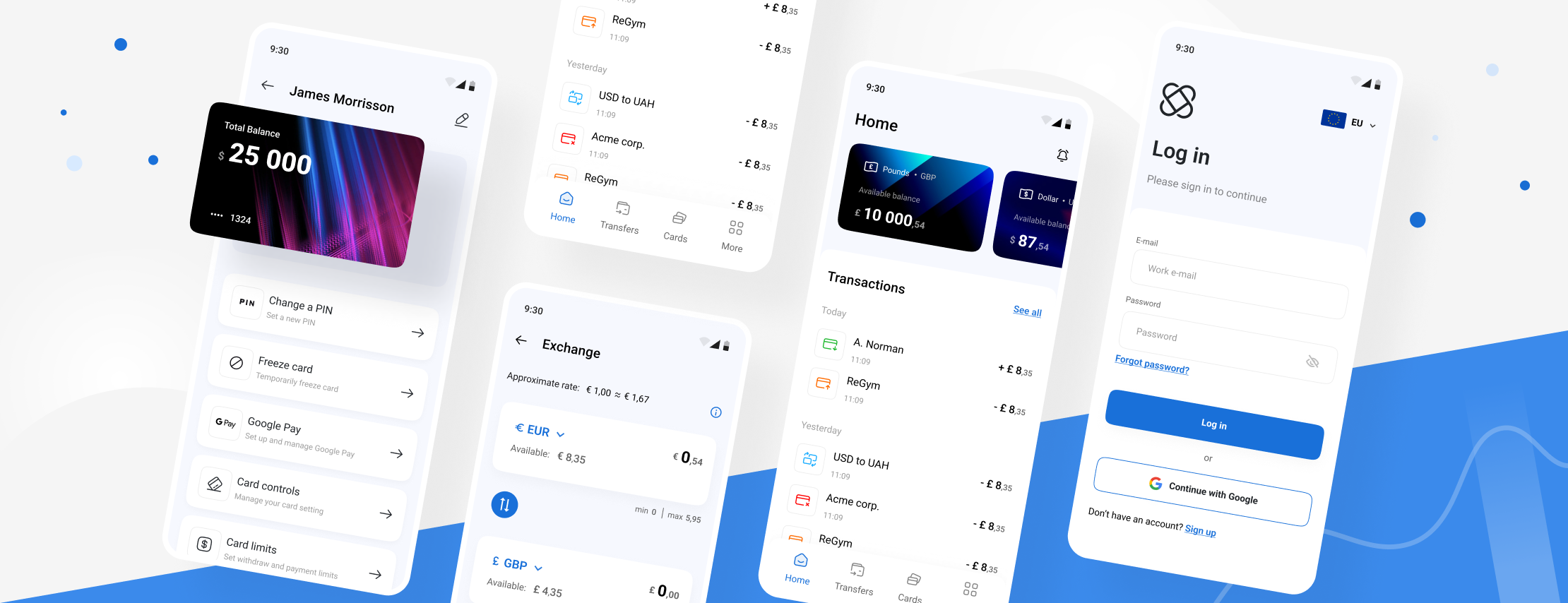

Digital Banking App

Brief product's description

Andersen's mobile banking app development team offered a ready-to-use and highly flexible solution. This is an e-wallet for fiat and crypto payments tailored to the needs of both businesses and individual clients. The product matches all modern requirements in terms of usability, compliance, and security.

How does it work?

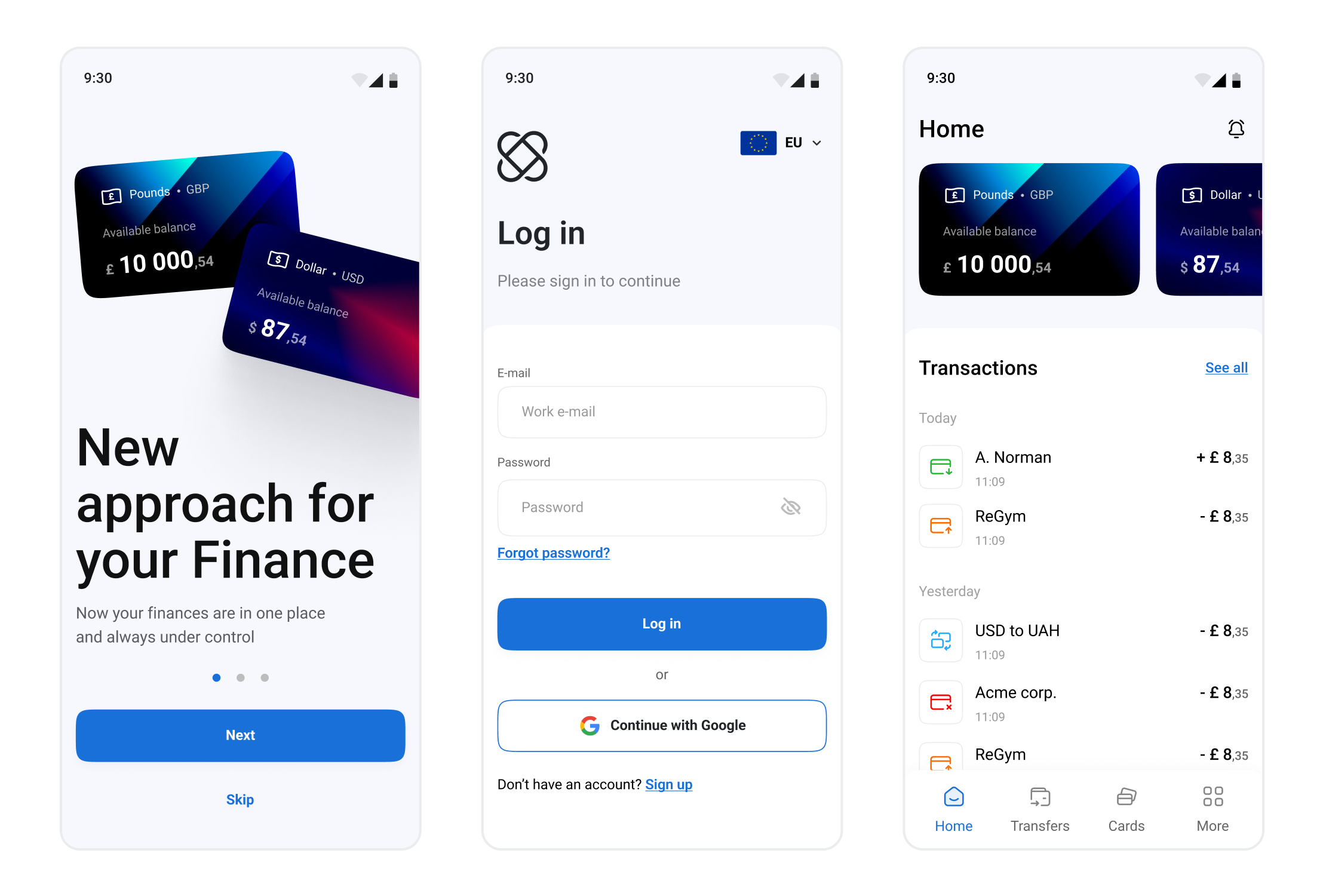

Andersen's white-label digital wallet was specifically designed to provide users with a seamless and convenient user experience. It is based on the experience from countless successful projects implemented by our engineering teams.

Even the basic features of our innovative and progressive white-label digital wallet and mobile banking app exceed expectations:

Account management:

- Multiple accounts held in different currencies;

- Account balance checks;

- Transaction history and details;

- Account statements;

- Personal information management.

Fund transfers:

- Domestic and international transfers (including SWIFT and SEPA);

- Peer-to-peer payments;

- Mobile wallet integration (e.g. Apple Pay and Google Pay).

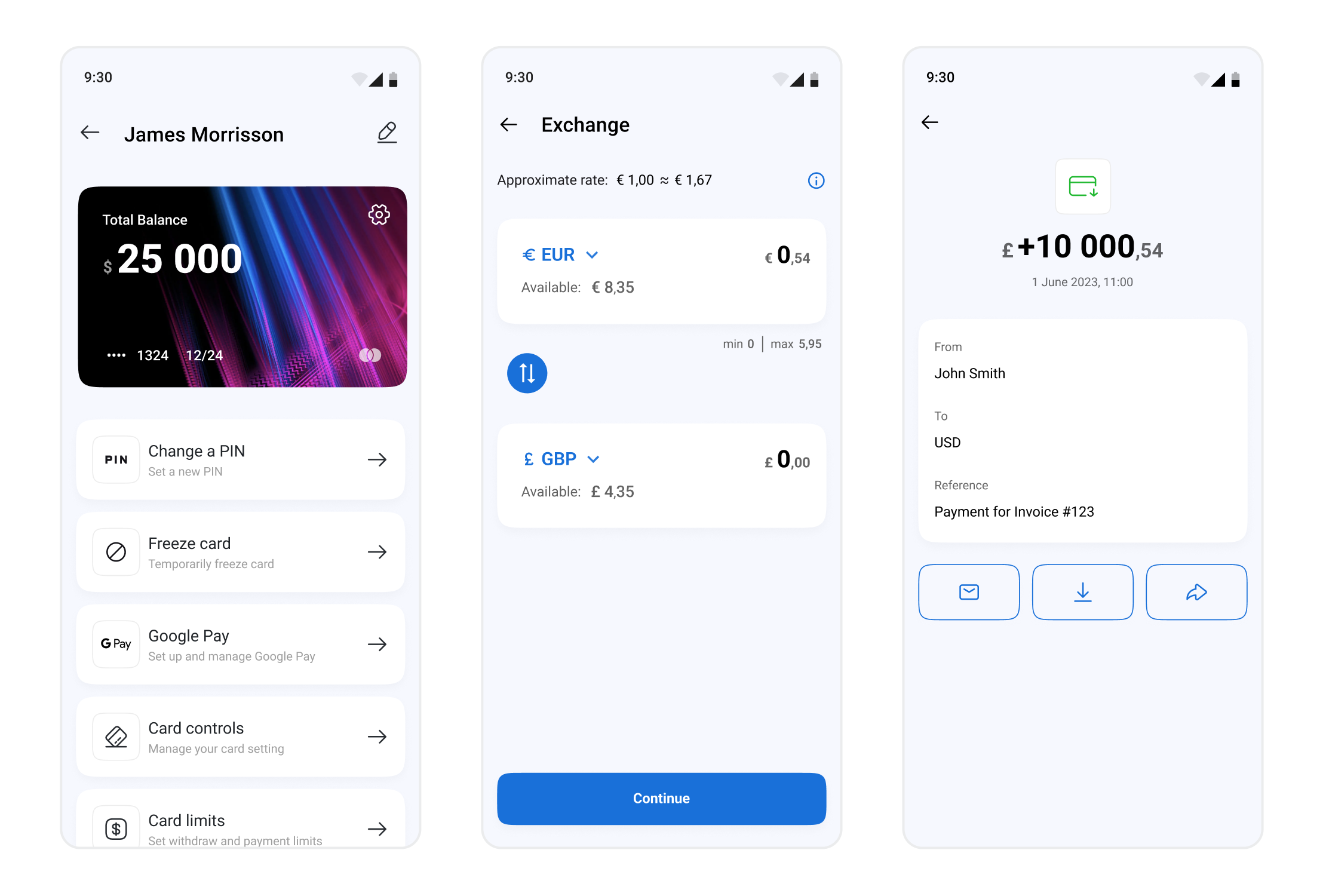

Card management:

- Debit and credit card controls;

- Card activation and deactivation;

- Spending limit adjustments;

- Travel notifications;

- Contactless payment setup.

Alerts and notifications:

- Account balance updates;

- Transaction notifications;

- Fraud detection and security alerts;

- Personalized notifications and offers.

Security and authentication:

- Two-factor authentication (2FA);

- Encryption of sensitive data.

Customer support:

- In-app chats and messaging;

- Frequently asked questions (FAQs);

- Contact information for bank representatives.

Also, the feature list of Andersen’s white-label digital wallet and mobile banking solution can be easily extended with the following modules and functionalities. As a result, it is capable of addressing every need in the next-gen FinTech domain.

Deposits and withdrawals:

- Mobile check deposits;

- ATM locator;

- Cardless ATM withdrawals.

Fund transfers:

- Scheduled transfers;

- Bill payments.

Investment services:

- Stock trading and portfolio management;

- Mutual funds, ETFs, and other investment products;

- Retirement account management;

- Market updates and financial news.

Budgeting and financial planning tools:

- Spending analysis and categorization;

- Savings goals and progress tracking;

- Budget creation and management;

- Financial insights and recommendations.

Loans and credit:

- Loan applications and management;

- Credit score tracking and monitoring;

- Credit card offers and applications.

Customization and personalization:

- Customizable app dashboard and layout;

- Personalized offers and promotions;

- Integration with personal finance management tools.

Moreover, we can add extra features on your demand:

- Account registration in compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) verification processes;

- A secure and integrated wallet for users to store, send, and receive different cryptocurrencies;

- Real-time market data, including price charts, market cap, trading volume, and historical data, along with analysis tools and news updates;

- Buying, selling, and trading cryptocurrencies using various order types such as market, limit, and stop orders;

- Tracking of crypto holdings, monitoring of the overall value of the portfolio, and analyzing performance over time;

- Customizable price alerts and notifications for making informed trading decisions;

- Fiat-to-crypto and crypto-to-crypto exchanges;

- Staking cryptocurrencies to earn interest or participate in DeFi (Decentralized Finance) lending protocols.

Having accumulated substantial experience in wallet app development, including the provision of cryptocurrency wallet development services, we know how important dependable integrations with third parties are. Hence, we provided for:

Integrations with banks and electronic money institutions (EMI):

- Banking Circle;

- ClearBank;

- Companies House (UK);

- EMBank (LT).

Integrations with security providers and access management systems:

- Keycloak;

- LexisNexis;

- All OAuth and SSO (single sign-on) compatible providers;

- Fourthline.

Сlient's onboarding/KYC:

- Sumsub;

- Onfido;

- Jumio.

Card issuing:

- Exceet;

- Galileo;

- Modulr;

- Tribe.

Other possibilities:

- myWorld;

- HanseMerkur.

While working on our white-label digital wallet, we clearly saw that there were no ready-to-use solutions capable of fully addressing the specificities and regulatory limitations of developing countries. Thus, we delivered the best possible user flow, tailored the design to ensure visual exclusivity, and provided for extensive customization potential in terms of e-wallet app development.

Other key advantages include a top-notch API gateway that enables connection with any external FinTech platform of choice and extensive and detailed solution documentation.

Andersen's solution is successfully used by

- Traditional banks

- Fintechs

- Neobanks

- Crypto startups

Product delivery roadmap

To deliver an optimal solution, we followed best practices in digital banking app development and white-label e-wallet development.

Product demo

Discussing your idea and demonstrating possible solution

Gap analysis

Identifying missing values and defining product delivery roadmap

Implementation and integrations

Assembling an engineering team that follows Agile delivery principles

MVP go-live

Releasing the product after a thorough QA round

Schedule a product demo

Customers who trust us