- What exactly is a Loan Lending App?

- Advantages of loan lending apps to end users

- Disadvantages of loan lending apps to end users

- How do Loan Lending Apps work?

- Loan Lending App Development: pros & cons

- How to create a Loan Lending App: where to start?

- Discovery and planning

- Choose your tech stack and team

- Design and development

- MVP and testing

- Release

- Support and maintenance

- Loan Lending App Development peculiarities

- Set up your own company and secure investment

- Comply with the law

- Expert legal and financial help

- Wrapping up

The race to digitize everything is on. Most businesses, if not all, have to adapt and move operations online if they want to survive and thrive among the smartphone-obsessed population. And this doesn’t exclude mammoth institutions like banks, venture capitalist firms, loan companies, and the like. If anything, they are being outdone by new digital businesses which have sprung up because of the opportunity for online financial solutions. And they’re killing it!

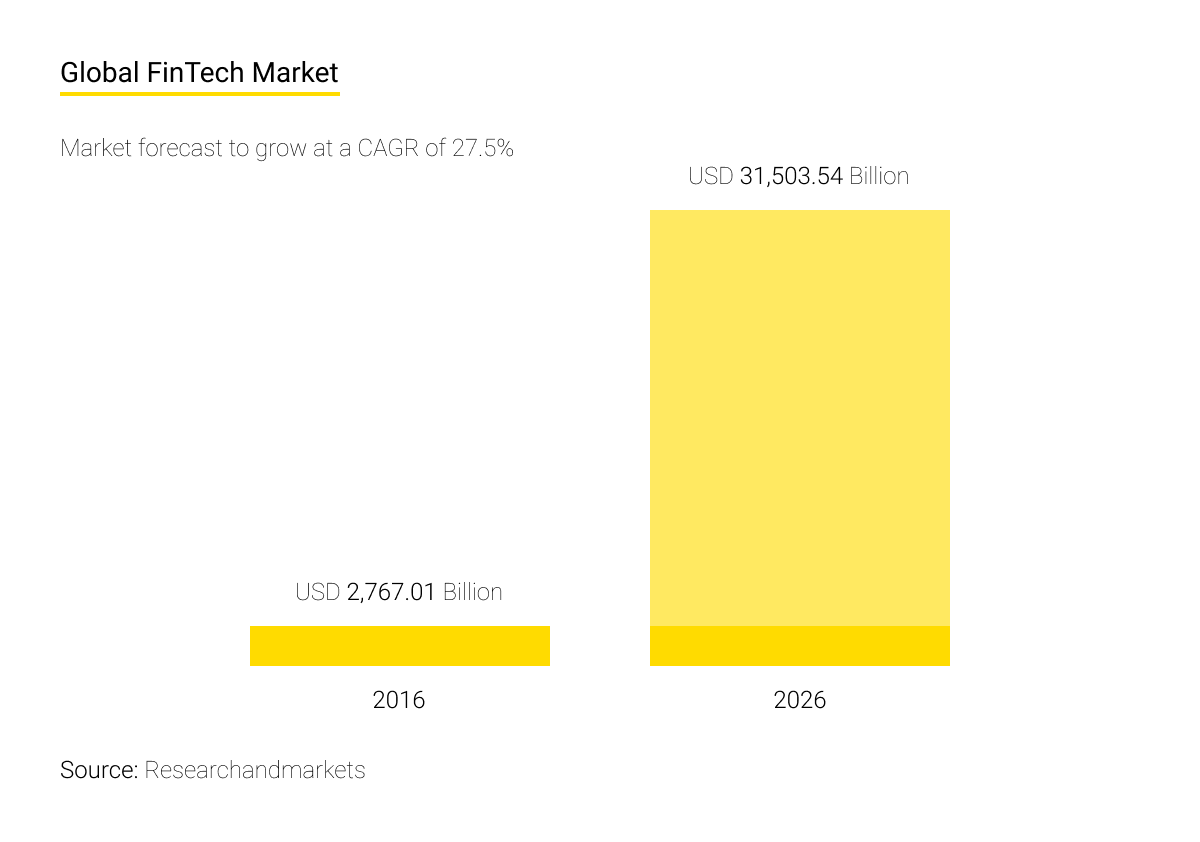

FinTech is thriving and is predicted to reach over $31,503 billion in market value by 2026. With over $210 billion being invested in FinTech businesses worldwide in 2021 (Research done by KPMG), no wonder so many people are looking to take advantage of this by creating their own financial solutions.

Alternative lending is the branch that is making noise, and it’s expected to reach around $400 billion by 2026. Apps that lend you money are the current trend of alternative lending.

And are we surprised? No, not really. Online lending platforms and apps offer people the opportunity of borrowing money without a lengthy, complicated process, without leaving the house, and at lower interest rates.

If you’re interested in loan app development, you’re in the right place. In this article, we will explain in detail what these solutions are, their pros and cons, and how to proceed if you’d like to have one developed for you.

What exactly is a Loan Lending App?

Money loaning apps are a form of P2P (Peer-to-Peer) lending, meaning an entity – investors, startups, small companies, venture capitalist firms, and so on – lending to a person – individuals, homeowners, students, business-starters, or just about anyone else who wishes to take out a loan. There are no banks involved or large loan companies, and everything is done online. There is no need for multiple trips to the bank, signing tons of paper contracts, or excruciatingly long financial examinations.

Advantages of loan lending apps to end users

They are accessible

Lending through an app is a lot easier for borrowers than a more traditional avenue like going through an intermediary. There is no need for long trips to the bank, and just about anyone can do it from the comfort of their own home. This also applies to investors, allowing them a fast and smooth investment process online.

No hassle processing

The best thing about money loaning apps is that people can borrow and invest money quickly, easily, and without going through an extended process. There’s no need for long background checks, signing a mountain of paperwork, or trying to convince lenders to accept your request. Instead, a borrower can just apply for a loan from an investor, go through the relevant background checks and receive the money straight into their account.

Lower interest rates

Most of the time, interest rates are lower than those from an intermediary. This is because of lower down payments, the platform's online nature, and competition between money loaning apps.

Flexible amounts and pay-back time

Borrowers can quickly negotiate the amount borrowed (up to a certain amount, of course) and the time it will take to pay the loan back in full. This gives borrowers more freedom to choose how much to pay back and over how long.

Disadvantages of loan lending apps to end users

Credit risk

Borrowers that turn to money loaning apps are usually people who aren’t able to apply for more conventional types of loans due to their low credit ratings. This is a risk for the lenders – there is always a chance the borrowers won’t pay them back.

No insurance or government protection

The government does not provide insurance or protection to the lenders in case of the borrower’s insolvency – so the risk is all the investors’.

Legislation

Some places do not allow lending through loaning apps or have extra rules and investment regulations in place. Therefore, peer-to-peer lending may not be available to everyone.

But for those who can, lending and borrowing via an app is faster and easier. And that’s not to mention that the market for digital lending is expected to reach $22.4 billion by 2028. With apps like Earnin, Brigit, Dave, and MoneyLion, in the lead, other companies, startups, and investors are following suit to enjoy a slice of a fast-growing market due to increasing demand.

How do Loan Lending Apps work?

The great thing about money loaning apps is that there are no banks or other intermediaries between the lender and the borrower. The app acts as the go-between for these two parties, keeping interest rates and other costs low for everyone involved.

Investors can decide how much they’d like to lend and to whom after borrowers apply for loans of various amounts. Once the loan is approved, the transactions and payments are made using the app where both parties have gone through relevant checks, linked their bank accounts, created wallets, and where they then complete the necessary transfers.

Loan Lending App Development: pros & cons

So you and your team want to develop your own reliable loan app. Here’s why that’s a great idea:

Guaranteed demand

Alternative lending is one of the fastest-growing trends in FinTech right now, so you’ll be taking advantage of increasing demand and plenty of opportunities to launch and scale.

Get closer to your customers

Having your own app will ensure that everything is done close to home. You can be part of the process at every step of your clients’ journey.

Better UX

Lending and borrowing in-house means you can optimize and ensure the best user experience for everyone using your app. Integrate personalized aspects into the app to create a seamless and smooth user experience.

However, like everything in life, developing your own loan lending app also has its disadvantages:

Promotion and competition

Firstly, you don’t know if your app will be successful. For this, you will need a great marketing strategy to promote your final product and distinguish it from your competitors.

Developmental process

And secondly, developing an app isn’t that easy. Therefore, Andersen’s experts have prepared the following guide to explain in detail what it takes to successfully create a money loaning app.

How to create a Loan Lending App: where to start?

Assuming you already have an established business (if not, we’ll cover some of the pre-developmental steps later on), here is how the developmental process should look:

Discovery and planning

Your discovery and planning stage usually has two important functions: business analysis and market research.

During the business analysis phase, you need to establish your primary business needs, what your clients expect, your budget, opportunities, risks, etc.

When exploring the market, make sure you spend enough time researching the available products to see what features to implement, how things work, and how things look. Check out app reviews – even the bad ones! You can consider them and make your app even better based on upcoming trends, statistics on most used features, etc.

For an app to be a success, you need the following basic features:

Sign up/Login

An easy registration process is crucial for both parties as this will add to the overall UX. As well as being simple and quick, the process should also be thorough to ensure the legitimacy of borrowers as well as lenders so that both parties’ financial interests are well looked after.

Dashboard

UI here is everything, so having an easy-to-use, simple dashboard where clients can access all areas quickly is vital. From here, borrowers and lenders should be able to find all the basic features of the app.

Loan management

Borrowers and lenders need to access their loan information, applications, and selection process in one area. Here, borrowers can manage their requests, payback period, EMIs, and so on. Lenders, in turn, can review loan requests, negotiate, accept and track all activity.

Messaging

Both parties should be able to communicate with each other within the app. Here they can discuss requests, negotiate terms, payback times, and EMIs, as well as ensure the legitimacy of the other party. This will help to build trust between the two and also with the app.

Payment and billing history

Both parties should be able to easily find and access their loan history whether requested, in progress, successful, or rejected.

Transactions and EMIs

In this area, borrowers can see their EMIs, loan status, and upcoming payments.

Transfers and withdrawals

Once the borrowers’ loan is accepted and deposited, the client should then have several options on how to transfer or withdraw the money. This could include withdrawals into a preselected bank account, transfers to specified cards, PayPal, etc. The same should be available for lenders’ investments and returns.

If you want to stand out in the market, then you should do thorough research into other new features that will attract potential sign-ups. This could include reward points, crypto wallets, etc.

Choose your tech stack and team

Now comes the task of choosing the experts and software to create your MVP (minimum viable product). You can do this in-house, which can get very expensive, lengthy, and impractical, or you can outsource to a team of trained and experienced experts from a software development company.

One such company is Andersen, with our 480+ experienced software developers specializing in Finance software development. Having completed over 350 projects, our engineers will ensure everything is done on time, perfectly, and to your satisfaction. We think of everything from security, performance, future scalability, UX, ease of integrations, adding new features post-development, etc.

When choosing the right team for your project, make sure they have the right expertise for the type of app you want to create and the right tools to do the job. At Andersen, engineers come equipped with a comprehensive tech stack of everything needed to create a state-of-the-art money loaning app.

Design and development

Once you have your team and the tools secured, it’s time to begin designing your app. Here, your expert team needs to think of the customer and build an attractive, user-friendly app that performs well and has all the essential features, especially ones that will make it stand out.

Here are some past projects from Andersen which will show you several successful design and development stages:

A finance solution to facilitate issuing loans

This IT project was implemented for one of the largest banking holdings in Eastern Europe.

An ePayment solution providing financial services

Andersen was contacted by an ePayment customer to improve the way they provided financial services for businesses and individuals.

MVP and testing

Creating a minimum viable product version of your desired app will allow you to see what works and what doesn't, see gaps and missing features, predict bugs, and get ahead of the problem. This will save you money over time as you won’t be going full-speed ahead in a potentially wrong direction.

Once you have your MVP, it’s time for testing – make sure you’re checking for bugs, security gaps, a positive user experience and sufficient functionality, data integration, etc. You don’t want to miss anything because this can hurt the reputation of your final product – who goes for an app that has a low rating and hundreds of negative reviews? So starting off on the right foot is crucial!

You can accelerate your MVP design with Andersen's expert-level capabilities to develop, prototype, and deliver your innovative software product.

Release

Once you’ve tested and optimized your MVP, it’s time to release the final product. Make sure your marketing team is employing world-class promotional tactics and strategies to give your app the launch it deserves.

Support and maintenance

The process doesn’t end there. Your app needs ongoing maintenance and updates to stay user-friendly and keep up with the latest trends – yes, this is a never-ending process; however, this part allows for more creativity as you and your team of experts can come up with new techniques and features to add.

Loan Lending App Development peculiarities

Set up your own company and secure investment

If you don’t already have an established business, it’s crucial to set up a legal entity – the most common and most accessible is an LLC (limited liability company). This will ensure you operate legally and in accordance with tax rules and regulations. Additionaly, to start any business, you need funding to build your app.

Comply with the law

As you’ll be dealing with a lot of personal data, you must comply with laws, for example, GDPR (the EU data protection regulation), CCPA (California Consumer Privacy Act), and others. They are in place to protect the public from data sharing and selling and other wrongful uses. If you don’t want to accrue huge fines, make sure you read the regulations and follow them religiously.

Expert legal and financial help

Because of the nature of the money lending business, you will need other experts to help you along the way. For example, you will need a lawyer for all your legal needs and a financial expert to help you with the money side of things – which is, in fact, the whole side of things, so this is crucial.

Wrapping up

So now you know how to develop your money loaning app and, as you can see, it can be a cumbersome task that would be best performed by experts. At Andersen, we have world-class engineers, a comprehensive app development tech stack, and the experience of having successfully completed hundreds of similar projects – contact us for more information.

Take advantage of the growth of the FinTech industry and provide a service to thousands of customers looking to easily borrow, lend, and invest in this post-pandemic world where everyone could do with a little extra help.