The customer chose to protect their confidential information

A High-Performing and Feature-Rich eBanking Ecosystem

About the client

In this instance, our customer was a leading American online bank. Their primary competitive edge lies in their commitment to delivering cutting-edge client experiences.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/usa-desktop-2x.png)

Project overview

The customer requested Andersen's expert IT team to develop an e-finance ecosystem based on their clients' multiple needs. As a result, the customer wanted to effectively obtain a considerable number of digital banking products and services while maintaining the highest possible industry standards.

Description

Lifestyle concept

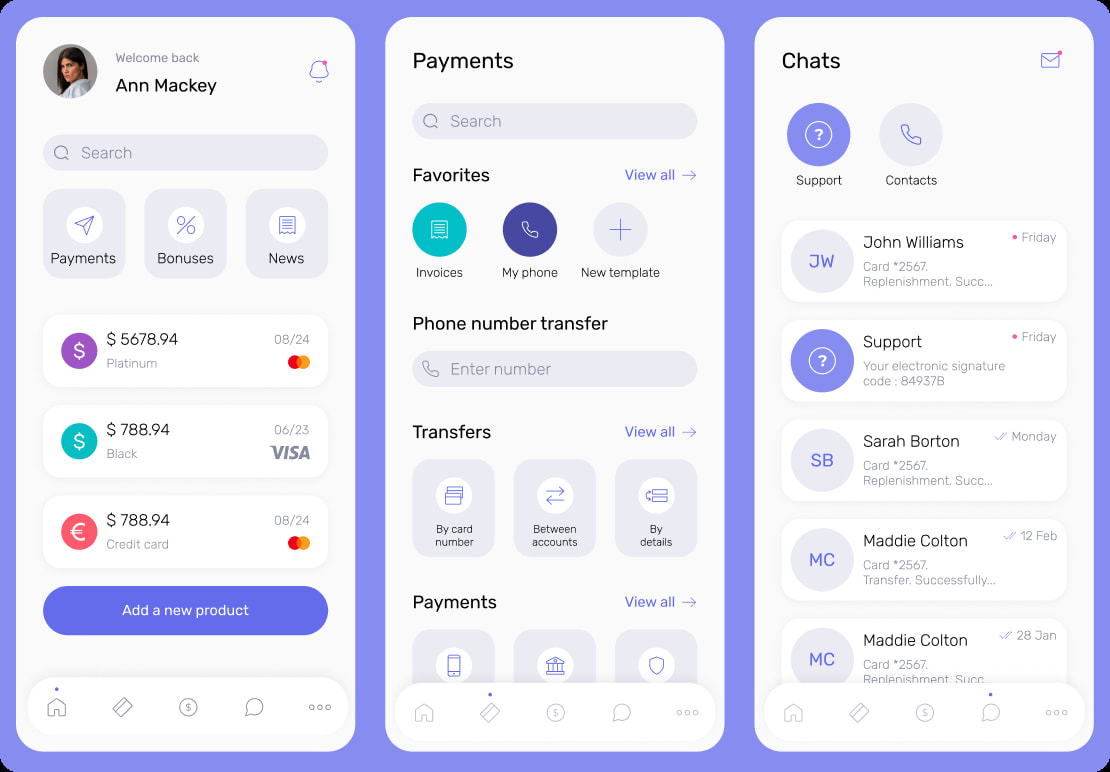

Andersen's involvement in this complex IT project was based on the so-called lifestyle banking concept. That is to say, the ecosystem was expected to ensure the most customized and personalized user experience possible. Among other things, it allows the clients to assess and plan personal spending, invest savings, receive bonuses defined by the loyalty programs, book trips, buy movie tickets, book tables in restaurants, and much more. All the aforementioned services are made available via mobile apps and the website, in an intuitive and seamless fashion.

Core

The core of the entire ecosystem is constituted by the bank itself, i.e. the world's largest independent online bank with 16.7 million customers. As a pioneer of digital banking, the customer does not have traditional offices at all. Instead, the bank operates a network of representatives responsible for delivering the company's products to any region of the country within the shortest possible time. In addition, the clients can interact with the bank via online channels and a contact center. To be as effective as possible, the bank implements its AI-fueled strategy and applies artificial intelligence and machine learning technologies to their communications. Hence, 80% of their HQ staff are IT professionals.

Collaboration

The Andersen team has been working in close contact with the customer to craft a super e-banking app. Our task was to ensure a unique user experience and deliver challenging outcomes to build an ecosystem for financial and lifestyle services. As a result, both individuals and businesses were to obtain a tool of unprecedented quality via mobile and web channels. Another goal of importance was to provide all the advanced super app services based on a single user ID.

Marketplace

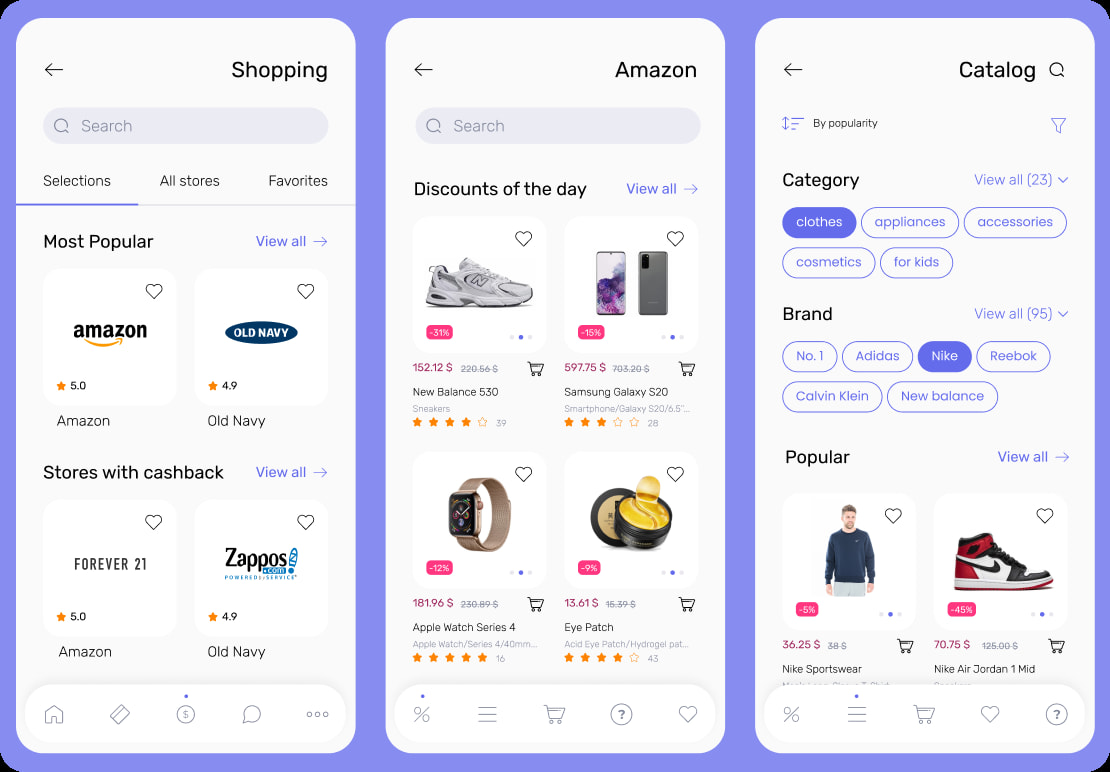

Another key feature of the super banking app is its Marketplace. External partners cooperating with the bank can connect with the Marketplace via an open API. The latter uses an app-within-app model and offers targeted relevant products and services.

App functionality

With Andersen's assistance, the bank is now in the right position to offer a super app for e-banking services and such capabilities as:

- Digital banking platform covering all the bank's financial products

- Lifestyle functionalities (movie tickets, concerts, theatres, restaurants, tourist trips and travel, shopping, sporting events, etc.)

- Complete and seamless integration with all the components and services of the ecosystem. These include mobile telecommunications, investments, business, and insurance

- Marketplace for products and services provided by external partners to meet client needs

- Greatest personalization for recommendations and services provided. The ecosystem can also anticipate the financial needs of a client

- End-to-end integration with a built-in voice assistant

- AI and ML leverage for the artificial intelligence strategy

Solution

The resulting solution makes it possible for end-users not only to manage their finances but also provides them with such advanced lifestyle options as:

- Online commerce with the capability to place orders via the application directly (foods, books, clothes and shoes, household appliances, etc.)

- Recommendations concerning upcoming events and other leisure opportunities (city quests, guided tours, lectures, exhibitions, parties, masterclasses, etc.)

- Fitness and wellness

- Food and flower delivery

- Automotive products and services

- Goods and services for children

- Transportation, logistics, and carsharing

- Cleaning services

Project results

- A high-performing and feature-rich eBanking ecosystem was successfully developed to provide a personalized user experience;

- The bank ranked among the top three online banks according to the number of active clients;

- 20,000+ cards are issued daily;

- 20+ million users avail themselves of the investment app day-to-day;

- Over $25 million is issued monthly in cashback and customer bonuses;

- 600,000+ legal entities use the bank's payroll services;

- More than $13 billion in assets is managed;

- 50% growth in the customer base was achieved within a year, totaling 17 million clients;

- 40% of client requests are processed through a voice assistant in chats, reducing the need for employee involvement and resolving issues in an average of 40 seconds.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us