- Personal finance assistant application: a concept

- Personal finance market stats

- What to expect from a finance tracking assistant?

- The list of key features and integrations

- Client accounts

- User prompts

- Wallet management

- Tracking

- Conclusion

What is a reliable personal finance tracking app? What are the typical requirements expected from such a finance assistant? Finally, how can you build a personal finance app, and what are the relevant market trends that must be taken into consideration while dealing with that challenge? In this piece, Andersen’s FinTech experts will attempt to answer these questions about personal finance app development.

Personal finance assistant application: a concept

Investopedia defines personal finance as ‘managing your money as well as saving and investing.’ As such, this phenomenon encompasses a wide variety of aspects, for instance:

- spending control, i.e. setting limits and monitoring your expenses;

- daily budgeting, i.e. capability to plan your financial behavior, correct your patterns, and build reliable projections;

- mandatory deductions and compulsory payment management, e.g. taxes, loans and mortgages, insurance policies, alimonies, etc.;

- income tracking encompassing all the sources of your income, including investment, with all your cards safely linked.

Correspondingly, the key goal of a finance assistant app in this respect is to keep track of all those operations so that the eventual balance sheet ends in credit. In other words, we are speaking of a personal finance tracking app.

In addition to recording, an optimal solution of this type should also be capable of building projections, monitoring progress made, and even generating data-driven recommendations.

Personal finance market stats

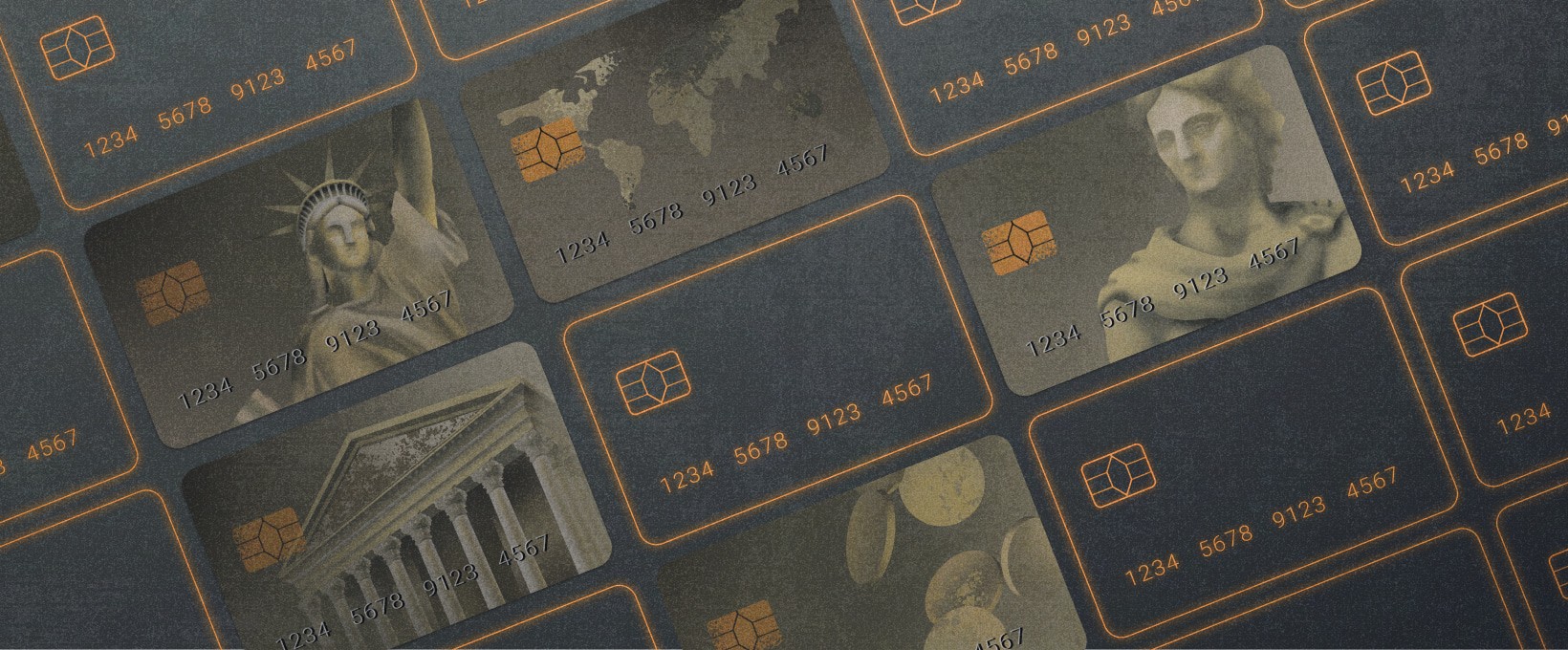

According to some recent estimates, back in 2019, the market size of personal finance software was around $1,000 million. By 2027, it is projected to reach almost $1,600 million. Thus, as you can see, this segment is quite lucrative.

What is the main driver of this growth? Life itself, including financial constraints, motivates people to use such tools. Let's take a look at the US as a developed country lacking social security nets. As you can see, many people are in a precarious situation and definitely need a mobile personal assistant:

- As of 2022, an average US credit card holder owes $5,668;

- As many as 40% of US residents possess ‘less than $300 in savings’;

- 70% of the surveyed Americans agree that they do experience difficulties while dealing with ‘at least one aspect of financial stability, such as paying bills or saving money’;

- Recently, 97% of Americans lacked time for financial planning.

It is no surprise that, under the current conditions, the popularity of finance apps is growing. It has recently been reported that in 2021 in the US alone, mobile finance apps reached 573.1 million downloads. What is of even greater interest is the fact that, according to Statista, over 50% of the mobile finance app users are younger than 35.

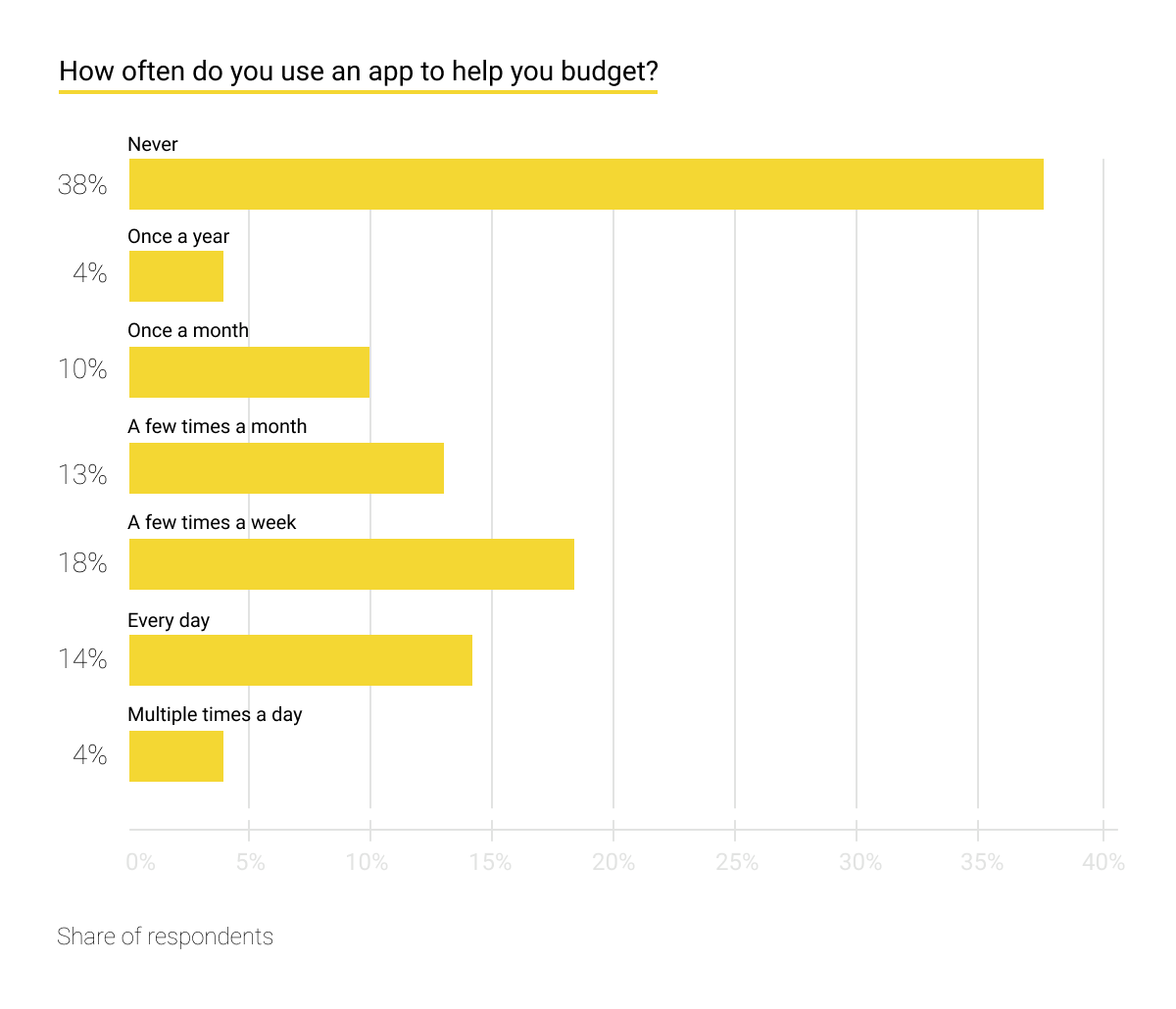

This trend can also be observed in other developed countries. For instance, 2022 data from the UK shows that, beyond any doubt, this country is an example of a developed and technologically advanced country. The statistics, covering residents under 30, look like this:

Hence, one can draw three conclusions here:

- First, most people are facing financial difficulties nowadays. These problems are likely to increase.

- Second, young people are trying to deal with them by using personal finance apps.

- Third, these young customers use the apps quite frequently. Hence, this market is more than lucrative.

What to expect from a finance tracking assistant?

So, your company is planning to initiate a personal finance app development project. What are the minimum criteria for success? On the basis of our experience, we at Andersen can share our practical guidelines:

- Intuitive UI/UX with clear and engaging data visualisations, as many people understand graphs better than figures and tables. This helps balance sheets to end in credit.

- Reliable integration with available finance service providers, e.g. banks, brokers, loan holders, for real-time data collection and processing.

- Maximum possible security and absolute compliance needed to protect you from data leaks and cyber incidents.

- Space for personalization which may include themes, colors, layouts, etc. This is necessary to win new customers and retain the existing ones.

- Gamification elements, with personal achievements properly monitored and highlighted, needed to engage end-users and motivate them to use the assistant as frequently as possible.

In addition to these requirements, AI-fueled capabilities are also a must nowadays. They can handle a challenge the typical tools cannot. Namely, they not only monitor income, savings, and costs, but are also able to assess regular patterns, build projections, and generate recommendations and warnings.

The following figures indicate that modern end-users need not only tracking, but also AI-based assistance:

- 65% of Americans state they do not remember and do not know ‘how much they spent last month’;

- 31% of Americans regret their spending habits and behavior;

- 49% of Americans agree that their emotions motivate them to ‘spend more than they can reasonably afford.’

AI already has the potential to address these pain points owing to:

- Its capability not only to track events but to provide for end-to-end data management, with all patterns clearly identified;

- Conversation engines that interact with users in a human-like fashion and motivate them to behave responsibly;

- Automated operations, such as paying bills and interest, so that end-users simply cannot forget about them;

- Projections built on the basis of the goals end-users set;

- Accurate financial advice provided regularly.

The list of key features and integrations

What would a practical list of features and integrations needed for the aforementioned capabilities look like? While the following range is not exhaustive, it is a reliable guideline based on our extensive experience:

Client accounts

System of intuitive and protected client accounts serving as a starting point for end-users. As such, it has to provide end-users with easily accessible controls and customizable dashboards needed to perform the entire range of operations.

User prompts

Special information windows displayed to users to navigate them through their user experience helping them accomplish the registration and onboarding processes and informing them about new features.

Wallet management

This range of capabilities is related to payment functionalities integrated with customers’ cards and other banking apps. It covers not only daily spending, but also such aspects as taxes, compulsory payments, including loans and interest, mortgages, payments for public utilities, etc.

Tracking

Automated spending trackers with an opportunity to assign a specific category to each transaction and vizualize your financial situation. In addition to tracking and storing data, you can add AI-tools capable of analyzing your financial history, building projections, and generating advice.

Conclusion

Personal finance assistant apps are a promising niche. Most people need financial guidance and live in precarious circumstances. Correspondingly, they need reliable tools to handle this challenge. With our high-caliber FinTech developers and finance expertise, Andersen can be your reliable partner to build such a tool for you, including even the most complex AI-functionalities. Contact us so that we can discuss this project with you!