The customer chose to protect their confidential information

A Landing BNPL Solution for the Gulf Region

About the Client

Andersen's customer, in this business case, was a FinTech company working in the Gulf region. Its mission is to meet the demand for consumer and SME finance in a way matching the local traditions and standards. That is, they seek to provide financial services on an interest-free basis.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/saudi-aravia-desktop-2x.png)

About the project

The domain of interest-free finance came into existence 50 years ago. The main driver of its growth is obvious: people living in countries with significant Arab populations want to have access to sources of funding matching their traditions and practices. As of now, this industry is experiencing fast growth. Its compound annual growth rate is expected to exceed 10% over the next five years. Under these promising circumstances, our company was approached by one of the largest international investment holdings based in a Gulf region country. Interested in a wide range of industries, this customer asked us to engineer a locally-compliant FinTech product. In practical terms, the project was about building a mobile app for personal loans matching the locally prescribed norms.

App functionality

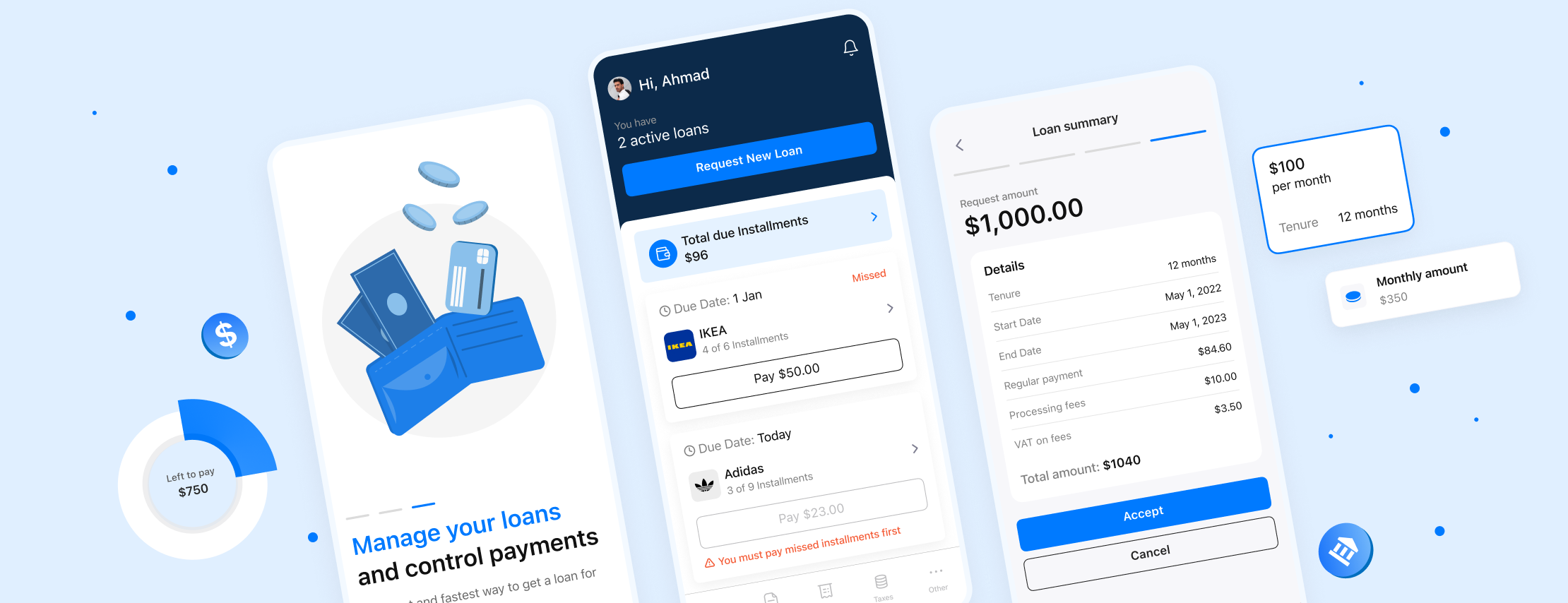

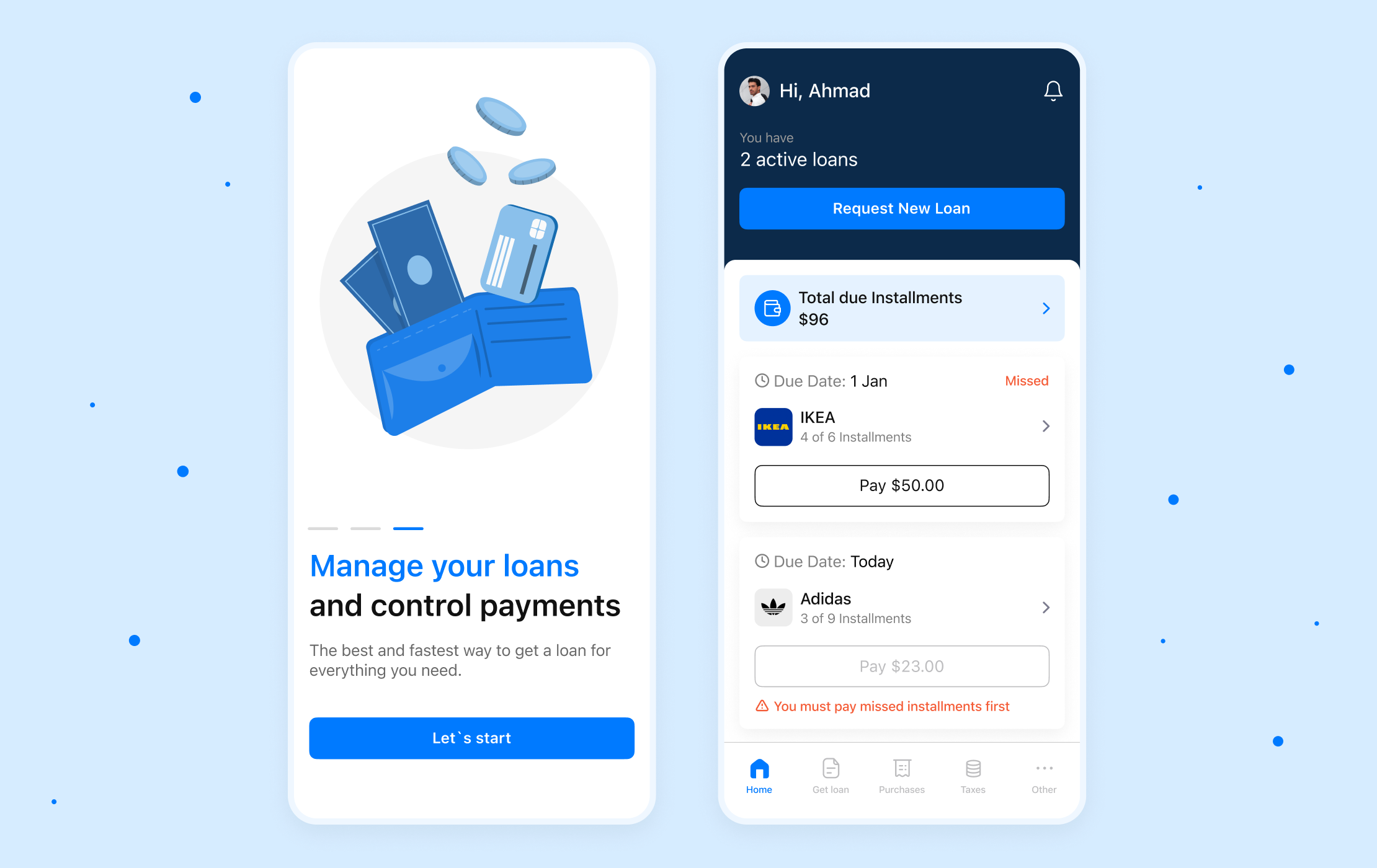

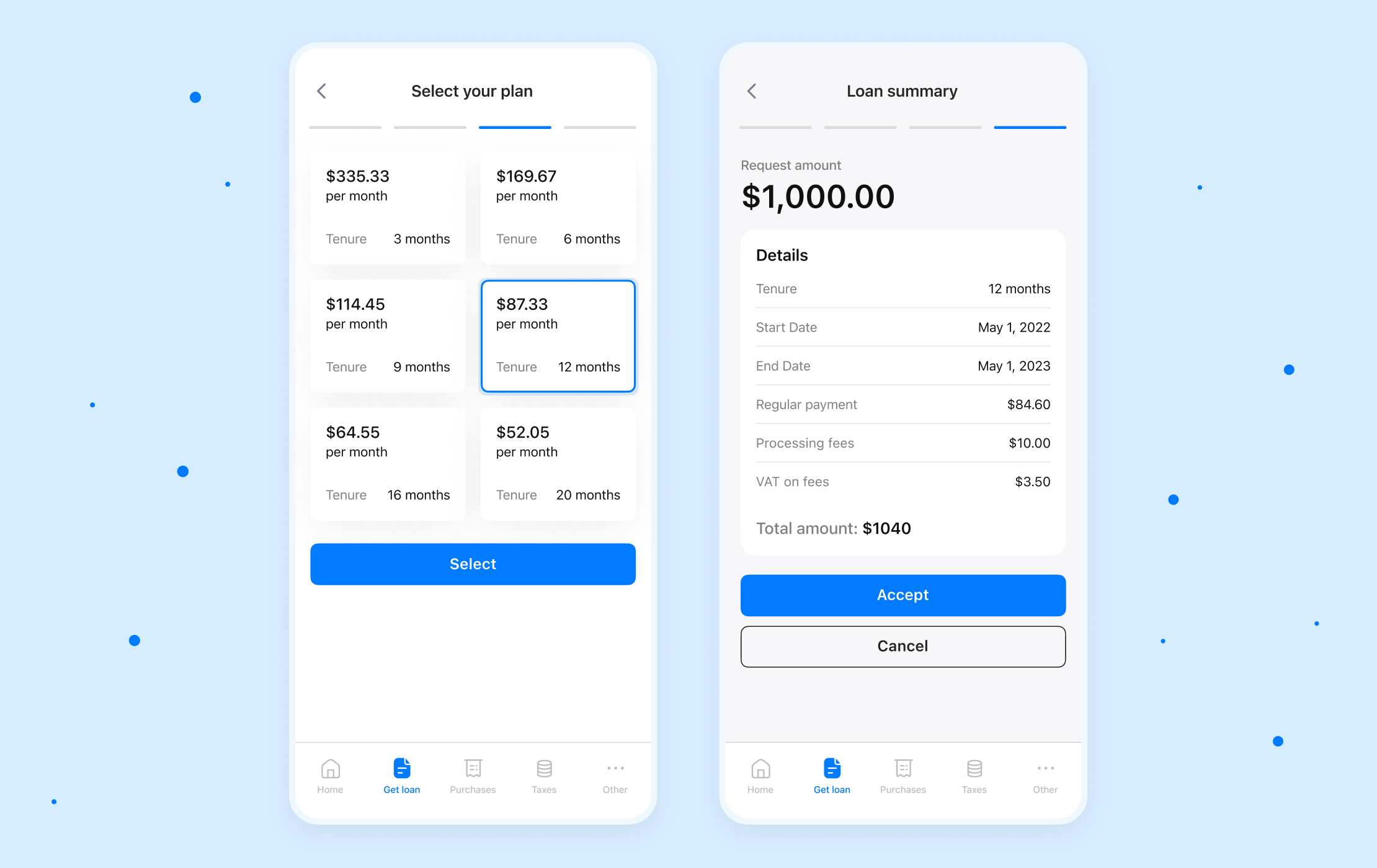

The resulting app fully matches the customer's expectations in terms of compliance and functionalities, including:

- Convenient-to-use and intuitive user accounts;

- Overview of available finance products with convenient filters;

- User history;

- KYC procedures;

- E-signatures;

- Loan application, verification, and repayment operations;

- Integration with external commodity exchange platforms.

Solution

In order to deliver the best possible solution, we divided the development process into several phases with varying deadlines to reach the goals set by the customer. The first stage was focused on safe login functionalities, registration procedures, intuitive dashboards, loan repayment, and transaction history. Andersen’s goal in this respect was to create an app capable of serving the customer's end clients. Namely, we ensured such capabilities as tracking loans and debt load, as well as paying for loans. Several important and complex integrations (i.e., KYC, integration with the core loan management system, etc.) were made by our team during this phase.

The second phase was focused on the in-store elements and the loan application experience in general. Practically, it means that users need to have the possibility to visit an online store to apply for a loan product via the app. This phase also included eligibility checks, approval of applications, generation and e-signing of all necessary docs, and loan remittance.

Another crucial task was also to ensure total compliance with the guiding principles of the local financial interest-free system. In order to make this possible, we integrated the app with a special commodity exchange. The latter allows the customer to automatically purchase commodities (for example, rice) on behalf of their end-clients by creating accounts in the clients’ names to perform these transactions.

Project results

Andersen delivered the solution according to a very tight schedule. The results are the following:

- The team has performed 9 integrations;

- Up to 10,000 users can be handled during peak load periods;

- 89% user satisfaction rate.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us