enhancing their operations.

Ways we improve products

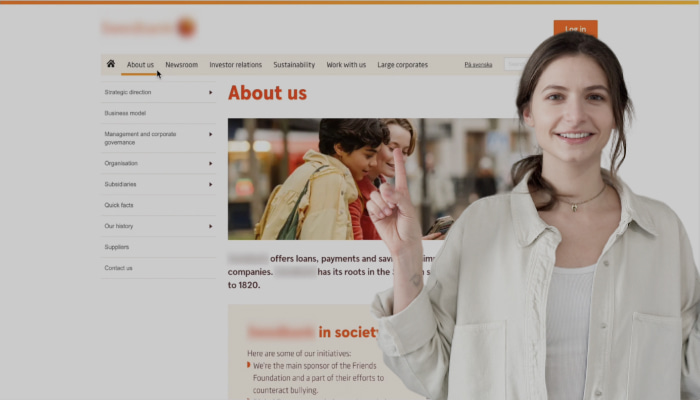

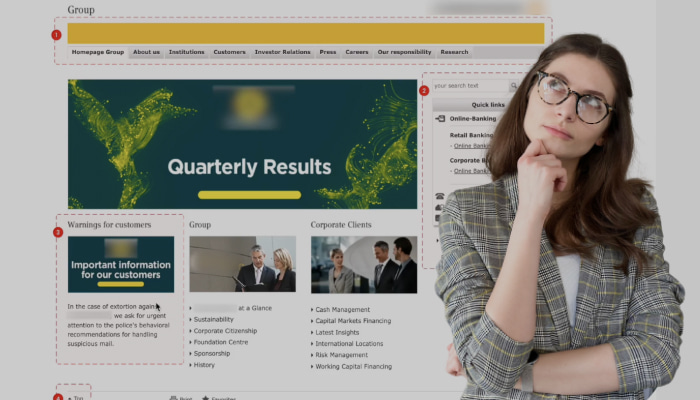

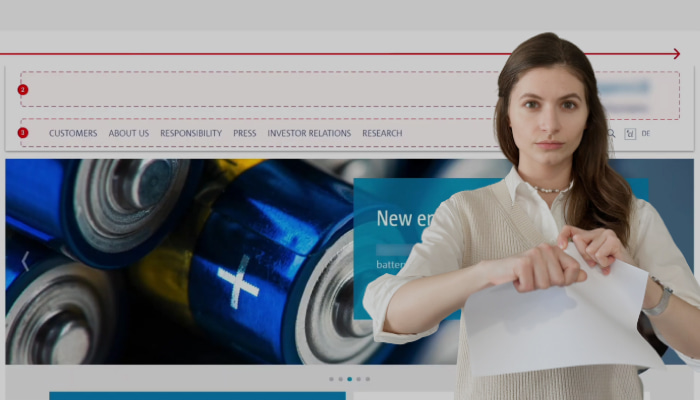

In these videos, Andersen's team shows our UI/UX design vision. We analyze our competitors' projects and discuss how to improve their design and conversion rates.

An accessibility audit for a Swedish Bank

Andersen explains how to improve the accessibility, i.e., website usage, of their product.

A UX audit

Andersen's experts develop hypotheses and apply all possible techniques and principles, such as accessibility guidelines and Jakob Nielsen's heuristics.

Navigation improvements

Learn why usability and business goals are what we focus on in our Information Architecture.

Testimonials

We are proud of the custom financial software development services we have provided. Here is what our customers share about our contribution.

Expert Voices in Business and Science

Andersen frequently creates opportunities for learning by hosting interviews with experts and thought leaders from diverse scientific and business fields.

What trends will shape the near future of finance apps?

Who can run banks more adeptly: machines or people?

Interview

Transformation of Financial Services

Interview

Finance and Banking: Trends and Challenges

Something to think about

Andersen's professionals consistently engage in research on the financial services market, keeping track of trends and changes. Our company's team wants to share our vision of where the global market is heading in FinTech engineering, insurance software, development outsourcing, etc.

We are ready to assess your challenge and help you with it. Schedule a call to start.

IT skills and experience in Finance

By employing the latest technologies, frameworks, and components, our engineers create solutions that combine compelling and accessible modern design with high performance.

Software development scope

Leverage blockchain to unlock new business and technological opportunities, enhancing efficiency, security, and traceability.

- Blockchain marketplaces;

- Fraud-resistant payment systems;

- dApp development.

Leverage blockchain to unlock new business and technological opportunities, enhancing efficiency, security, and traceability.

- Blockchain marketplaces;

- Fraud-resistant payment systems;

- dApp development.

Partner with us to leverage our tech expertise and proven eMoney track record for the success of your IT plans.

- Fintech web and mobile applications;

- QR code payments;

- eWallet and digital wallet development services.

With our expertise and record in open banking software and APIs, your organization will have the leverage to establish effective partnerships and create extra income channels.

- Data analytics and security;

- Personalized account management solutions;

- Payment service provider software.

Tax and accounting software solutions developed in cooperation with our team will advance your productivity, facilitate your spending management, and make sure your business becomes more cost-effective.

- Tax refund solutions;

- Custom accounting software for businesses;

- Fund accounting software systems.

Andersen’s blockchain engineering specialists are in a position to carry out your cryptocurrency development project with our domain-specific resources.

- Cryptocurrency exchange platforms;

- Digital wallet integration;

- Cryptocurrency wallet development.

Obtain a high-performing and comprehensive price comparison solution tailored to your segment for the best possible results.

- Comparison services for businesses;

- Utility comparison software;

- Price comparison services for retail.

Andersen excels in leveraging the essential tools required to develop bespoke software solutions for compliance needs.

- AI-driven automation of document flow;

- Knowledge management;

- Transaction monitoring.

Since 2007, we have developed multiple digital lending solutions that cover underwriting, calculation, origination, management, etc. for customers ranging from fintech startups to global banks. Andersen creates decision support systems from scratch via AI or integrates them with external solution providers.

- Bespoke loan origination software;

- Tailored loan management systems;

- Lending automation and management software.

Andersen helps fintech companies swiftly select IT specialists and assemble productive teams capable of implementing custom, SaaS-based, and other IT solutions to attain business objectives.

- Finance-focused IT teams;

- Position requirements analysis;

- Compliant development and delivery.

The finance sector demands rigorous standards for compliance, financial data safeguarding, and informed decision-making. Andersen's advanced algorithms are designed to help you.

- Automated transactions;

- Reporting and planning;

- Leading RPA practices.

Andersen will be happy to offer you our extensive range of NFT Development Services and provide you with state-of-the-art deliverables.

- NFT exchanges and marketplaces;

- NFT sites and apps;

- Wallets to work with NFTs and SFTs.

With our dApp engineering services, you will be ready to implement sophisticated and advanced initiatives in this emerging domain.

- dApp design and engineering;

- dApp QA and consulting;

- dApp support and maintenance.

Contact Andersen for dependable DeFi development services.

- Crypto stacking and lending;

- Yield farming and lotteries;

- DeFi exchanges.

Andersen's smart contract expertise extends beyond the financial domain. Our engineers specialize in applying smart contract solutions across diverse industries, such as real estate, logistics, gaming, and more, leveraging their deep knowledge to deliver practical, industry-specific implementations.

- Audit of smart contracts;

- Design and development of smart contracts;

- Smart contract optimization.

Order Consultancy Services

Andersen's financial software development consultants assist businesses across major industries by addressing complex problems with technological solutions: custom undertakings, SaaS initiatives, or off-the-shelf options. Using our knowledge, we focus on solving core problems and driving added value.

FAQ

For over 19 years, our finance software development company has delivered over 300 IT initiatives for finance entities. Andersen's talent pool possesses expertise in APIs, mobile apps, trading platforms, fintech solutions, and insurance software, monitoring all relevant trends. Over 70% of our industry-focused engineers take pride in more than 5 years of relevant valuable experience.

Schedule a free IT consultation

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us