App for monitoring legislative changes

Heloïse Pinette

Public relations expert at BNP Paribas

"Andersen's team is committed, creative and keen, and they delivered tangible results"

UX-research

In order to build a product that would not only solve the task assigned but also be as convenient as possible, our FinTech specialists conducted a thorough research of the problem, studied the corresponding processes on the financial market in detail, analyzed users’ needs, and based on the gathered data, suggested several possible solutions to the challenge. After discussing them with the customer, it was decided to go with the concept that included AI and ML components.

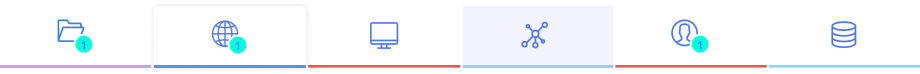

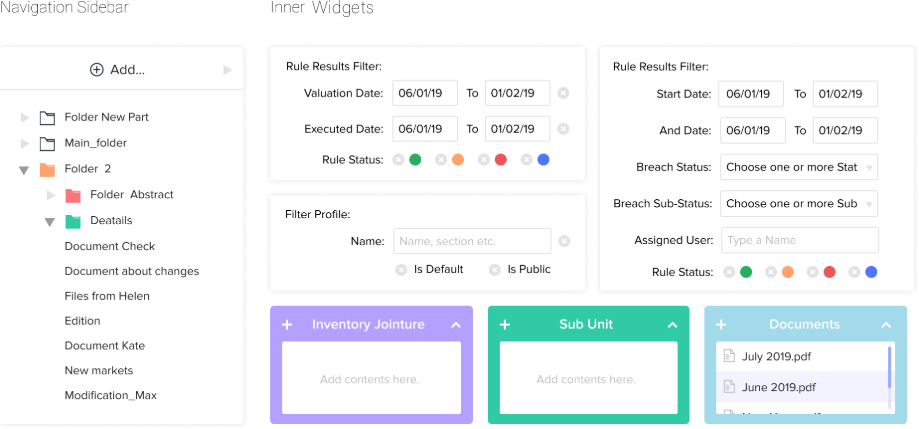

UI-system

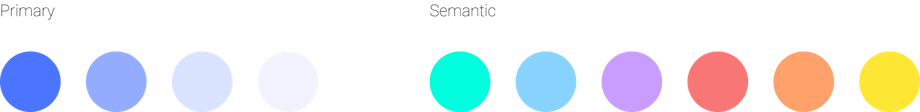

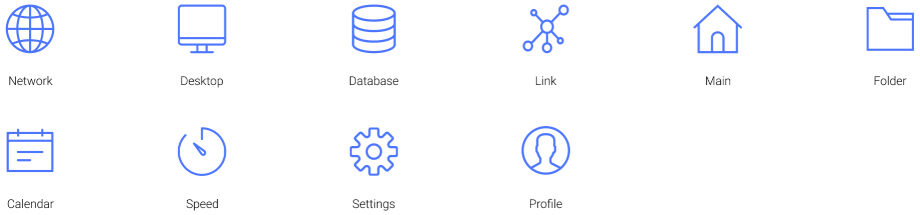

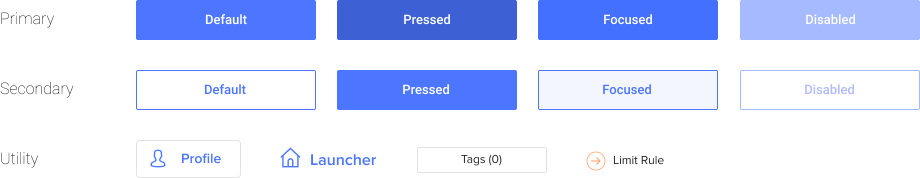

Since the software includes complex functionality to solve the challenging task, it was necessary to build an effective interface so that the user doesn’t face any difficulties using the app. Therefore, the design is based on the principle of simplicity: a structured user-friendly system of widgets and tabs, simple icons and buttons, a well-thought combination of colors (shades of blue on the white background together with fresh colors).

Colors

Iconography

Buttons

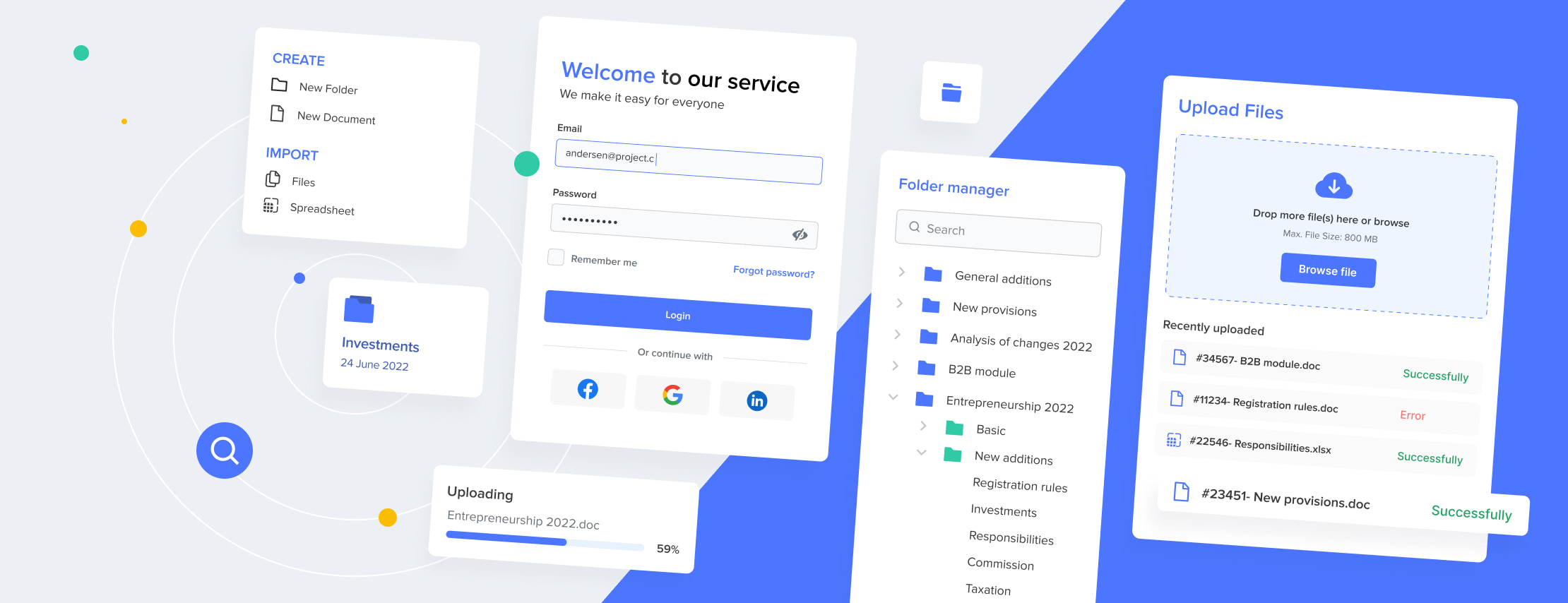

Menu

Widget system

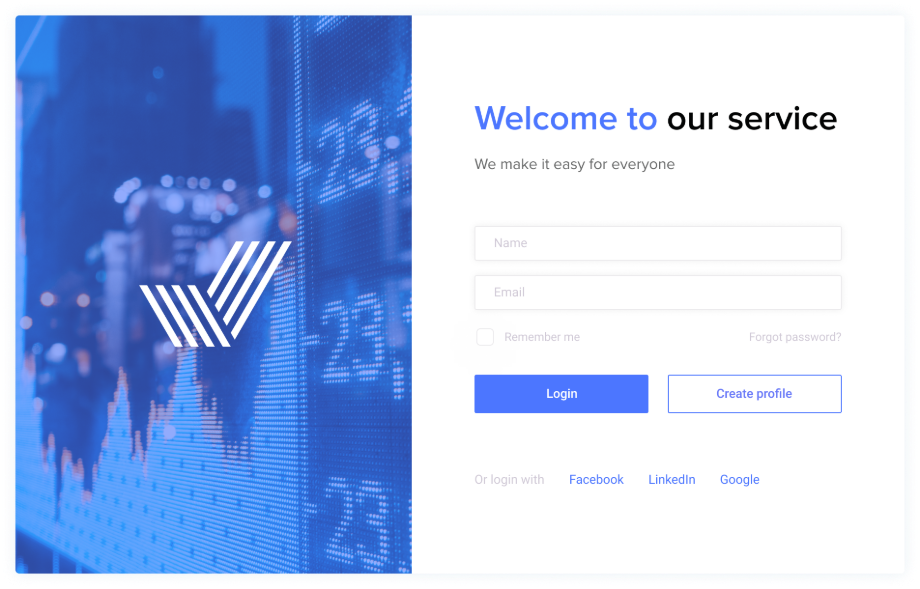

Log in

The log-in system is simple and secure at the same time. The user simply enters their name and password, but the application launches only in case the administrator confirms the entering. The admin can also add a user to the database and provides the necessary rights.

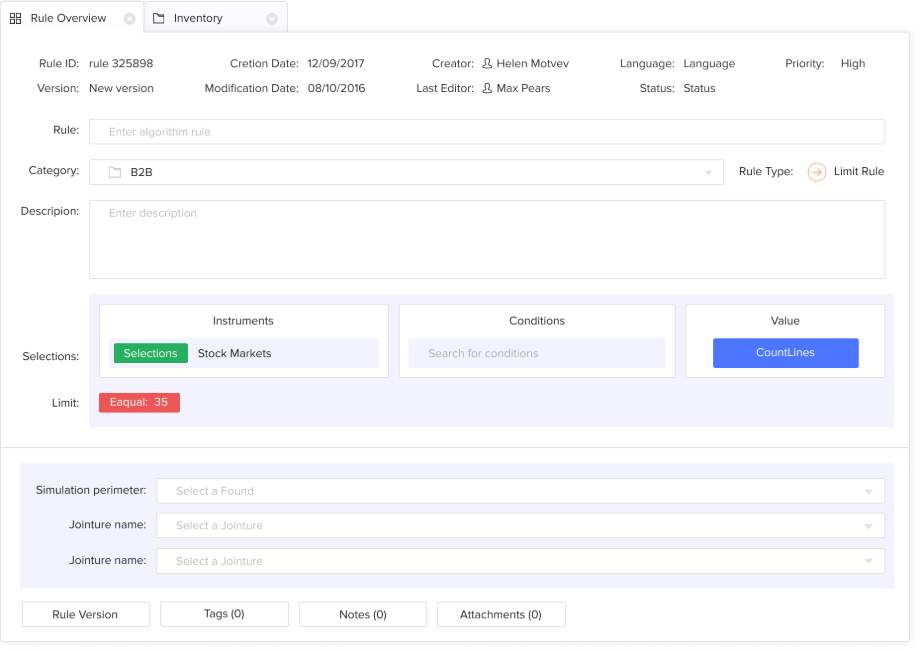

Analysis

The key feature of the application is an automatic analysis of bank documents with Artificial Intelligence and Machine Learning components. On the page below, the rules are created by taking data such as limits and selections from the database, calculating with complicated formulas, and adding to the corresponding table.

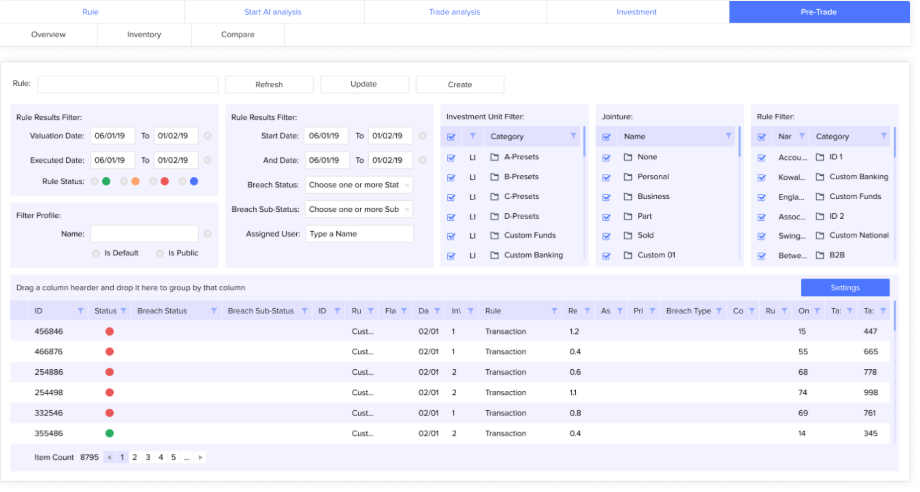

Statistics

A module containing more than 50 widgets was created to enable automatic statistics gathering and evaluation. The process can be performed both automatically and manually. The module contains a lot of filters to ensure convenient work with data.

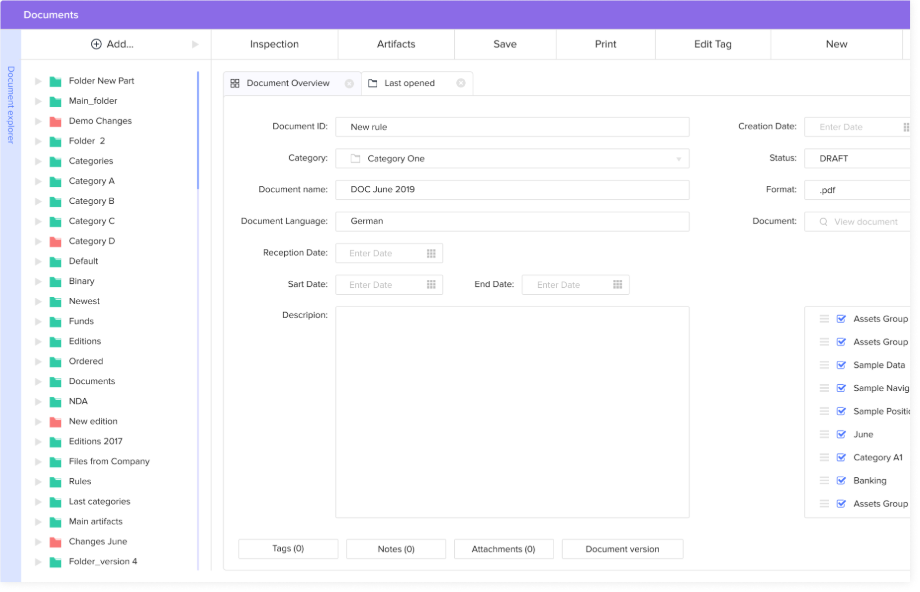

Documents

We developed a separate module aimed at storing documents in the program. Using AI, the system analyzes the documents added to the module and extracts rules from them for further implementation.

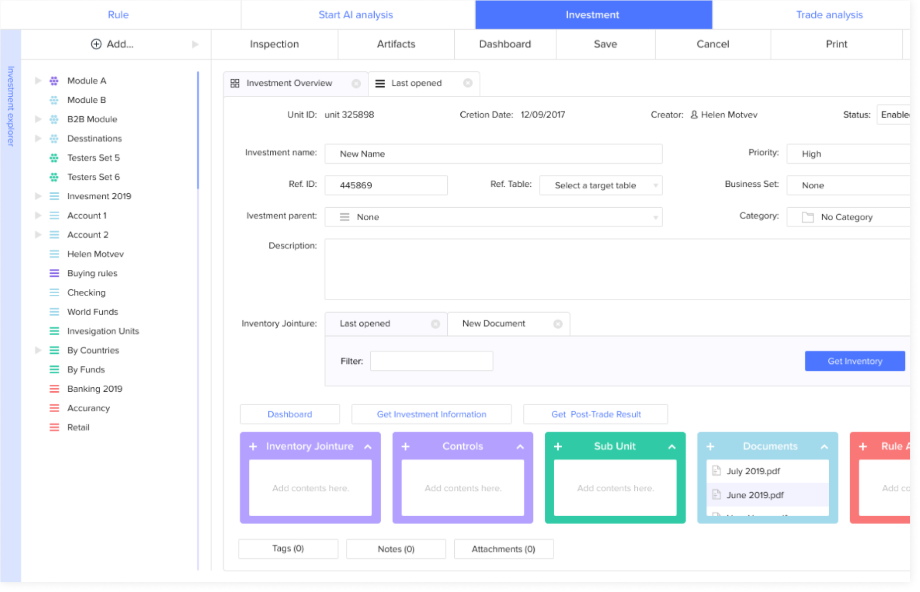

Investment unit

A module where investment units in the form of tables are created. Each investment unit can be connected to a certain jointure that will extract information from the given table.

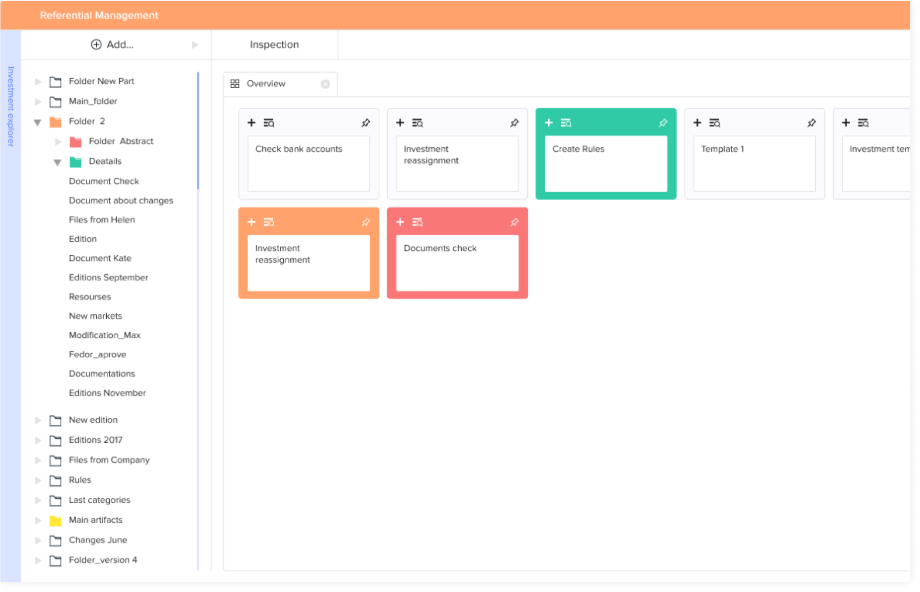

Referential management

Visualization of data from the database. Here, the user can select a table, view it, and configure the way they need choosing what is to be shown, which jointures it should be connected to, etc.

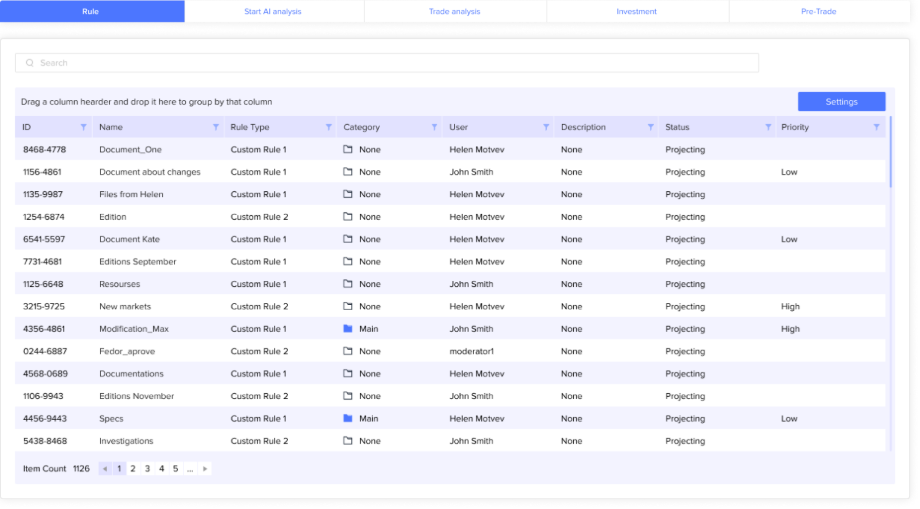

Rule overview

The database with all the rules. In the database, the user can search for the necessary data using various filters, as well as create a table right in here and then automatically fill it with data.

Customer review

Experts from Andersen showed incredible dedication and creativity while helping us meet this challenge. We discussed what was expected from the product with Business Analysts, and the result didn’t disappoint us: the solution includes all the necessary modules and functionality to cope with banking regulatory documents analysis effectively.

Heloïse Pinette

Public relations expert at BNP Paribas

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us