A FinTech Tool for a Bank to Manage Personal Finance

About the client

General Financing is a Lithuania-based financial organization. Their key business area in this capacity is to offer personalized loans to end clients.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/lithuania-desktop-2x.png)

Project overview

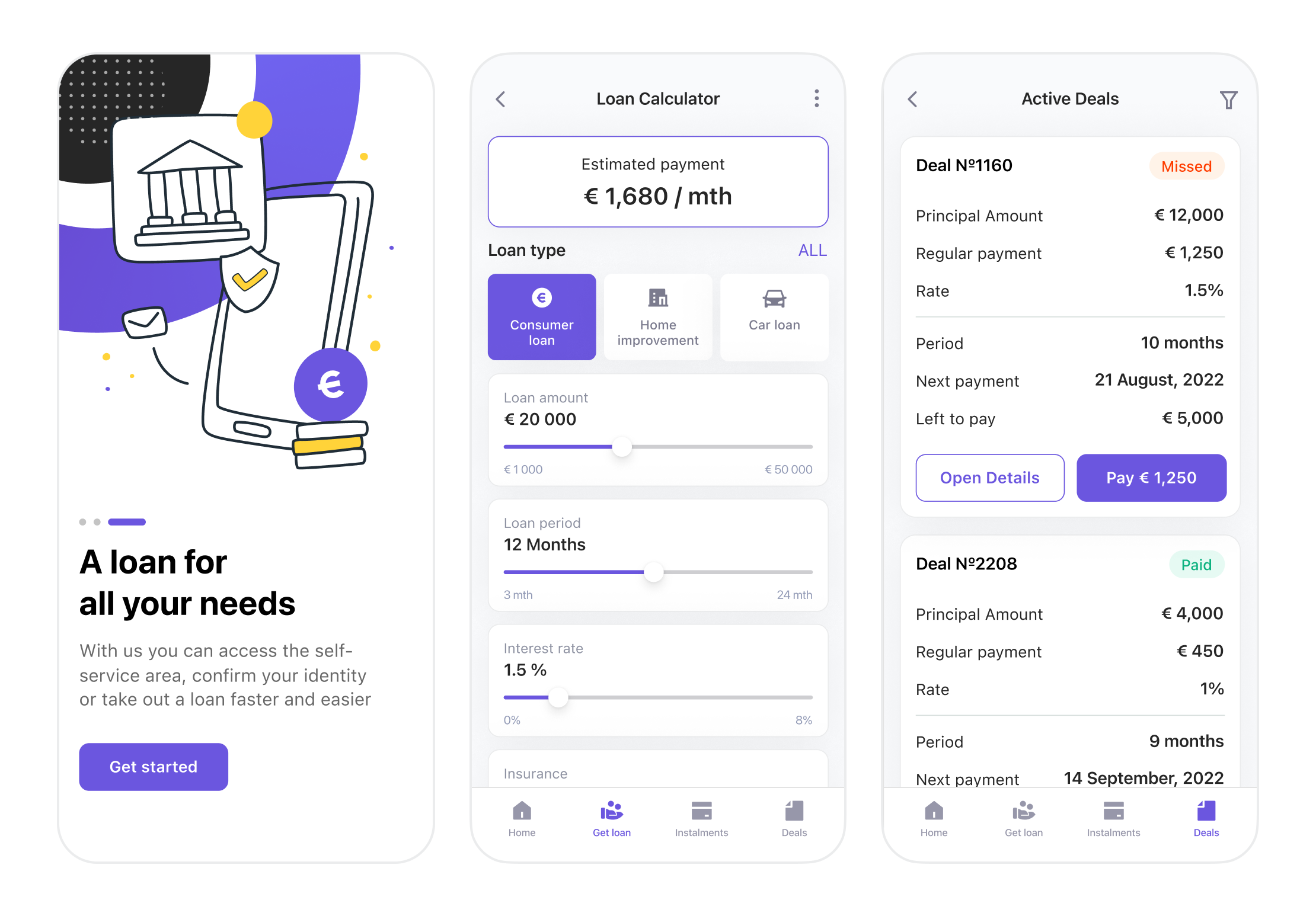

Andersen developed a cutting-edge FinTech software solution with a focus on delivering an exceptional customer experience. The native mobile app for Android and iOS that we delivered offers a comprehensive range of features for personal finance management. They include convenient payments, remote authentication, real-time account balances, loan management, client finance management, and more. The flexible Back-end architecture, based on Kotlin, Swift, Java, and Spring, enables easy integration and adaptation to meet the changing needs of clients.

Application functionality

- Remote authentication (to identify customers via biometric recognition) for bank office activities

- Real time accounts balances

- Payments

- Additional profile and Bank information

- Profile and Bank settings

- Customer finance management (automated finance curation, budgeting, financial goals, analytics) and accounts aggregation service (customer fin accounts information from third parties)

- Enrollment and onboarding

- Accounts detailed information and statements

- Loan management: online loan application in real time, loan refunds, loan detailed information, instalments, statements

- Notifications and messages

- Deposit management (online deposit creation, deposit additional payments, deposit withdrawals, deposit detailed information, statements)

Solution

The native mobile application for both Android & iOS. Main technology stack: Kotlin, Swift. Middleware web-service is an integration module between the mobile app and backend. The web-service implementation is based on a REST-architecture approach. Main technology stack: Java, Spring. Backend inner service is powered by Oracle PL/SQL.

Results

The flexible backend architecture makes it easy to add new API functionality according to Customer needs

- 23% Increase in number of clients who were attracted by the native customer oriented e-banking app within the first 6 month after the e-Banking app made it into the market.

- 8% Loan deals` growth in the first 6 months from apps publishing.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us