The customer chose to protect their confidential information

Digital Banking for B2B2C

About the client

In this case, our customer was a provider of FinTech solutions. The customer is strongly focused on simplicity, transparency, and fair costs. As such, this company offers a business-oriented BaaS platform for the finance industry and is fully regulated under the European compliance regulations. The customer's experienced team is totally dedicated to fulfilling their clients' goals in the domain of financial services.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/germany-desktop-2x.png)

About the project

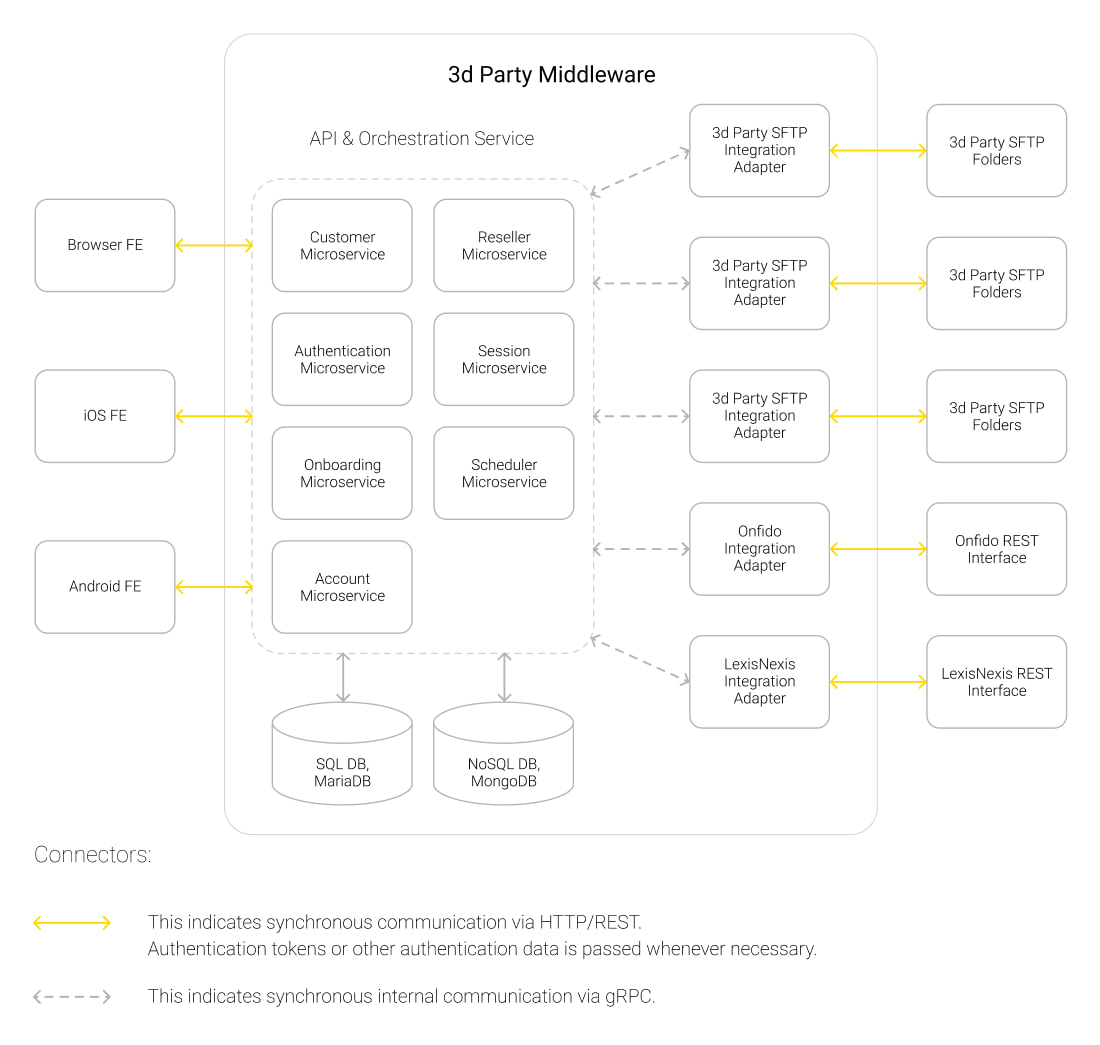

Andersen, which has an extensive talent pool of banking software development experts, was approached by a FinTech company from the EU to engineer a Banking-as-a-Service platform for their business clients in the finance industry. The project was Germany-based and lasted 11 months, relying on such technologies as Java, Spring, and React. The goal was to provide a reliable basis for the customer's clients to offer financial services via their own software. Andersen's scope of work included building an enterprise-grade app and API platform, as well as integrations with core banking systems and third-party services. The software covered the entire business cycle and incorporated KYC and AML processes.

A typical client of the resulting Banking-as-a-service solution, in this case, is an entity with its own impressive user base, which offers financial services via digital channels.

This platform, delivered with the Banking-as-a-Service for FinTechs framework, was expected to provide the customer's clients from different segments with a dependable basis for their activities, empowering them to offer various services to their end-users via their software. In other words, it was planned to allow the front-end solutions of the customer's clients to connect with the core middleware, the development of which was also entrusted to our team.

Project requirements

- Data protected with SSL technology;

- Seamless payments universally ensured with the failover capability;

- Real-time payments;

- Bank accounts and digital wallets;

- Total compliance, including AML and KYC;

- Reliable and safe onboarding processes based on multi-step checks.

Business idea

First, our task was to build an enterprise-grade mobile app and an API platform – i.e., middleware software. Second, the customer required reliable integrations with the core banking systems, reference banks, the online banking front-end, and a range of third-party services, software modules, and systems.

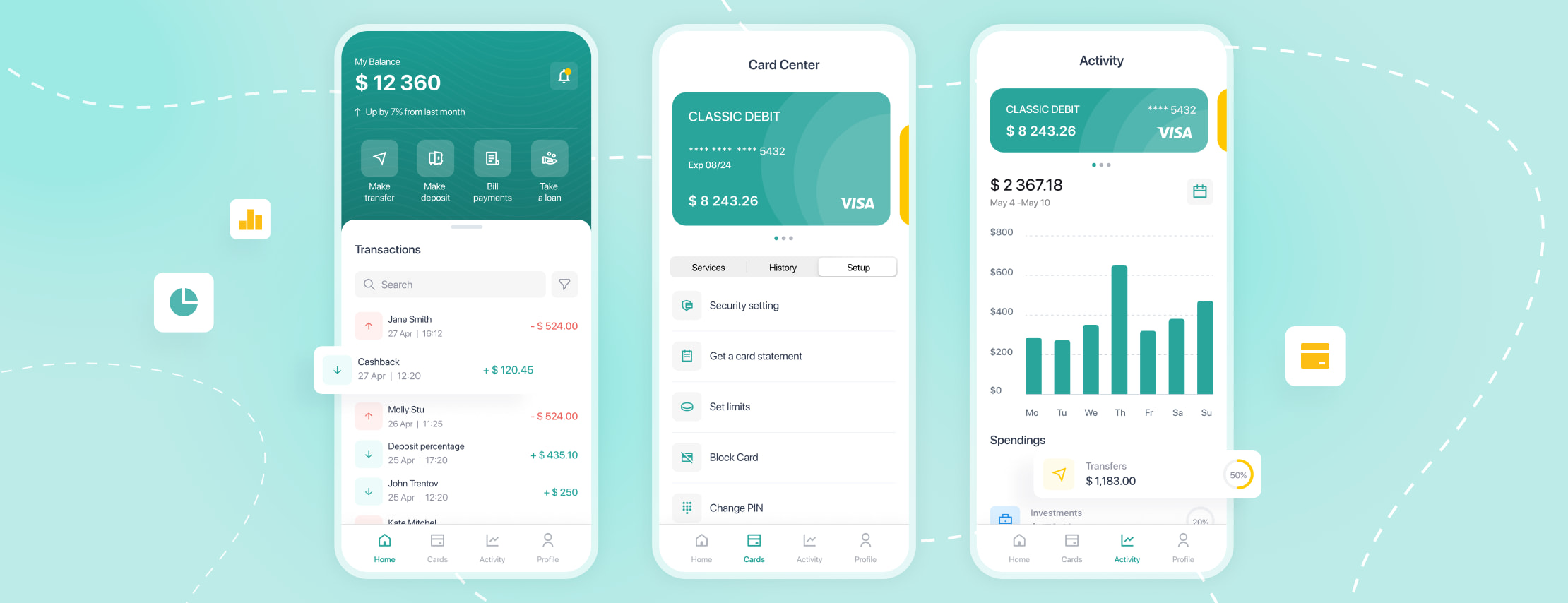

App functionality

Andersen has successfully delivered the software for the customer's entire business cycle, which covers every aspect of their interactions with clients and interactions between these clients and their end-users.

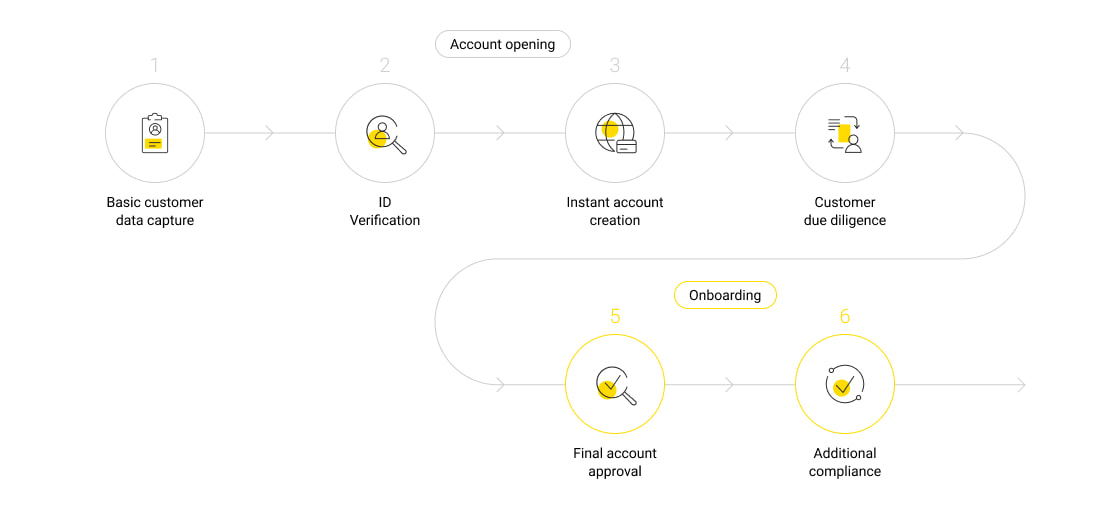

Onboarding

- Client validation;

- ID capture and selfie validation;

- Confirmation via email;

- Confirmation via phone number;

- Signature capture and validation;

- Policy generation.

Account activation

- Possibility to easily open an account via one of the customer's other products;

- Generation of KYC-based online banking credentials.

Service activation

- Debit card issuance and activation

- Client acquisition procedures.

Account opening

- Basic client information capture;

- ID check and verification;

- Ultimate approval for accounts;

- Extra compliance features, including typical spending patterns and typical transaction types.

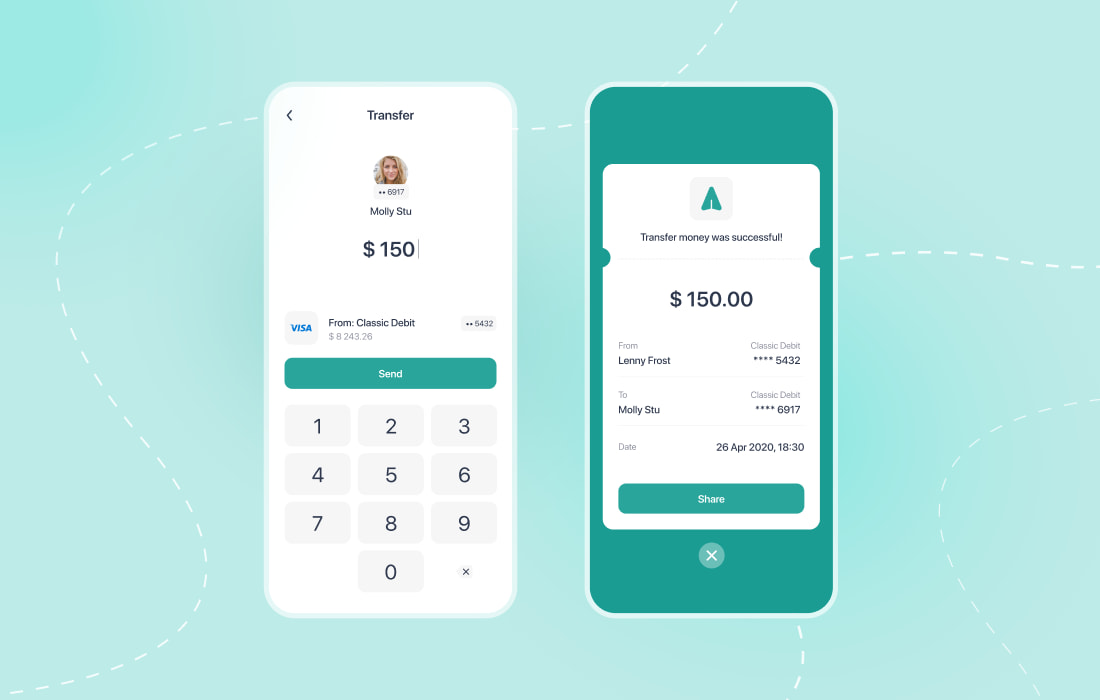

SEPA & SWIFT integration

- SEPA payment integration for greater efficiency of cross-border payments in the eurozone;

- SWIFT payment integration for inter-currency wire transfers worldwide.

KYC & AML integration

- KYC processes to understand clients, monitor transactions, reduce risks, and prevent bribery and corruption;

- AML compliance software embedded to report suspicious activity, keep records, monitor money flows, etc.

Project results

- The online native banking app has won 31% more clients within the first six months of release;

- The enterprise-grade mobile app and API platform support the entire business cycle;

- Reliable onboarding processes have been implemented in full, including client validation, ID capture, and policy generation;

- The streamlined account activation now enables easy account opening and the issuance and activation of debit cards.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us