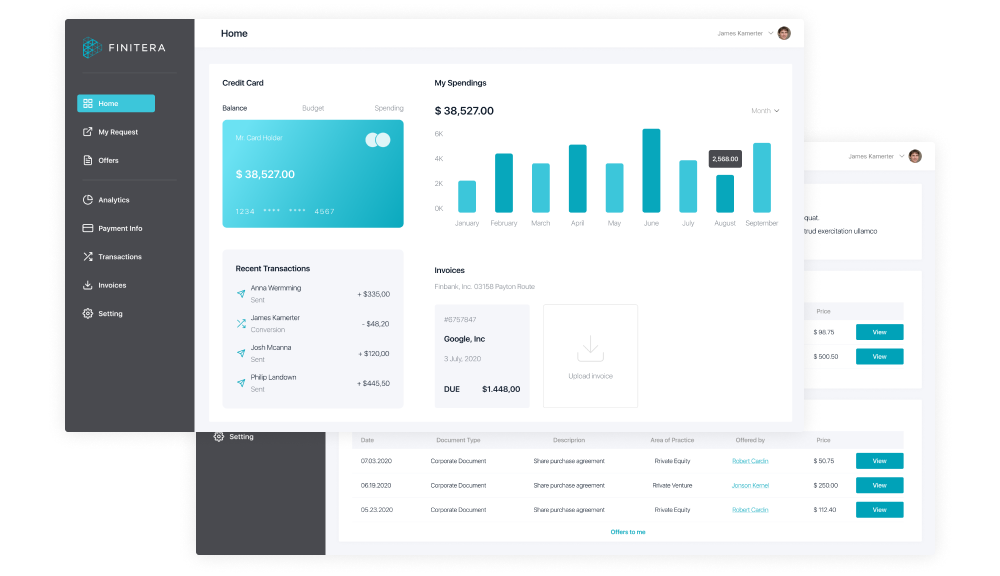

A FinTech Tool to Provide and Manage Short-Term Loans

About the client

Finitera is a Latvia-based FinTech company. It offers its end clients a wide range of financial services, including short-term loans.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/latvia-desktop-2x.png)

Project overview

An investment company that specializes in providing short-term loans to individuals, operating in different countries.

Development of a system for providing different variations of short-term loans with appropriate calculations. Integration with credit establishments (to provide credit history), SMS/email providers (to send notifications), and other third-party services.

Application functionality

- Checking the possibility to issue loans to the clients (scoring model)

- Control of all applications and loans

- Customization of pages in WEB system with the appropriate CMS system

- Possibility to customize different entities in the system (currencies, invoice items, notifications, discounts and so on)

- User group administration (with a wide range of rights in the system)

- Debt collection division

- Integration with adoptive WEB system (client profiles and availability to apply for loans)

- Export of needed information in XLS and import in the appropriate format

Solution

Main technology stack – PHP & JavaScript (JQuery). Database - PostgreSQL. Development, deployment process and usage of the product are based on using of Docker, Beanstalk Redis. GitLab CI.

Results

Flexible system with some additional changes (change of the credit history mapping and some other additional features) for separate countries allows to implement business in different countries (all in all the business works in 14 countries all over the world).

- The implemented flexible system has allowed the customer to expand its business to 14 countries;

- A 7% reduction in overdue debt has been achieved through assistance services and integration with collection services;

- The customer experienced a 13% growth in the number of clients re-applying for loans within the first year.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us