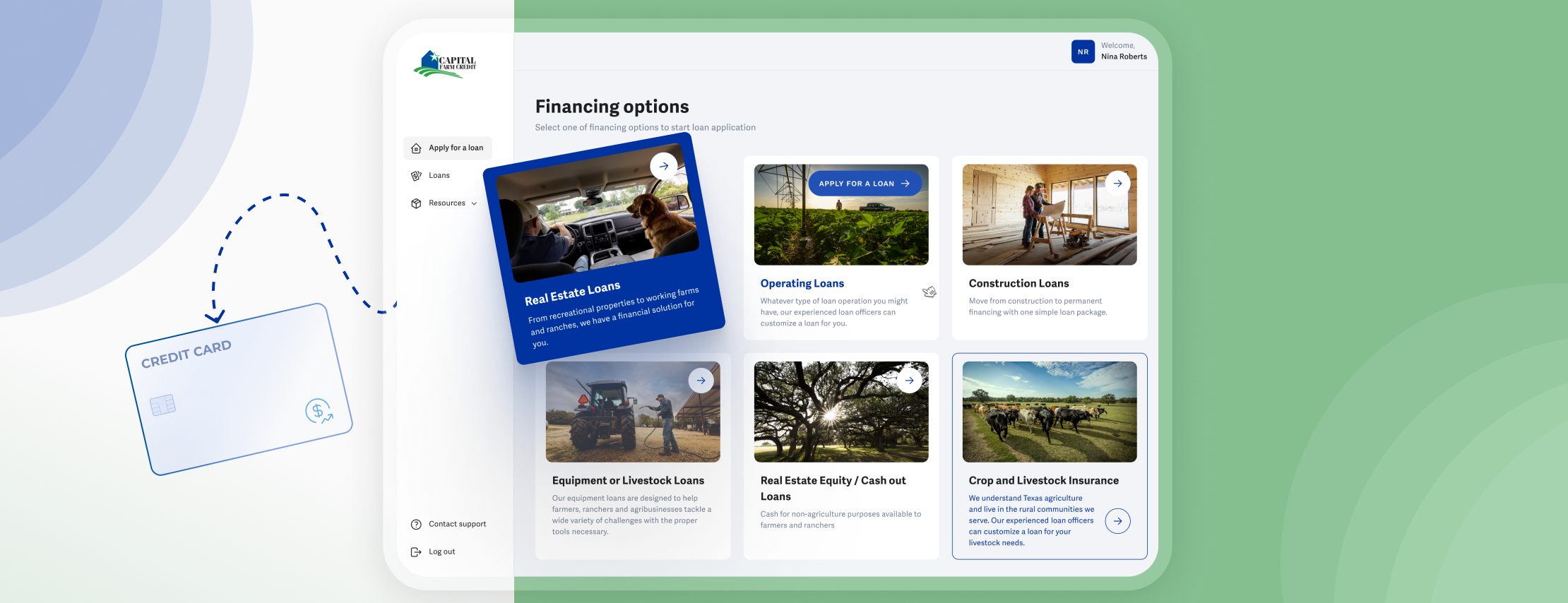

Fintech lending portal for the agricultural sector

About the Customer

Andersen's customer, Capital Farm Credit (CFC), is a Texas-based agricultural lending cooperative that provides credit and financial services to support rural real estate development, agribusinesses, and agricultural production. Their key offerings include rural land, home, equipment, and operating loans, as well as crop insurance.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/usa-desktop-2x.png)

Business Context

Before partnering with Andersen, the customer operated with multiple services and tools, with each department relying on different, non-integrated programs. This fragmentation resulted in a significant amount of manual work.

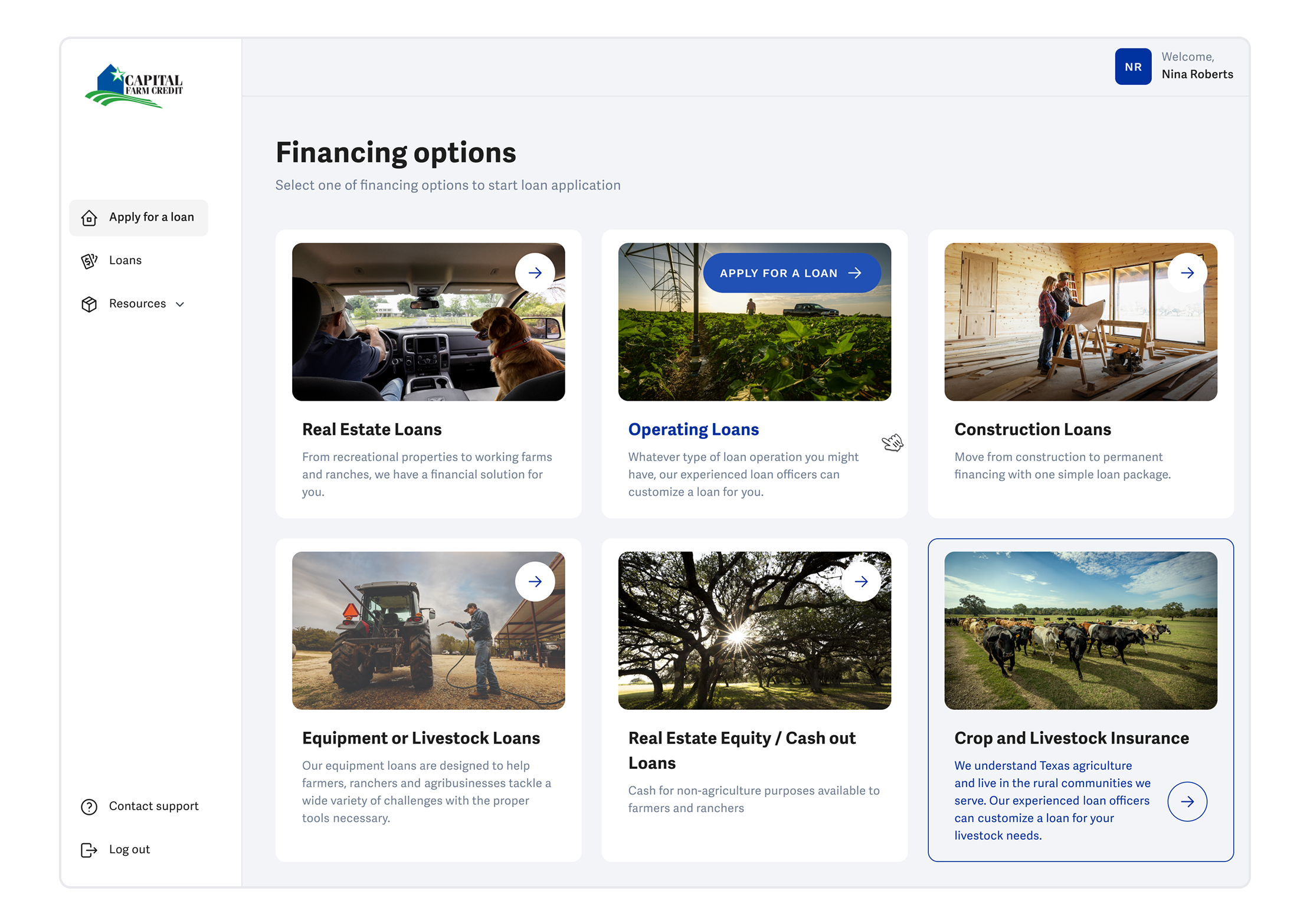

The lack of integration negatively impacted end clients. Two separate portals were in use: one for potential borrowers to submit loan applications and another for existing borrowers to track loan statuses and make payments. This dual-portal setup was inconvenient for users, while outdated interfaces further detracted from the customer experience. Additionally, managing multiple systems made the registration process lengthy and cumbersome.

Facing the need for a unified customer portal for the agricultural sector, the company selected Andersen as its vendor to build a lending solution.

Customer Challenges

The fintech lending platform project was particularly challenging due to the ongoing, large-scale technology transformation within the organization. Key initiatives included replacing the loan application system, overhauling the cash management front-end, deploying the MuleSoft service bus, replacing the digital signature system and integration with the InfoImage PDF generation tool. These changes introduced numerous dependencies that impacted the integration of the SOC 2-compliant customer portal.

Several key factors drove the company's need for AgriNext portal for the agricultural sector. Specifically, they aimed to enhance client engagement, shift inquiries from phone calls to digital channels, and attract new clients. The resulting solution was designed to support all these objectives.

Additionally, the ecosystem of the architecture itself is highly complex — a natural characteristic of regulated, security-sensitive financial institutions.

Project overview

The resulting AgriNext Portal was built on a scalable microservice architecture. It integrates several newly developed modules designed to simplify client and agent interactions concurrently:

- Loan application - enables clients and prospects to initiate loan requests, upload documents, and communicate with lending agents. This is achieved through a single, user-friendly interface;

- Lending admin - streamlines internal operations by helping agents verify information, request additional details, and make loan approval decisions more efficiently;

- Identity Provider (IdP) - ensures secure authentication and authorization across the entire ecosystem via Azure-based identity management.

Given this scope and complexity, a dependable integration foundation was essential. Andersen selected MuleSoft as the integration platform to connect the following services:

- Q2 API;

- CRM API;

- InfoImage API;

- Twilio;

- SendGrid;

- HUB System (OneDrive).

Solution

The Azure solution for the agricultural industry developed by Andersen includes the following functionalities:

- Authorization and authentication;

- User profile management;

- End-to-end application flow, including a questionnaire, data provisioning, information submission, and application management from the customer's side;

- Customer support requests via email.

Results and Benefits

The implementation of the unified customer portal has had a positive impact on the customer's operations, including:

- Enhanced UX;

- Improved operational efficiency;

- Optimized loan processing;

- Scalability and future readiness;

- Robust security and compliance.

About Andersen

Andersen is a custom software developer implementing complex fintech projects according to local and industry-specific requirements, including fintech lending platforms.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us