- Crowdfunding market overview

- How does crowdfunding work?

- Types of crowdfunding

- Crowdfunding platform development: important features

- Crowdfunding in business: monetization models

- How to build a crowdfunding platform?

- Initiate a discovery phase

- Design and develop an MVP

- Test, launch, and maintain the solution

- Conclusion

The creation of fast and secure mobile banking apps, biometric authentication, API integration, and Blockchain, combined with the increasing quantity of charity-based and donation-based projects and startups have led to an explosion of the crowdfunding movement. Raising funds in such a way helps to bring valuable ideas to life, whether you are a non-profit organization, a promising new business, or a talented and motivated individual. In this article, Andersen’s experts explain how to create a crowdfunding platform for effective collection of funds to help your business rise.

Crowdfunding market overview

The market is rapidly expanding thanks to the demand for crowdfunding companies and websites like Kickstarter that small and medium-sized businesses actively exploit. In the past year alone, firms worldwide collected nearly five billion US dollars by exchanging their shares for capital on dedicated platforms. In 2020, businesses in the US managed to raise about $74 billion, which exceeds the amount jointly collected by the rest of the countries via the best crowdfunding platforms. By 2026, crowdfunding’s global market value is expected to reach $239 billion, demonstrating 16% growth yearly. The trend is predicted to gain momentum in Europe in the next several years too.

Collecting money on dedicated platforms is popular across various industries. On Kickstarter, gaming, design, and technology are the three most prevalent areas. Among other firms that will likely seek funding on a crowdfunding platform are farming businesses and non-profits.

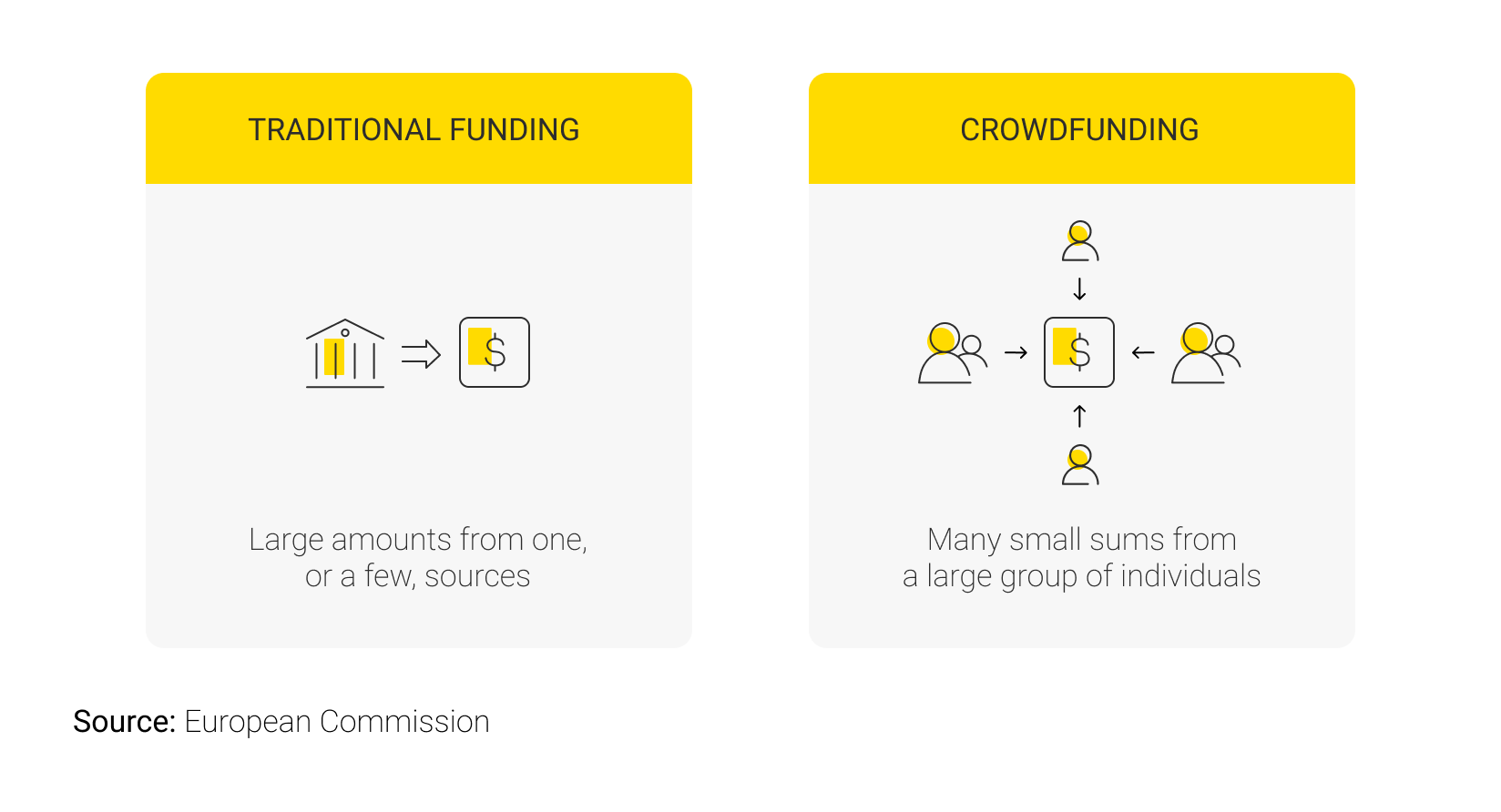

How does crowdfunding work?

What is crowdfunding in business? To understand this, we first need to give the definition of crowdfunding. The term refers to seeking the financing needed to fulfill a business or personal goal from a large number of people rather than turning to a centralized source, e.g. a financial institution. The backers give money either on a reimbursable or a grant basis. The entire process can be accomplished via a dedicated platform, app, or even via social media, and thus, is rather simple and doesn’t require additional paperwork and сompliance with bank formalities.

The most outstanding crowdfunding examples in recent years are Kickstarter, which is mainly aimed at initiatives in the field of art and inventions, as well as popular alternatives to Kickstarter, e.g. Indiegogo, which is extensively used by entrepreneurs and charity projects; Crowdfunder, where a project can be financed in return for company shares; Patreon, which was designed for sponsoring creative content; and more.

To understand how crowdfunding works, let’s have a look at the following sequence of steps:

- Both a backer and an applicant for funding register on the platform;

- The applicant specifies the campaign details, including its description, deadline, the target amount, etc.;

- When the deadline arrives, the collected amount is usually transferred to the applicant;

- The platform, in most cases, charges a service fee.

Types of crowdfunding

To learn how to start a crowdfunding platform, one needs to know more about their main types:

- Loan-based solutions allow backers to receive their invested money back with interest. This software is popular among lenders and borrowers as it provides for rapid and easy investments without any tedious bank procedures. Solutions of this type have embedded features for verification of the borrower’s credit history and instant transaction processing.

- Donation-based apps serve for collecting funds for a campaign by people who give them on a grant basis. These projects are often charitable and are organized by non-profits to support healthcare, educational, and other initiatives.

- Equity-based platforms allow companies, mainly startups, to raise funds by selling shares to backers. These companies, as a rule, have already been in the market for some time and aim at expanding their business.

- Royalty-based solutions differ from the previous category since backers don’t become companies’ shareholders but receive interest after projects are up and running.

- Rewards-based platforms are designed to provide sponsors with benefits of a non-monetary nature, e.g. discounts, memorable gifts, special offers, etc. in exchange for their support. This type of cooperation is suitable for specific industries, e.g. travel and hospitality, entertainment, and more.

Crowdfunding platform development: important features

When developing the software, one should consider providing the required functionality for the different roles, i.e. admins, sponsors, and applicants for financing. These key features include:

- Profile creation and signing in with a transparent and clear process for all the roles;

- Verification of financial solvency, including identity verification and the insurance of the required level of discretion;

- Secure and rapid transaction processing, including the ability to schedule payments, calculate interest, choose between different payment methods, make multi-currency transfers, etc.

- Effective account management, which allows admins to promptly get statistics and reports on campaigns along with a well-ordered list of the involved parties, their financial information, and other relevant data.

- Generating reports for tax authorities, which allows the involved parties to keep their income tax issues in order.

- Customer support, where all the participants in the process can get assistance and receive the needed information via chatbots, live chats, and so on.

Crowdfunding in business: monetization models

Companies that plan to make a profit from their platforms need to think through the following monetization strategies in advance and choose the one that suits them best:

- Platform fees, i.e. the withdrawal of a commission from the fund raised by the platform;

- Membership fees, i.e. the withdrawal of subscription fees on a regular basis by the platform;

- Ad campaigns, i.e. receiving revenue by promoting other businesses’ goods and services;

- Loan processing fees, i.e. the withdrawal of remuneration by the platform for processing transactions;

- Revenue fees, i.e. the withdrawal of interest from sales by the platform after the project is up and running.

How to build a crowdfunding platform?

Now you have an overview of how to use crowdfunding, it’s time to dive more deeply into the process of starting a crowdfunding business. Andersen recommends those who want to build a crowdfunding platform that will skyrocket to take the following steps:

Initiate a discovery phase

To get a solution that will be both cost-effective and high-performing, you’ll most likely require a hand from professional business analysts to conduct a project discovery phase. As a result, you’ll obtain detailed market research with competitor analysis and outlines of user personas. This will help you to decide on the most appropriate software type and monetization strategy, elaborate effective wireframes and solution architecture, choose the best-matching technology stack, etc. The skilled specialists will also provide you with all the necessary documentation, e.g. the Vision and Scope document, Software Requirements Specification, Architecture vision, a project roadmap, and more. All of this will help you to implement your business idea with maximum efficiency and the best possible outcome.

Design and develop an MVP

Crowdfunding website development or app development often starts with an MVP. The goal is to build a solution with the essential functionality in the shortest possible time. With the working product in place, you will be able to start getting revenue more quickly, even before it’s tested on users and upgraded to its final version. Whether you opt for the MVP or skip this step to create a full version of the solution, make sure that the IT company you choose provides high-quality services from top-notch designers, developers who have mastered the relevant technology stack, proficient project managers, and other specialists.

Test, launch, and maintain the solution

After experienced QA engineers conduct the end-to-end testing of the platform to ensure its high performance and top-level security and quality, it is released to the market. Ensure that your custom software development company provides ongoing support and maintenance to scale the platform with new features and update it according to the latest technological trends.

Conclusion

To create a crowdfunding platform that will be a success, one needs to take into account the market situation, the latest technology and industry trends, the best software design and development practices, and other aspects. Andersen possesses vast experience in all of the above. Therefore, we’re in the right position to help businesses in any industry to build a stellar solution. Should you need any further information on the topic or a free consultation, contact our experts.