- What is DeFi lending and how does it work?

- How is DeFi lending different from traditional lending?

- Benefits of DeFi lending platforms

- DeFi development step by step

- Conclusion

Have you ever thought of launching a fintech startup where moneylenders and funding recipients would put their crypto assets into use in no time, with no go-betweens, and at high interest rates? If so, Andersen’s software development experts have good news. DeFi lending platforms worldwide boast a total value locked (TVL) currently amounting to an impressive $55 billion, and that’s taking into account that it has recently declined. In this piece, we explain how these systems operate, what features they can’t do without, and how to start a truly profitable solution.

What is DeFi lending and how does it work?

DeFi refers to decentralized finance that is governed via Blockchain-based apps and platforms on the principle of smart contracts. Let us explain in more detail.

- ‘Decentralized’ means that anybody can self-manage their crypto without turning to a single centralized governing institution.

- Blockchain technology serves for durable data storage.

- Smart contracts are automated protocols that enable transactions to be performed upon the fulfillment of the predetermined steps.

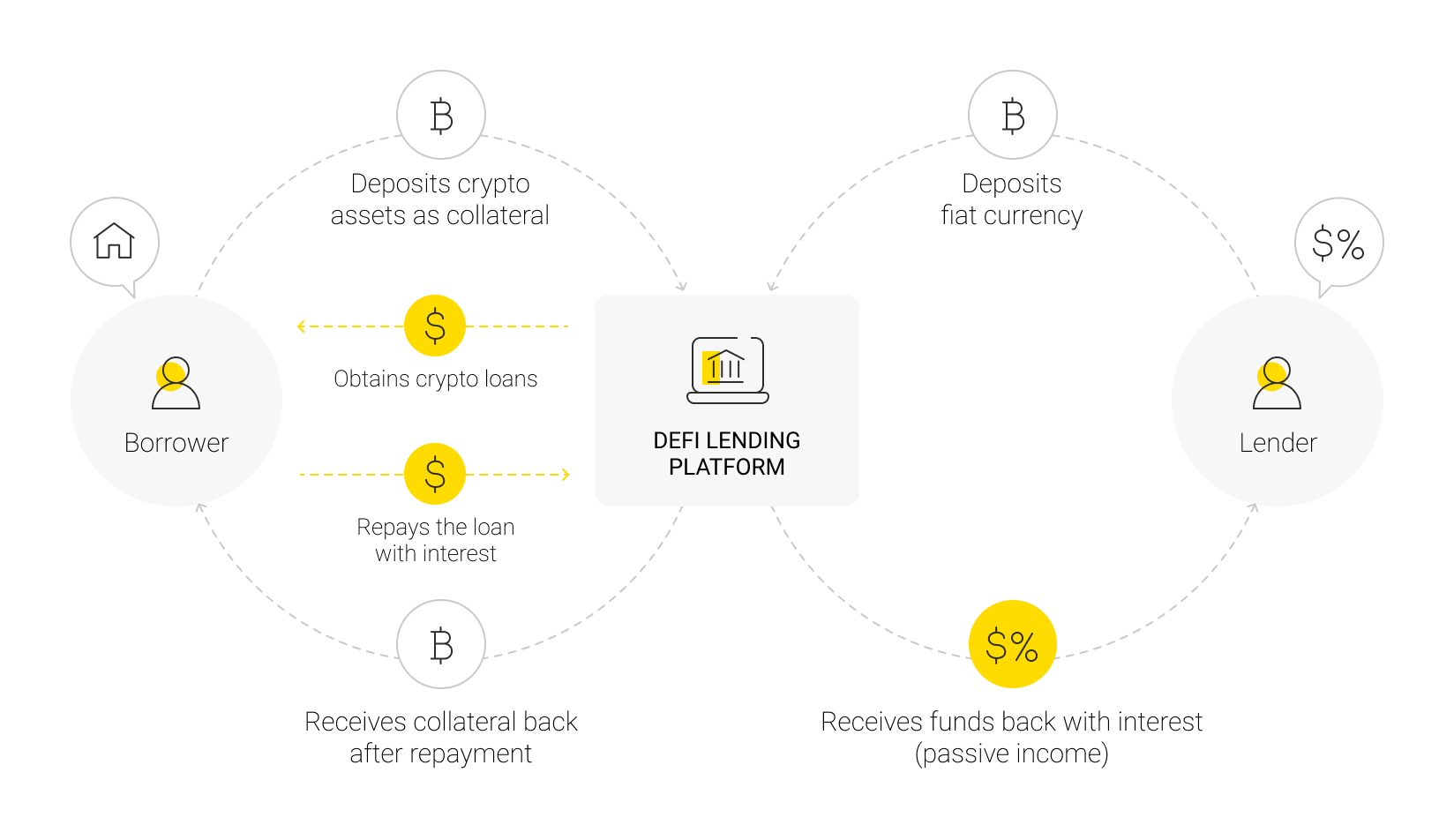

How does DeFi lending work? Any registered user can trade the backers’ crypto, provided that they pay the interest and, generally, put down a security deposit first.

The predominant DeFi lending platforms, judging by TVL, include MakerDAO, Aave, Compound, InstaDApp, and others. The secret of their success lies in the advanced features that we’ll touch on later in the article. Many of them also avail themselves of DeFi token development and issue their own currencies, or tokens.

How is DeFi lending different from traditional lending?

Before turning to DeFi development services, one should consider how the final product is different from traditional centralized platforms.

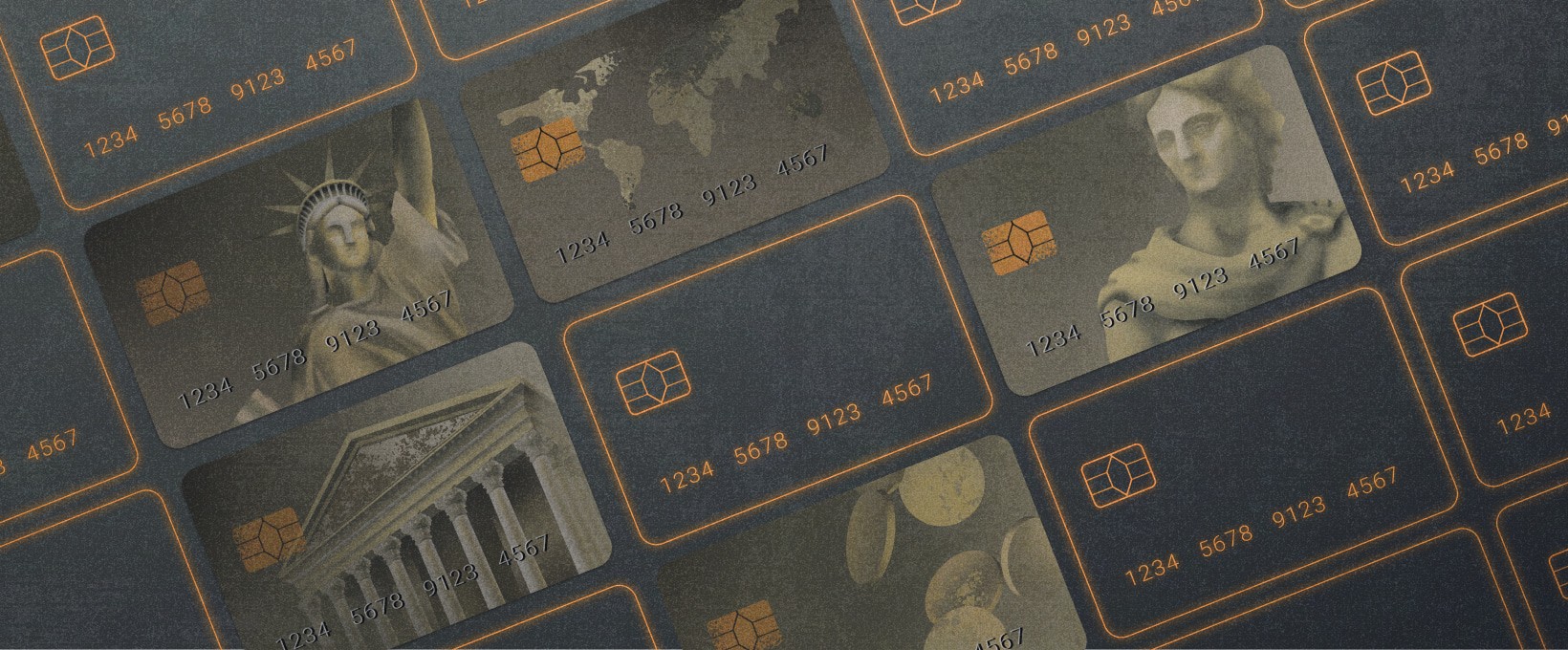

Availability

Traditional platforms adopt Know Your Customer standards to make sure that their clients are eligible to make transactions. This can delay the procedure. Along with that, underbanked applicants and those with derogatory marks on their credit reports often can’t avail themselves of the services that such systems provide.

DeFi lending platforms don’t require that users prove their identity when registering. Thanks to that, the entire process is substantially expedited. Although it’s worth mentioning that these resources aren’t intended for absolute beginners and require knowledge in the field of crypto investments.

Security

In a conventional system, the applicants’ creditworthiness is thoroughly checked, and the data regarding their income, workplace, etc. can be stored over a protracted period. This ensures increased traceability and operation security. As a rule, the users on alternative platforms remain unidentifiable. Therefore, transaction security is largely in their own hands. Although it should be noted that a trusted DeFi development company will do its utmost to program the system so that it is robustly protected from attacks and so that its data is encrypted end-to-end.

Interest rates

One of the most substantial benefits of decentralized solutions is that the interest rates are flexible. The conditions of deals are often stipulated by smart contracts. However, the parties can agree upon the desired rates between themselves. This allows for increased flexibility when traders want to benefit from the speculative nature of crypto markets. The backers, in turn, provide their funds at favorable interest rates. All this without the operational costs that are habitually there when it comes to the platforms backed by legacy institutions.

Benefits of DeFi lending platforms

On top of the aforesaid, opting for DeFi development services guarantees business owners a range of competitive edges.

- All the data, once entered into the system, remain invariable. This inalterability contributes to enhanced traceability and security of the financial and personal information of users.

- Deals’ participants have complete freedom to manage and control their assets however they want to within the conditions stipulated by the system. This alleviates the platform from responsibility and creates a win-win situation for all parties involved.

- The enhanced management over their finances gives users the freedom to trade across international marketplaces, thus, acting on the most favorable conditions. This keeps them engaged with the platform. In addition, the beneficial terms of DeFi lending platforms guarantee their continuous extensive usage by the audience.

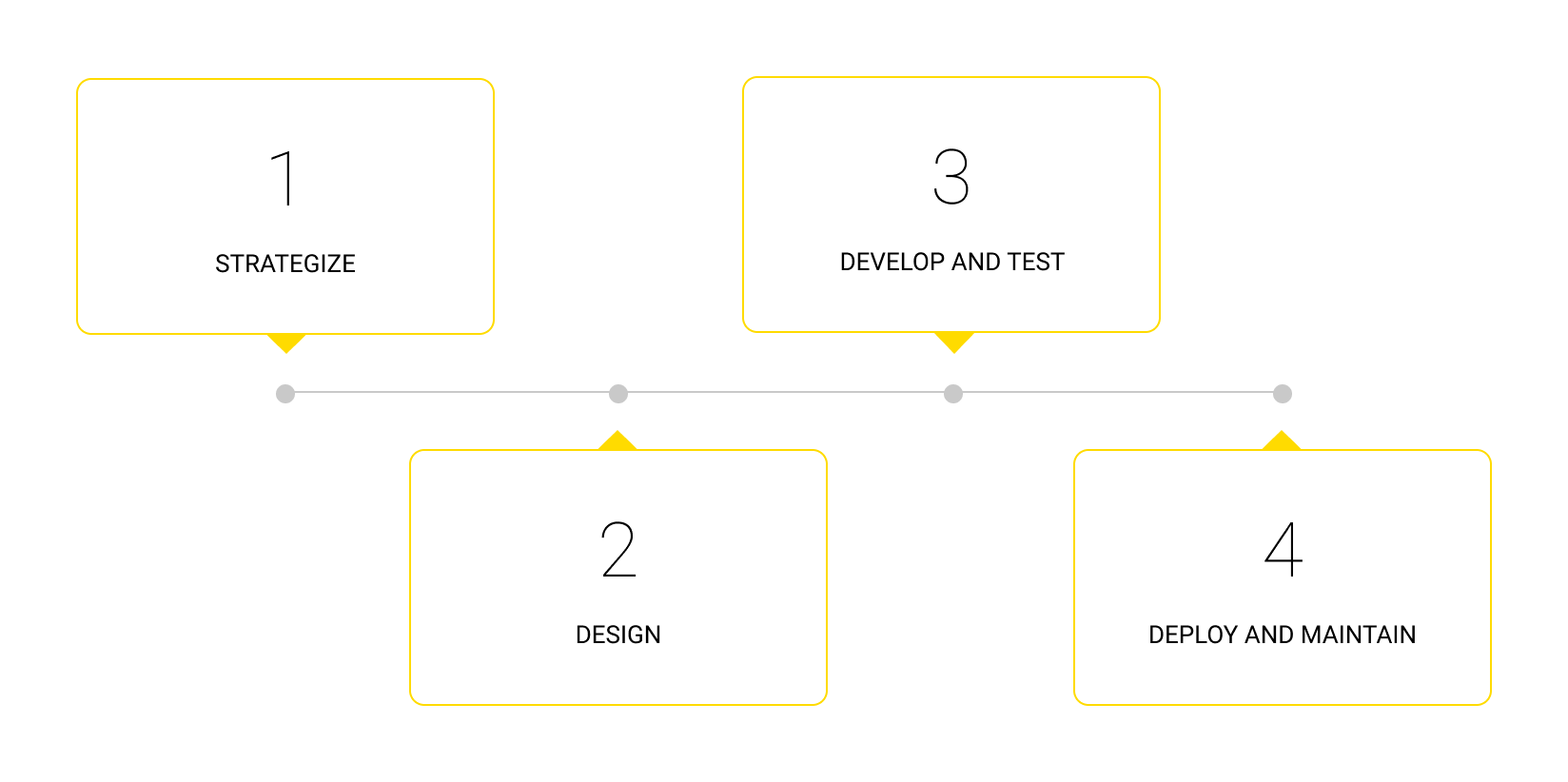

DeFi development step by step

Which functionalities are vital to plan for in DeFi app development, and what steps should a DeFi development company take to build them?

In addition to the conventional features that lending systems normally have, the essential elements of DeFi platforms include:

- A fiat gateway for accelerated onboarding of everyone irrespective of whether they already own crypto or not. The purchase of crypto is possible thanks to the integration of the platform with third-party APIs.

- Wallet compatibilit y for integrating users’ favorite wallets with the platform. The most popular solutions allow for linking dozens of wallets to an account.

- Lending and borrowing features, including the possibility to check your balance, set interest rates, choose between stable and variable rates, etc.

- The possibility to take fast loans that don’t require any security deposits so that you can invest quickly during the most favorable conditions.

- Oracle integration so that the platform can receive the latest updates on the crypto market prices.

Since solutions of this type are relatively new on the market, it’s crucial to delegate the work to top-notch fintech developers with a proven track record. A well-established DeFi development process includes the following stages.

Stage 1: strategize

Defining the project’s ultimate goal, eliciting features, and outlining the necessary resources are essential for its cost-saving and expedited delivery. Seasoned business analysts will help you understand what exactly the target users want and provide for a well-balanced tokenomics model, i.e. the DeFi platform conditions.

Stage 2: design

A well-elaborated solution design and architecture can eliminate expensive reworking in the future and save you thousands of dollars. Skilled IT architects will choose the best technology stack and blockchains based on the solution requirements such as its scalability, feature layout, integrations, etc. Professional designers will get the customer’s approval on all the highly-accurate prototypes to ensure the best possible UX and intuitive UI of the product.

Stage 3: develop and test

Based on the specifications delivered in the previous stage, the experienced DeFi development team will create all the features and provide for DeFi smart contract development. Today, the most popular methodology to follow is Agile, meaning that the functionality is built in concise iterations, continuously tested, and integrated into the solution. This is essential in these types of products as they are very challenging to amend afterward. In addition, the customer is constantly updated.

Stage 4: deploy and maintain

After the launch, your vendor’s team will continuously update the product to ensure its flawless performance and the relevance of its features.

Conclusion

DeFi lending platform development opens up new horizons for the finance industry. The technology contributes to the enhanced flexibility of finance management and its increased availability to a wide range of users.

With Anderen’s help, you will never doubt your software’s profitability, performance, and security. Our vast expertise in finance software development guarantees the utmost quality of our products. Feel free to contact us for a DeFi platform development consultation.