- Why insurance needs Robotic Process Automation

- Benefits of Robotic Process Automation in insurance

- Robotic Process Automation use cases in insurance

- Claims processing

- Underwriting

- Keeping insurance contracts

- Accounting

- Ensuring client satisfaction

- Robotic Process Automation implementation process in the insurance industry

- Determine which procedures to automate

- Draw up an automation plan

- Develop and test the software

- Implement the solution

- Conclusion

Today, industry leaders increasingly make use of cutting-edge technologies ensuring clients using their services enjoy an outstanding digital experience. Robotic Process Automation in insurance is found among the key technologies that streamline companies’ operations, boost ROI, and facilitate digital transformation.

RPA in insurance means the use of software robots to automate routine industry-specific tasks. Any repetitive processes such as customer onboarding, submission of claims, insurance payout calculation, and so on are prime candidates for automation.

Below are some compelling statistics proving the increasing popularity of employing RPA in insurance:

- In the past five years, the investments of insurance businesses in emerging technology have spiked by 650%,

- By 2026, a third of the global RPA market share is predicted to be held by finance and banking companies,

- Nearly 80% of FinTech companies have either employed or are going to employ process automation, and half of those are insurers,

- By the end of the decade, over 50% of all claims are projected to be handled by robots,

- Finally, in 2022, global spending on RPA software and services will surpass $4 billion.

In this piece, Andersen’s FinTech experts will share how RPA helps companies excel in the insurance market by streamlining their processes and boosting performance.

Why insurance needs Robotic Process Automation

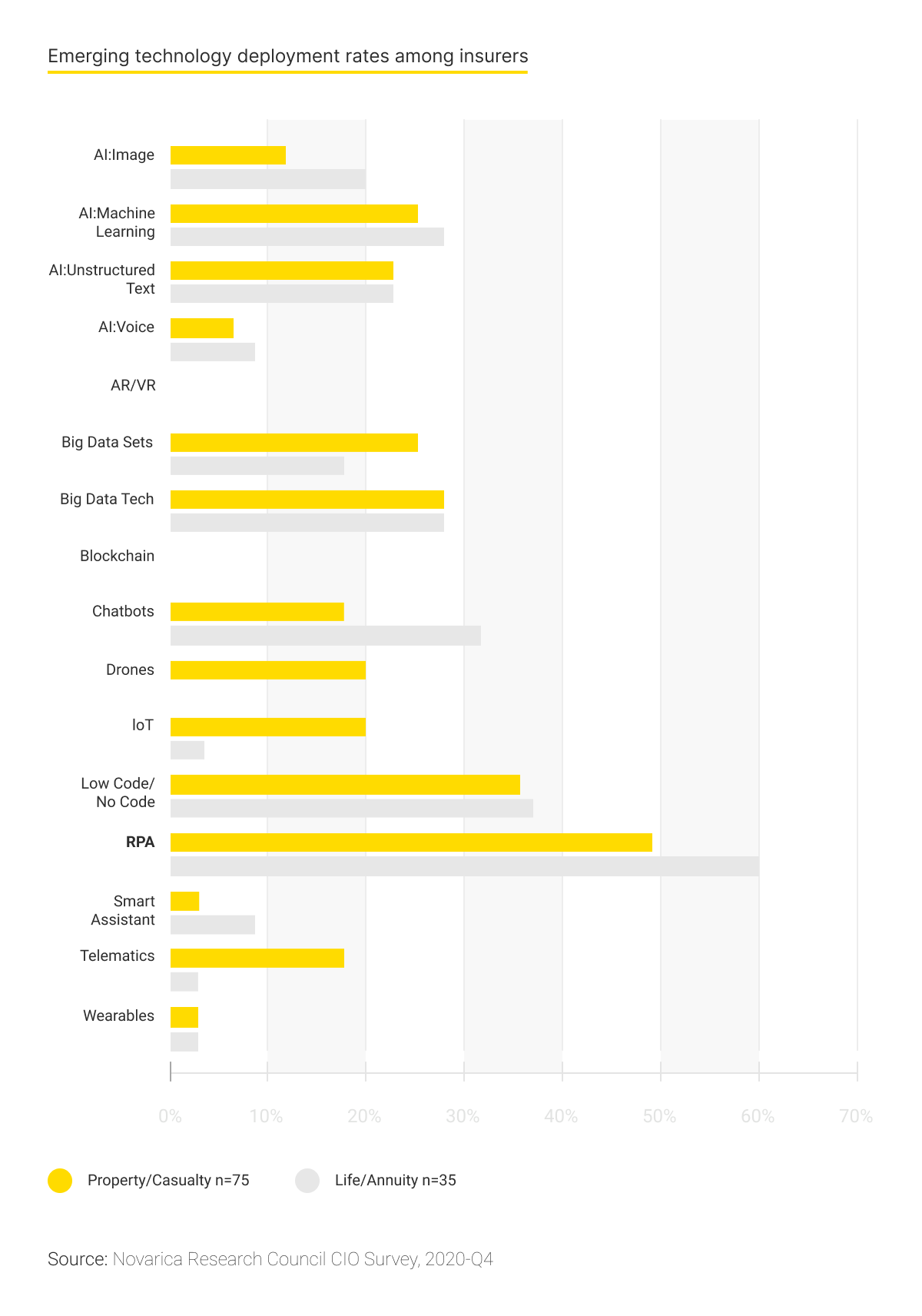

RPA in financial services, e.g. banks, financial companies, and insurance agencies accounts for 29% of tasks. Insurers are increasingly turning to process automation for the following reasons:

-

Overall tech evolvement. Today’s clients expect to employ finance services instantly and across their preferred channels. Software with RPA allows for the seamless collection, synchronization, and processing of siloed data scattered across various apps.

-

Prevalence of legacy systems. RPA for insurance companies is easily integrated with legacy finance software which makes it possible for institutions to adhere to best digital practices without giving up their longstanding industry experience and procedures.

-

Increased complication of industry regulations. The finance industry is known for its strict adherence to government regulations as its operations involve handling clients’ sensitive financial and personal data. Not only do these data privacy laws and tax and licensing rules change over time, but they also alter from state to state and from country to country. RPA implementation in insurance allows businesses to stay truly global by promptly assessing risks and effectively operating in different locations without putting themselves and their clients at risk.

-

The ever-increasing complexity of financial ecosystems and companies’ need for expansion. As the volume of client data grows, insurers are aspiring to shift the burden of time-consuming work onto virtual assistants. The benefits of RPA in insurance include simplifying and streamlining complex financial processes so that consultants and managers can devote themselves to more important strategic tasks while automation allows for companies’ growth and increased profitability.

Benefits of Robotic Process Automation in insurance

Robots are versatile assistants that work quickly and accurately and are able to:

- reduce the number of errors,

- increase the amount of work by up to 80%,

- cope with a large volume of tasks by working 24/7,

- increase business profitability by 2-4 times.

Why does a robot need less time to complete tasks? It doesn’t get distracted and can work simultaneously in multiple systems: Outlook, Excel, CRM, Word, Chrome, etc. Robots take on the following tasks:

- accumulate data about clients from various sources,

- enter information into company systems,

- transfer data from tables to systems and vice versa,

- verify key business information,

- send emails and notifications,

- create invoices,

- prepare reports on insurance claims, etc.

Robotic Process Automation use cases in insurance

Experts note that 43% of operations in the insurance industry can be automated. Let's consider the five most common RPA use cases in insurance.

Claims processing

Imagine that you need to make an insurance claim, so you are applying to your insurer for compensation. Obviously, it is important that the company responds quickly to your request. Robots sort claims and take on standard cases, while situations requiring critical thinking are passed on to insurance agents.

Along with that, bots do the following:

- help users register by answering their questions about creating an account, canceling or changing a subscription,

- support clients round the clock, advising them on standard issues,

- sort clients according to their needs, determine what they are calling about, and send them to different departments,

- rank clients into primary and secondary urgency, and perform other important tasks.

UiPath has created a robot that extracts data from client correspondence and compares it to standard claim forms. With this technology, collating data takes 42 seconds, instead of the four minutes that a human would spend on it. Thus, the program helps to save 18,000 hours and around $195,000 every six months.

Given the fact that the performance of bots can be improved with the help of Artificial Intelligence and Computer Vision, such RPA implementation in insurance looks promising.

Underwriting

A robot collects information from various sources, which makes it possible to assess the degree of risk to a person or object (house, car, and so on). Based on this data, the program calculates insurance premiums. If done manually, this procedure can take several weeks.

RPA use cases in the insurance industry related to underwriting help to retain clients, as collecting and entering data demands less time. An example of this approach is the Root underwriting system, which analyzes a client’s driving experience and offers them a fair price. Experienced drivers can save up to 50% on insurance, and companies get more accurate insights to predict risks and estimate premiums.

Keeping insurance contracts

Maintaining an insurance company's client account means that an insurance agent registers your form, creates, and, if necessary, cancels the contract. Insurers must double-check premiums and analyze duplicate data.

There are standard systems for keeping insurance contracts. They are expensive to maintain and update, and they don’t scale as quickly as desired in the context of a growing market.

RPA for insurance companies overcomes these challenges. Bots are fast, productive, and easily scalable. They take on the registration of forms and payments, cancellation of contracts, renewal of client accounts, classification of insured circumstances, etc.

Accounting

Robots also perform some accounting tasks: prepare reports, process payments, and issue invoices.

Insurance companies are obliged to process documents based on PCI standards, HIPAA confidentiality rules, tax laws, etc., with regulations changing from time to time. Algorithms, in turn, quickly find the relevant information and accurately fill in forms.

Ensuring client satisfaction

Several years ago, the large Polish insurance company PZU faced a problem - their client base was growing, and employees couldn’t fully provide personalized service. After the organization implemented RPA, the number of decisions made increased by 15%, the call center time was halved, and the accuracy of data entry increased to 100%. People began to receive answers to their claims faster, and insurance agents were able to devote more time to clients.

Robotic Process Automation implementation process in the insurance industry

Below are steps to follow if you want to successfully implement RPA in your processes:

Determine which procedures to automate

Before you implement process automation, have your business and market trends thoroughly analyzed by skilled Business Analysts and industry experts. This will allow you to clearly define the automation purpose and areas of application depending on whether you aspire to streamline back-office operations, devise a system for in-house use, or improve communication with clients.

Draw up an automation plan

A well-devised plan with clearly determined process automation criteria is needed for knowing the scope, budget, and timelines of your project, as well as for evaluating the success of the implementation process.

Decide who will be responsible for implementing RPA. This can be an internal IT department or an insurance software company. If you opt for the latter, your provider’s top-notch experts will undertake an in-depth analysis of your existing systems to evaluate problems and gaps and offer the best possible solution.

Develop and test the software

The insurance software development company you partner with will choose the technology stack and a team of experts with a proven track record to tackle your problem. To develop and test the solution, dedicated specialists are required, including a Project Manager, software developers, and QA engineers. Having long-term experience in the industry, they will develop and test your product end-to-end, ensuring its high quality, security, and performance.

Implement the solution

After the developers integrate the technology with your software and systems, your employees need to be trained in new working methods. This process, along with support and maintenance, is normally offered by professional software development companies, so that your business can start reaping benefits from using the emerging technology as soon as possible.

Conclusion

RPA in insurance has great potential - 40% of companies have already benefited from robotization. These technologies bring such important benefits to businesses as rapidity, profitability, and satisfied clients. For fifteen years, Andersen has been developing insurance software solutions and helping companies successfully integrate them into their processes. If you need professional advice on financial software development, don’t hesitate to contact us. All steps - from idea to technology development and implementation - will be taken on by our experts in order to accelerate the digital transformation of your insurance business.