The customer chose to protect their confidential information

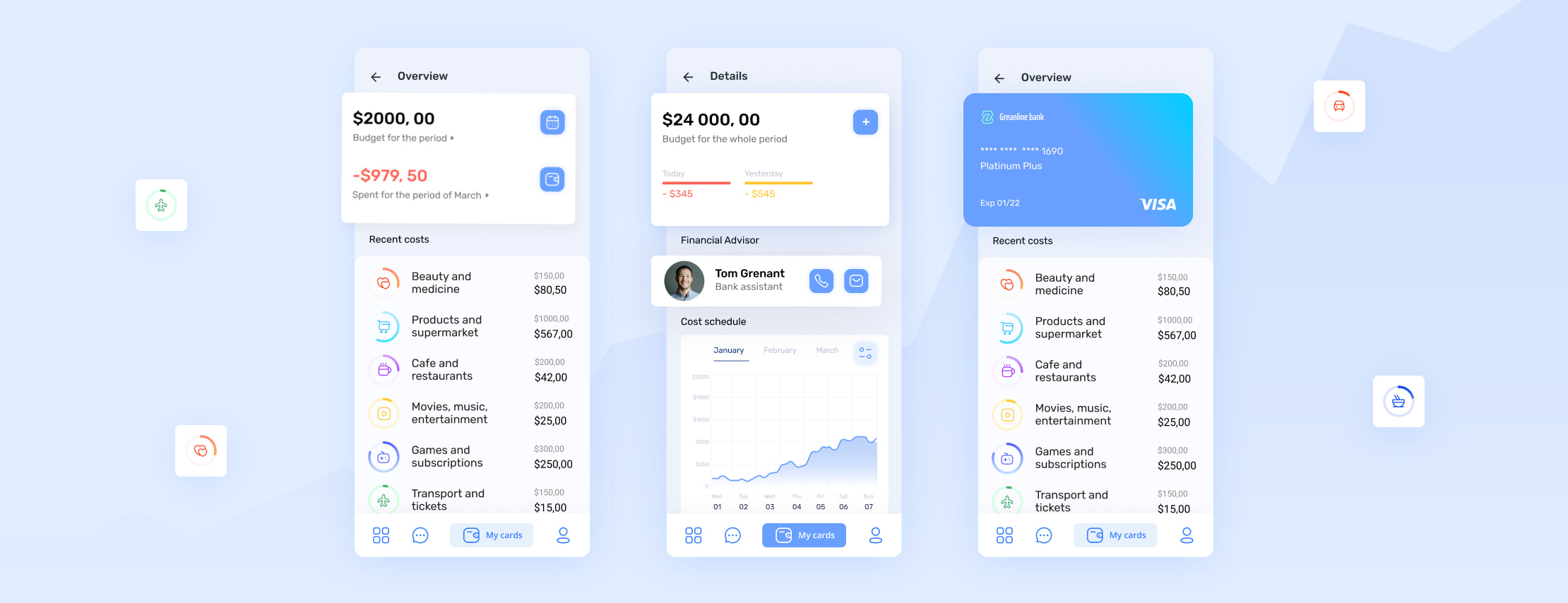

The NARVI Personal Finance App

About the client

The customer is a subsidiary of a large private financial holding in the region of presence, which includes one of the biggest banks and a number of financial companies.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/finland-desktop-2x.png)

Personal Finance Solution

Project overview

Andersen was asked to assist with a project aimed at developing a financial tool to comprehensively assess the financial situations and prospects of end clients, as well as to propose data-based course of action options to accumulate more wealth.

Project context

The Andersen team has created a financial assistant that can analyze the financial conditions of a client and suggest how to achieve life goals and effectively manage funds, i.e. spend, save, and accumulate them.

This personal assistant helps easily track and assess personal incomes, plan large purchases, optimize and, if necessary, limit daily spending. The app is an optimal option for financial planning and improving financial self-discipline. As such, it makes it possible to determine where money "goes" and how to adjust expenses.

Thus, it is a great tool for those who value their time and want to keep up with the times, as well as for those who want to control their own budgets. Namely, as a solution capable of analyzing large amounts of data and understanding its end-users, the assistant motivates them to achieve financial goals.

Project scope

- Effective personal finance management, including savings and rational spending habits

- Achieving goals and resource planning

- Accumulation of capital and investments

- Financial education and training

- Synchronization of bank accounts

App functionality

To ensure all the deliverables requested by the customer, the Andersen team developed an entire range of advanced functionalities in practical terms:

- Reminding about transactions and transfers;

- Smart Home and daily shopping options, including ordering groceries, paying utility bills, subscribing to paid content, etc.;

- 'Smart' insurance for retail customers (e.d. medicine and car loans);

- Modeling of financial risks (e.g. default and cash gaps) in real-time with recommendations concerning target strategies and products;

- Generation of suggestions to improve returns on high-yield investments;

- Recommendations covering banking products and purchases (e.g. loyalty programs from various retailers) based, among other things, on information about the customer taken from social media;

- Identification of clients' connections with the subsequent recommendations of new counterparties;

- Security and anti-fraud mechanisms;

- Analytics system aggregating all data and generating customized reports.

Project results

To sum up, the system can analyze the financial behavior patterns by coving user operations and independently offering to automate certain transactions, according to frequent requests.

Information about receipts and expenses is automatically adjusted to users.

Personalization services help clients to interact in such a way that, even in the case of automatic maintenance operations, consumers receive options customized to their interests and needs.

As for the robo-advisor and AI aspects, they provide great advantages in terms of investing and trading. Automation allows one to get timely info 24/7, while reducing the process costs. Such robo-advisors are available via both desktops and mobile applications. A high level of integration of the virtual assistant with databases and platforms is fully ensured, so that there is seamless access to financial information and big data.

Another valuable service is a personalized cybersecurity system. It responds to atypical authorization attempts and unusual transactions.

As a result of the projects, its successful implementation benefited the clients owing to the personal consultant capabilities, virtual assistant options, robo-advisor potential, virtual financial analysis, and personalized security services.

As for the benefits secured for the service provider, they include a credit advisor, micro-segmented marketing services, and the next-best-offering analytics.

- 70% of users entrust their data to the virtual assistant in order to receive personalized experiences;

- 50% of users take advantage of automatically generated recommendations for their banking transactions;

- The mobile app saw 200,000 installations within the first 6 months of its release;

- 1.5 times more clients reach out to retail customers using our software solution.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us