The customer chose to protect their confidential information

A Travel Insurance Advisor

About the client

Andersen was approached by a global leader in B2B2C insurance focused on automotive, travel, health, and home insurance solutions. The customer employs over 20,000 specialists all over the globe, processing and handling more than 70 million insurance cases every year.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/germany-desktop-2x.png)

Project overview

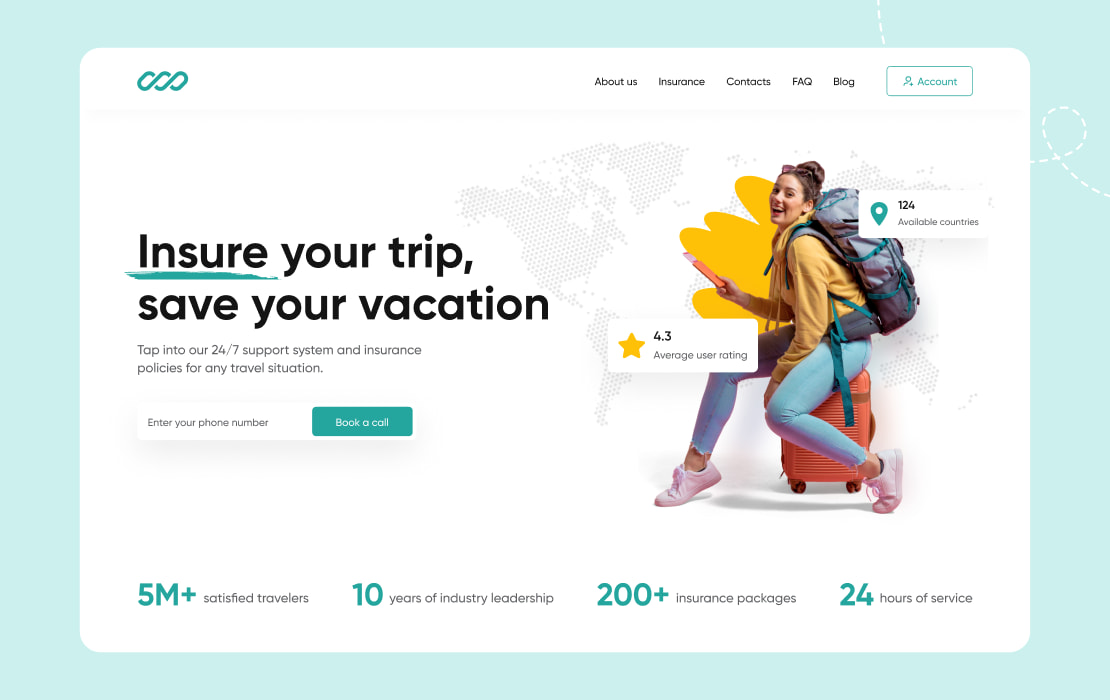

In order to facilitate their core business activities, win more clients, and boost their overall efficiency, the customer entrusted us with building an advanced online insurance platform that would work as a reliable and convenient-to-use advisor.

Project details

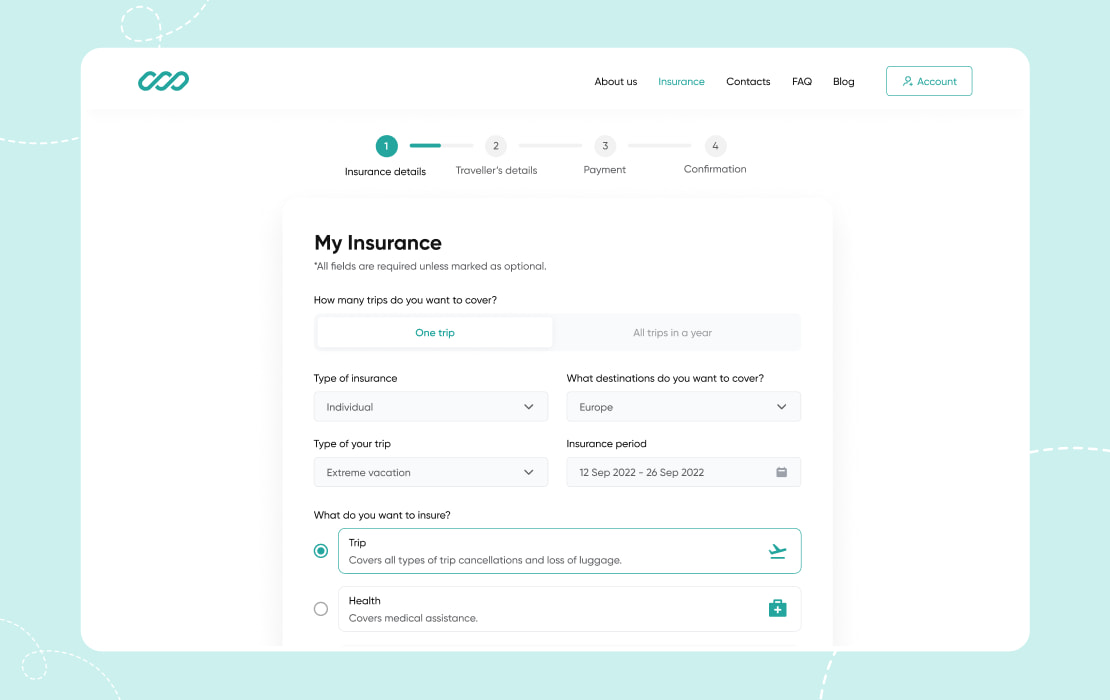

The initiative we have helped to accomplish is a travel insurance software solution accompanying travelers before, during, and after their trips. Namely, it gives its end-users access to the customer’s relevant insurance products and services. This insurance management platform is also intended to offer access to the services of the customer’s partners operating in the travel industry.

As for the main business principle the resulting travel insurance advisor builds upon, it can be described as a Freemium membership model. Thus, the range of features available to a client depends on the type of account this client has. Namely, registering with the platform gives end-users access to a set of free services only. Subsequently, users are able to upgrade their accounts to a paid membership with a premium service bundle and additional optional paid services.

In practical terms, the main goal for us was to thoroughly rewrite the customer’s existing online insurance platform and propel it to a new level. The customer’s travel assistant was written in Drupal. Owing to our contribution, the new stack now includes Java, Angular, and AEM.

As a result, the upgraded and improved platform is easily scalable and includes the functionality for launching in new countries, providing multi-language support, and managing content easily.

App functionality

The resulting insurance software solution is based on microservice architecture. This software is integrated with identity providers, the customer’s internal contracting systems, and several payment providers – i.e. internal systems to purchase insurance and Stripe to pay for the services of external providers. It is also worth mentioning that the list of integrations is currently being expanded and developed.

In addition, the digital platform is linked to a variety of services for a smarter traveling experience:

- A destination explorer to discover itineraries and new experiences at the destination point, as well as to find COVID-related information;

- A travel wallet to save trip details, add flight bookings, and receive trip updates;

- Travel protection capabilities, such as trip cancellation protection and medical assistance;

- Travel alerts with real-time updates concerning safety and security at the destination point;

- Free access to lounges and instant flight delay compensation – i.e. instant payouts if a traveler’s flight is delayed;

- Digital access to TeleHealth services, such as symptom checkers, online chats with doctors, remote medical advice, and teleconsultations.

Solution

To develop travel software requested by the customer, our experts proposed a comprehensive approach. This implied a thorough upgrade and modernization of the customer’s old travel insurance software solution so that it would be capable of handling all the new tasks properly.

As for the main project challenges we faced, the customer wanted the platform to be capable of quickly launching in new countries – roughly within 1-2 months. On top of that, the solution was expected to include reusable APIs – e.g. the same registration API for the customer's platform itself and other partner platforms.

Project results

The main project results concerning the insurance management platform discussed here are as follows:

- The product is now easily scalable. On average, it only takes up to 2-3 weeks to launch the platform in a new country, in comparison to 3-4 months with the legacy architecture;

- The reusable modules of the product, such as Authentication and Registration, will be further used in the customer’s other products;

- There was an immediate launch in several countries after the first release, covering a larger target audience within the EU.

Let's talk about your IT needs

What happens next?

An expert contacts you after having analyzed your requirements;

If needed, we sign an NDA to ensure the highest privacy level;

We submit a comprehensive project proposal with estimates, timelines, CVs, etc.

Customers who trust us