The customer chose to protect their confidential information

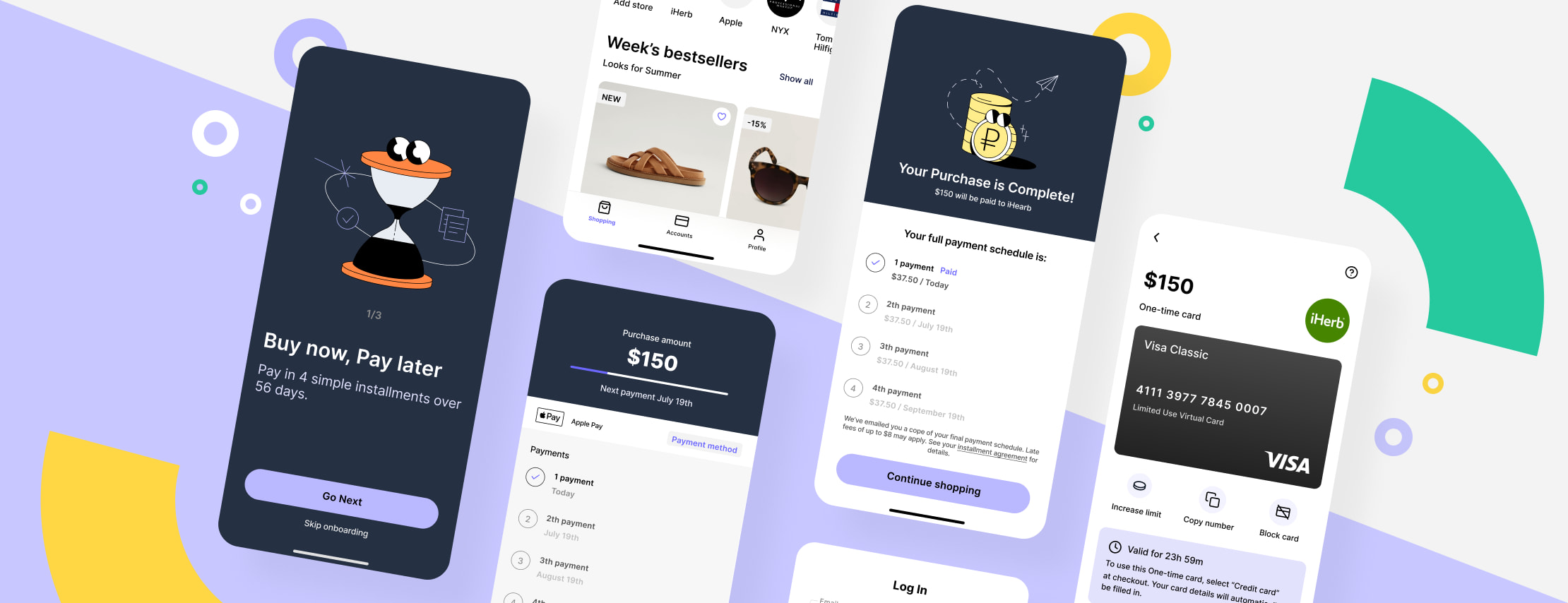

An Advanced BNPL Solution for an eCommerce Business

About the client

A European FinTech company that provides online financial services, including payments for online storefronts, direct payments, and post-purchase payments, approached Andersen. Operating across 15 countries with over 3,500 employees and handling approximately $35 billion in online sales annually, they needed a compliant, advanced, and user-friendly Buy Now, Pay Later (BNPL) solution to sustain their rapid growth. Andersen was selected as their technology partner for the task.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/sweden-desktop-2x.png)

Project overview

Mobile and web finance applications

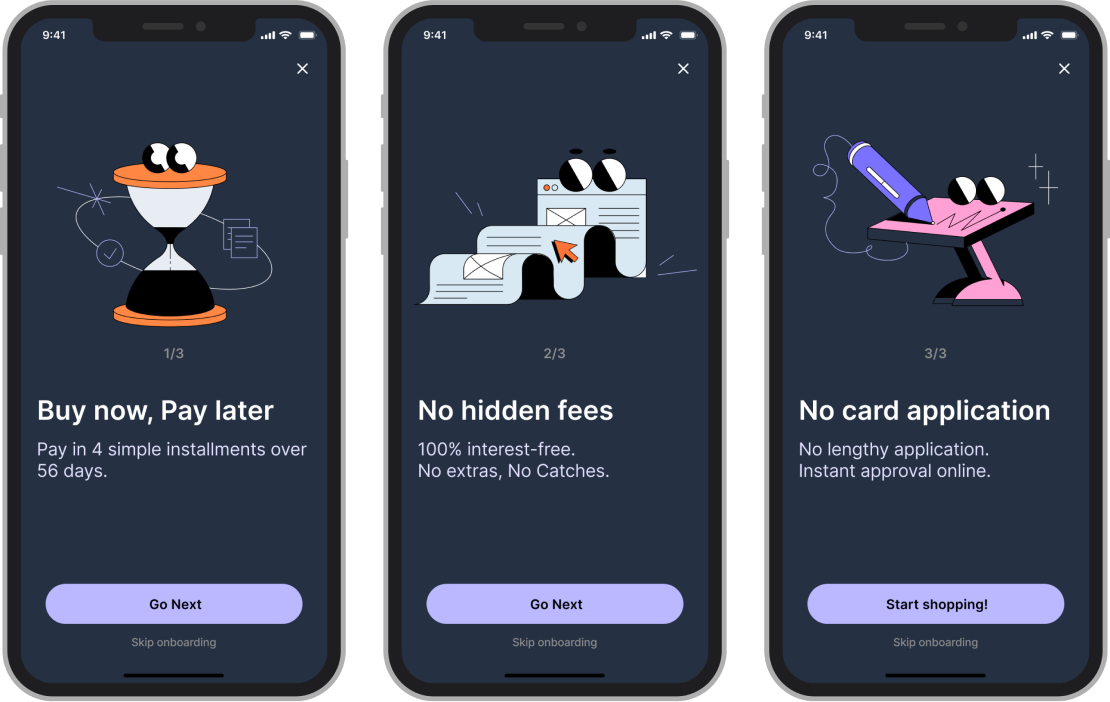

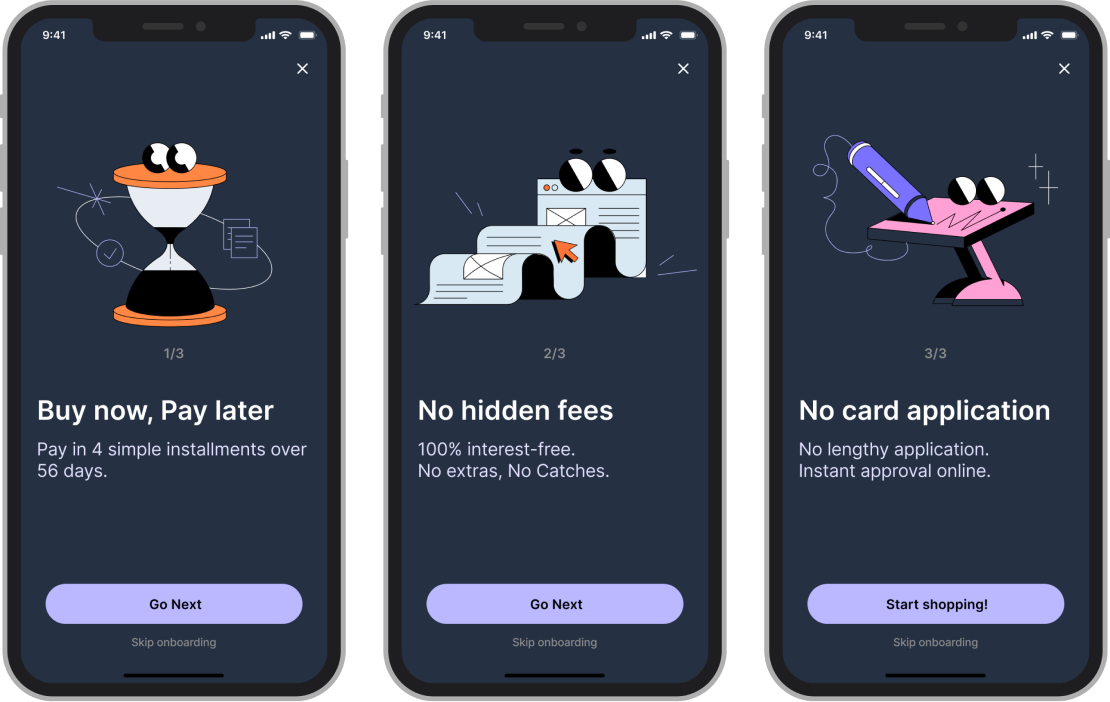

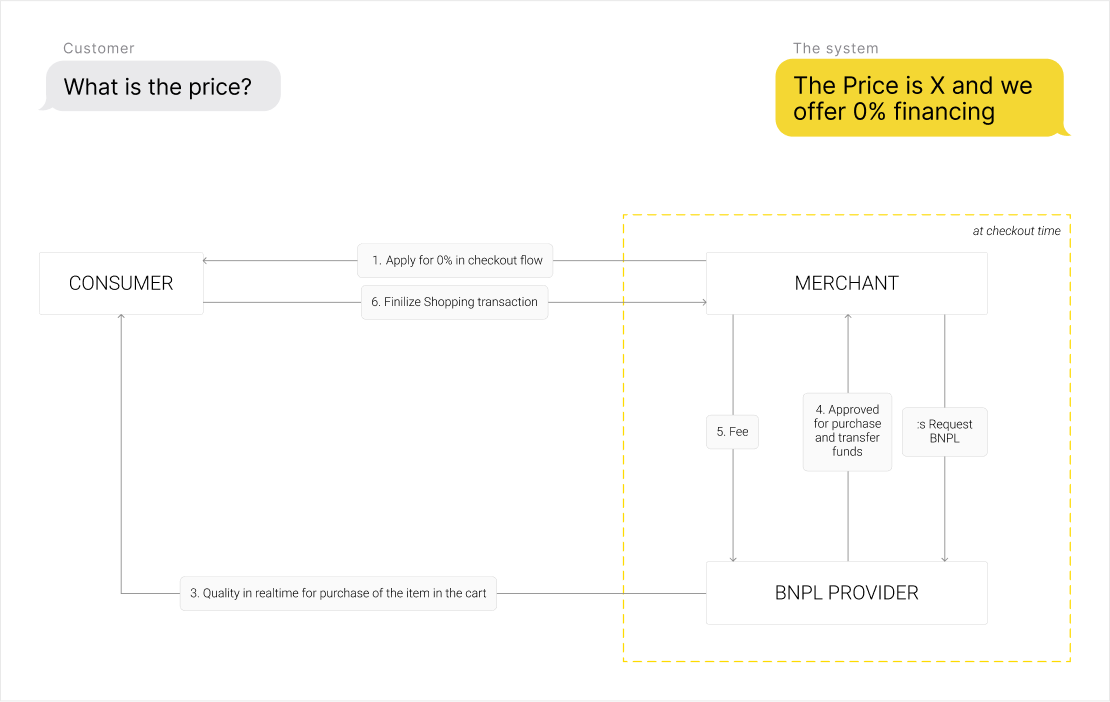

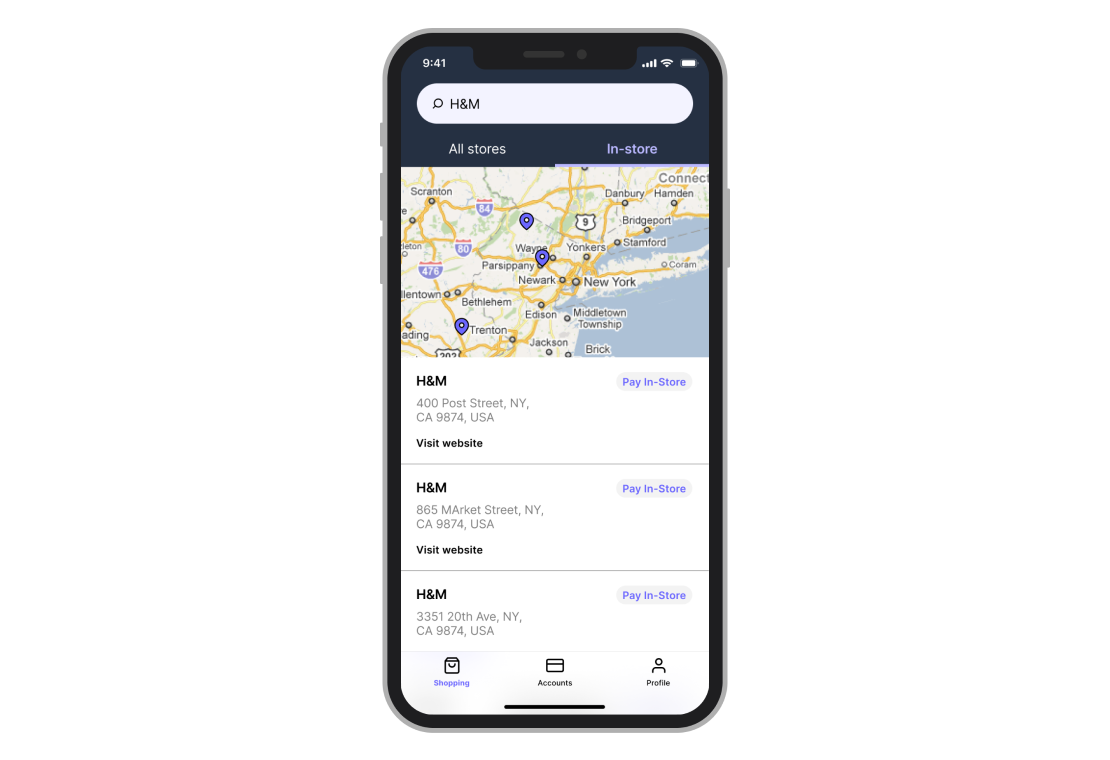

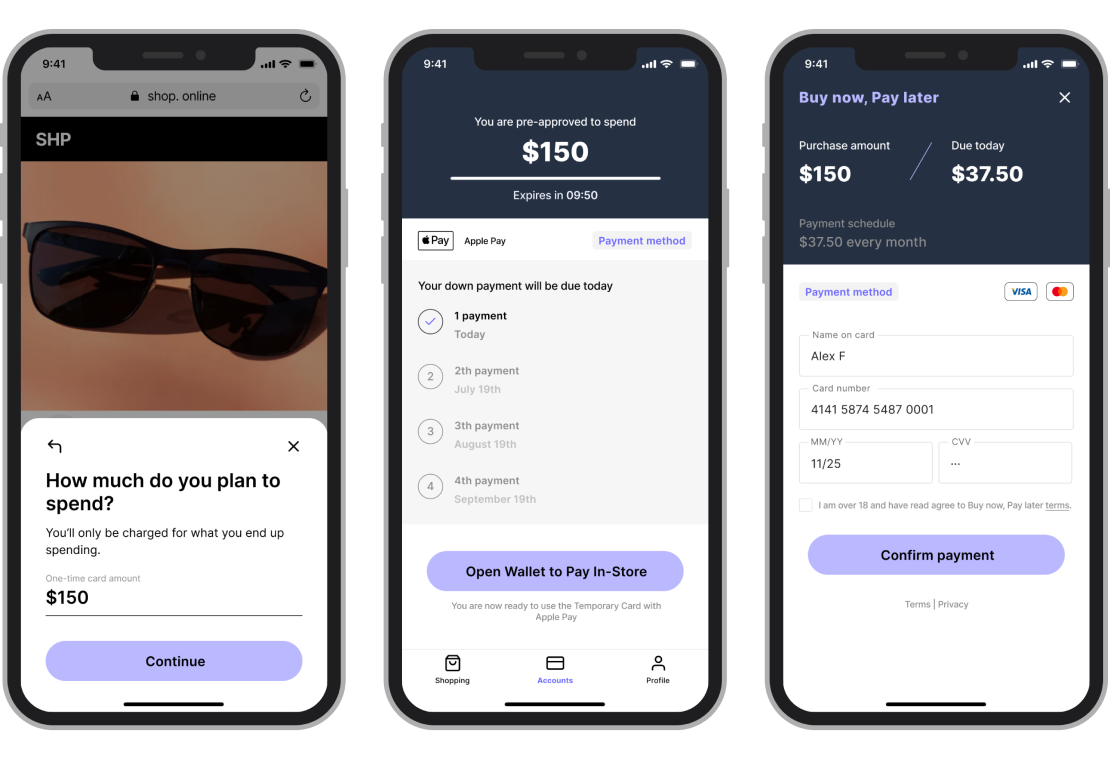

The project is a solution for “buy now pay later” offers. It belongs to the type of short-term financial products that allow consumers to make purchases in stores and pay for them later.

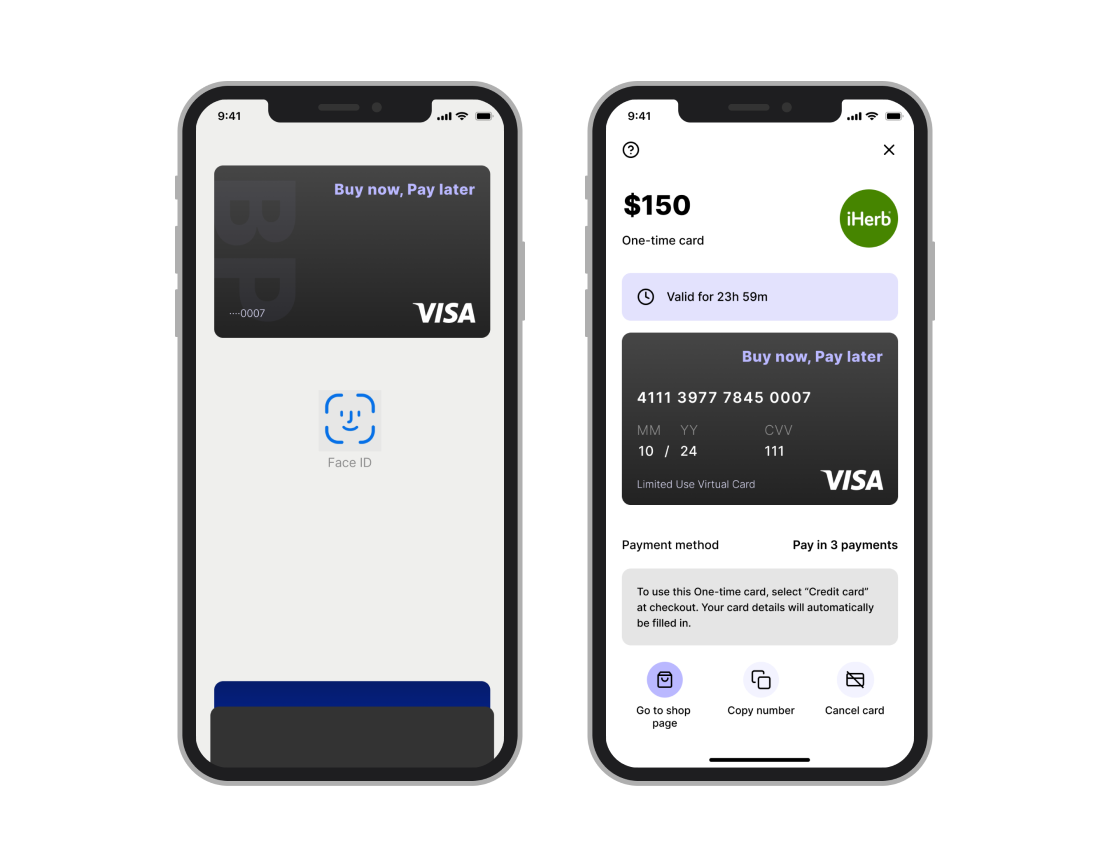

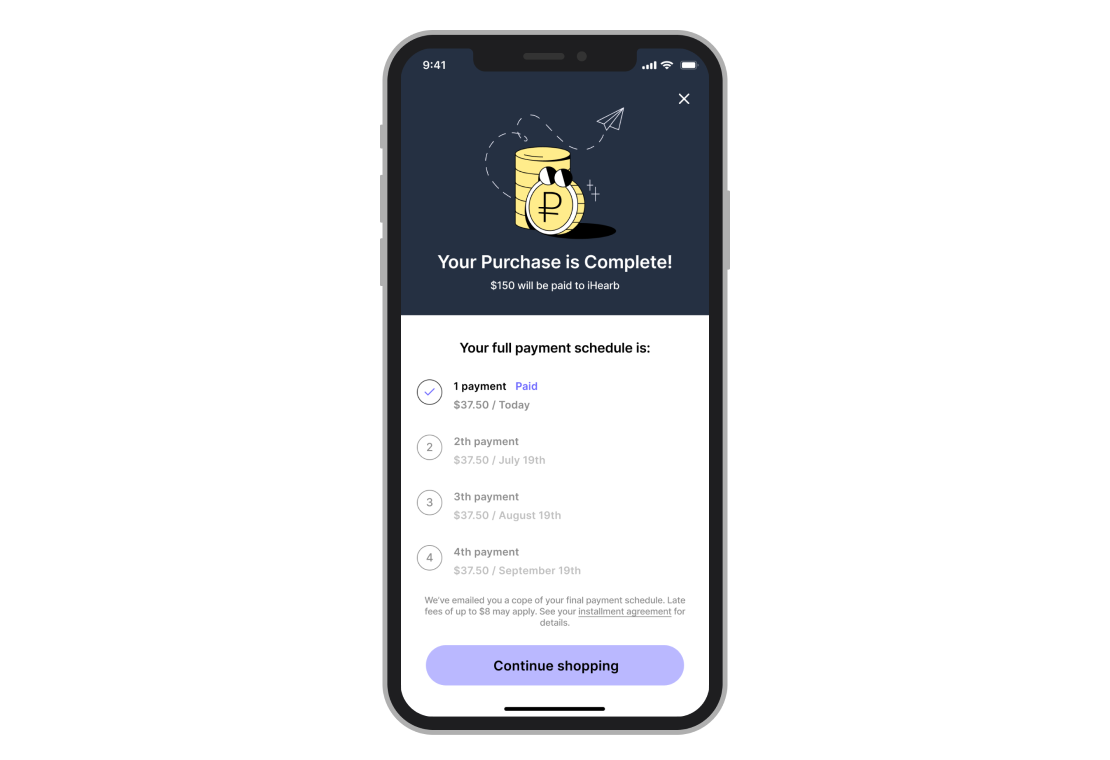

The application offers a credit option at the checkout of partnered online stores that make it possible to pay the total over a period of time. To use the app, the customer performs a simple registration procedure and selects what they would like to buy from the partner stores. After that, users reach the check-out stage to pay later, with installments and terms fitting them best.

To make it safe, a 2-step approval decision-making module was integrated. It functions on an automated and manual basis. The automated one makes purchases simple for customers, owing to the absence of challenging credit record checks. At the same time, the manual mode helps responsible managers approve and decline some specific purchase requests.

Reminders and notifications module helps customers stay updated on their activities and purchases made via the application.

There are no hidden fees when one pays in a timele fashion. The idea behind the fees module is to help responsible managers to control the size of the fees to be paid in the case, for example, late payments. As soon as the store ships the order, the user receives an email from the application outlining the payment schedule details.

Specialists

- 1 Domain architect

- 1 Solution architect

- Product owner

- Scrum-master

- 8 Back-end developers

- 5 Kotlin developers

- 1 DevOps

- 3 Business analysts

- 2 System analysts

- 4 QA automation engineers

- 4 QA manual engineers

- 6 Front-end developers

- 5 Swift developers

- 1 AWS engineer

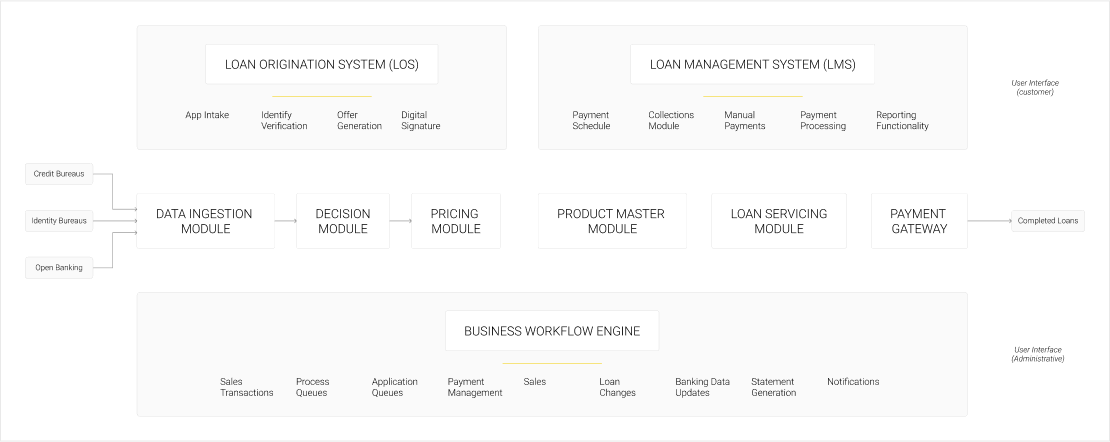

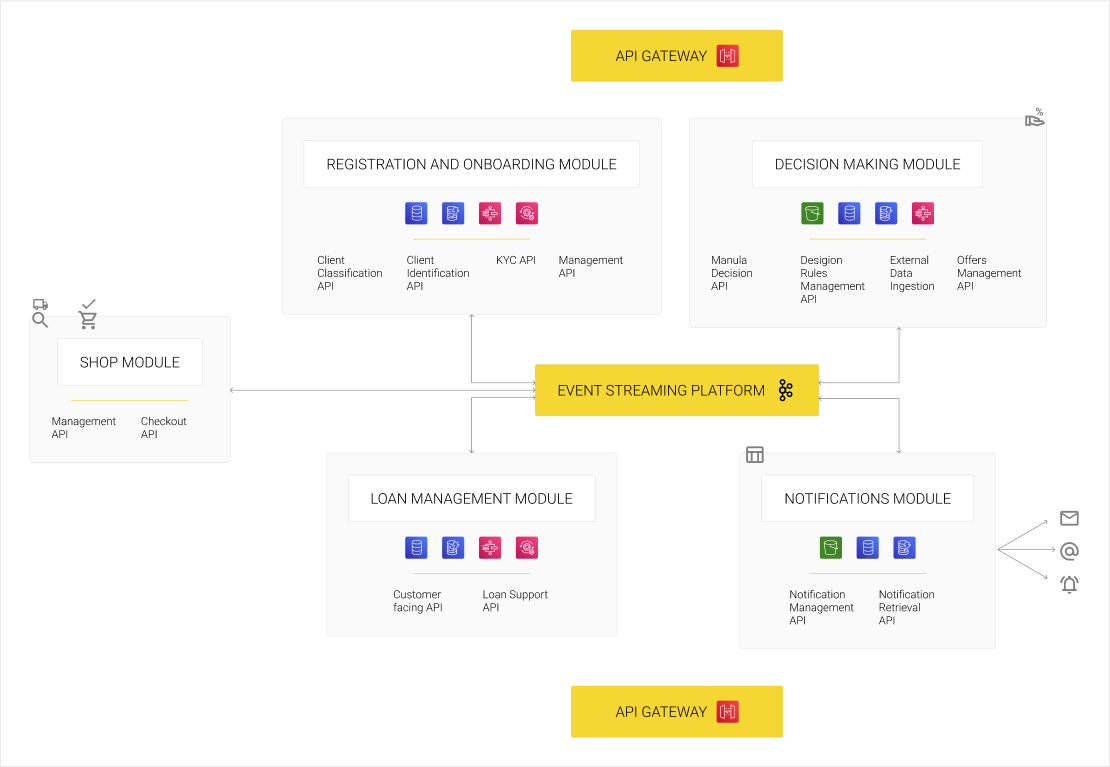

IT architecture structure

The Buy Now, Pay Later (BNPL) application was implemented with the use of microservices and event-driven architecture.

The application was implemented via microservices and event-driven architecture.

Various application modules expose corresponding functionalities to external consumers via APIs, with each API created as a container-based microservice. As for the APIs themselves, they are exposed to external consumers via the API gateway through which the authentication and authorization procedure is controlled. Finally, business processes within the modules are managed and orchestrated by the Business Process Management Engine.

Each of the Modules uses NoSQL Database for transactions and operational purposes. RDBMS is applied to manage structured data. Data caching is also performed, where applicable.

The Next Best Offering component of the Decision Making Module is built on the basis of ML capabilities.

Modules are completely decoupled and interact with each other via the Event Streaming Platform.

Registration and onboarding module

A fully compliant client onboarding process based on the rules for Client Classification API, Client Identification Natural Person API, and KYC API. The module tracks users and registration flows. It also tracks how users progress through them. This data can be analyzed directly in the platform. It can be alternatively exported for further analysis and integration with the rest of your event tracking features.

Decision-making module

The decision-making module is a control panel that enables one to approve purchase activities manually or automatically. If all defined rules are met, it will be done automatically. If anything fails to meet the applicable purchase rules, such a purchase would be transferred to the administrator. The manual approach requires two separate people to authorize a purchase.

The first person is responsible for creating the request (they are known as users), while the second person checks and approves such actions (they are known as administrators). This module helps specify a limit for the purchase order amount for the user. If the user tries to make a purchase order beyond the limit, this purchase order will automatically be directed to the 'To Approve' stage. That is where the admin can approve or refuse to approve this purchase order from 'Purchase Order Approval'. This module can help track approved or refused orders by such properties as "approved by", "refused by", "approval date", "refusal date", "refusal reason". It is possible to notify and alert about approvals via an email sent to a specific user or the manager responsible for approving a purchase limit.

Reminders and notifications

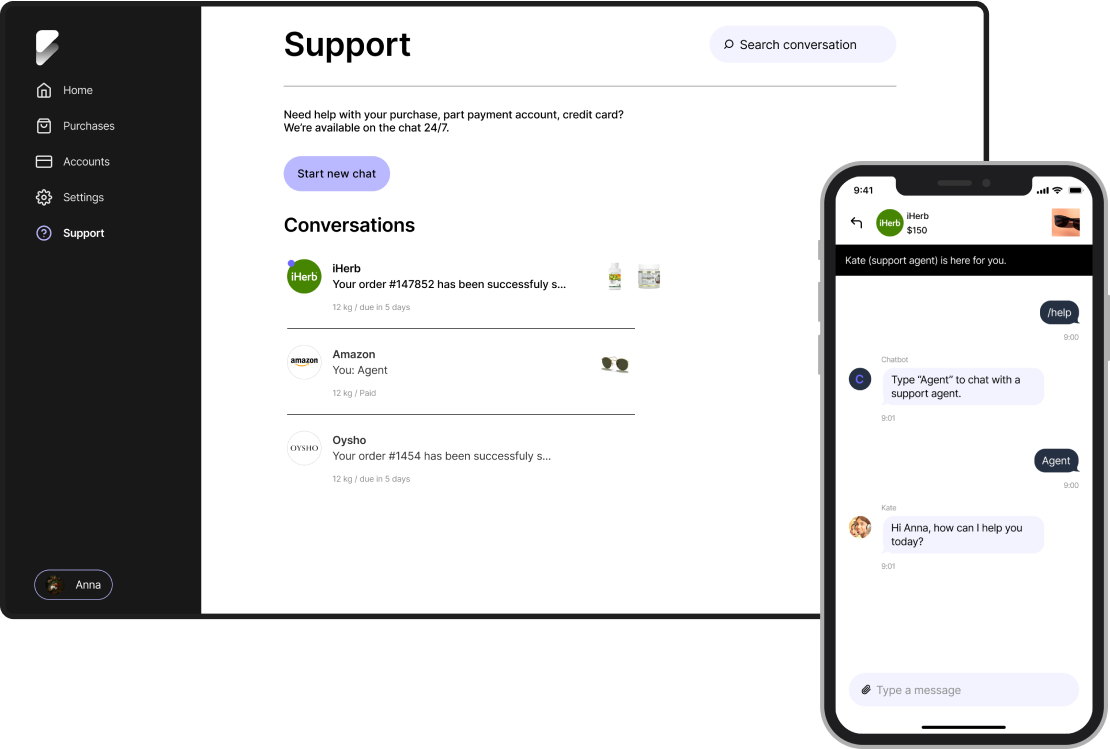

This custom-developed module keeps customers updated on all their activities and payments made via this single app. The platform keeps customers informed via emails and notifications processed by native mobile apps. The BNPL application can also be integrated with SMS service providers and mobile network operators to keep users informed about their respective delivery or payment deadlines. A customized module allows customers to set their own rules for such payment reminders. Moreover, notifications are connected to the shop module, tracking module, and fees module so that buyers are informed about special offerings, shipment statuses, and payment due dates.

Fees regulation module

This custom-built module enables admins to control statuses and fee amounts covering customers according to such properties as "person", "group", "region", or other differentiators. A wide range of settings is provided to divide customers into groups and assign specific fee amounts to them. The rule constructor automatically assigns such fee statuses to customers depending on their activities, e.g. late payments, loyalty statuses, etc.

Deliveries tracking module

By using “Shippo API”, our team has created a tracking module that will help manage and check where deliveries are located now. This API provides:

- Detailed shipment information, including addresses, carrier info, and shipping services

- Tracking history, covering such details as location, time, and statuses to refer to if an issue arises

- Up-to-date Estimated Time of Arrival (ETA) capability to analyze your parcel data to estimate the eventual time of delivery

- Original ETA displaying the initial ETA and any subsequent changes so that one can identify delayed deliveries

Shop module

The payment API is used to create a session to offer BNPL payment methods as part of customers' checkout process. The checkout API is applied to create a checkout with BNPL options and update checkout orders during the purchase. The Instant Shopping API is serving two purposes:

- Managing orders as they result from the Instant Shopping purchase flow

- Generating the Instant Shopping Button keys needed to set up the Instant Shopping flow, both onsite and offsite. That allows one to 'scan', via different shops, for available Buy Now Pay Later options. The platform enables you to split the cost of purchase, from any online store, into up to 4 smaller, interest-free installments. Separate graphs provide a complete overview of all purchases made and finances. Due date extensions and earlier payments are also integrated into the system.

Next best offering

This module analyzes customers' latest activities to forecast what could be of interest to them. It is fully automated and functions on the basis of previously collected historical data. The module creates a unique offer for each customer, delivers it through their preferred channel, verifies their eligibility, and provides discounts within a single platform.

Support module

This Custom-built chatbot module makes it possible for customers to get initial support 24/7. It is capable of automatically sort requests by topics. A mixture of automated and live support enhances every touchpoint across the entire customer journey.

Administration module

This custom-built module helps administrators control, edit, and manage a wide range of settings and other integrated modules.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us